- The five largest stocks in the S&P 500 could be replaced as market leaders.

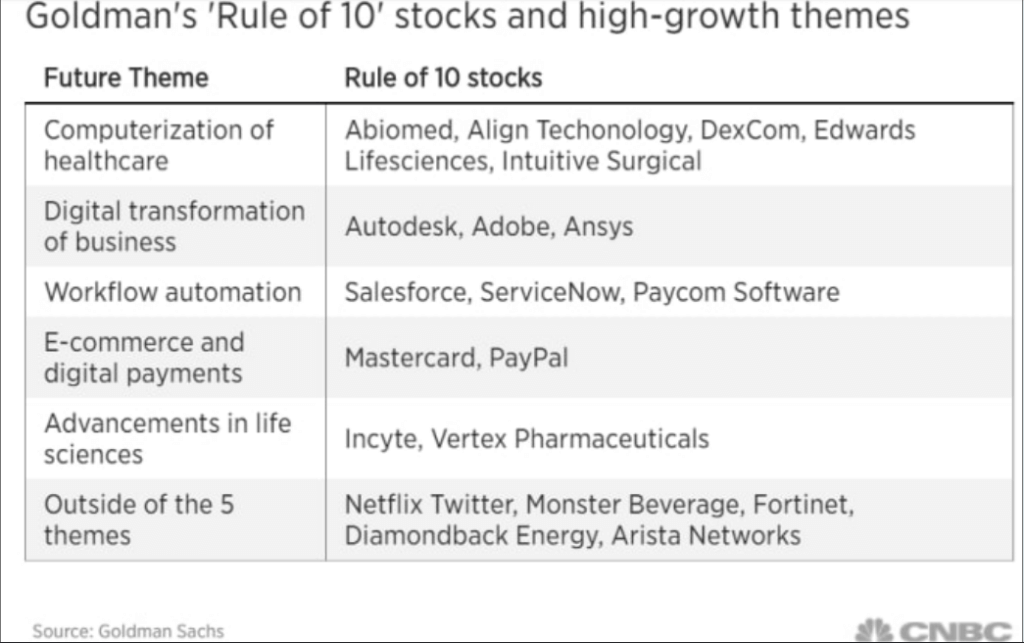

- Goldman used the Rule of 10 criteria to identify 21 stocks that could beat the market.

- Salesforce, Paypal, and Netflix are among those top stocks.

Five mega-cap stocks have led the U.S. stock market rally–Facebook, Amazon, Apple, Microsoft, and Alphabet (FAAMG stocks). They currently represent 23% of the S&P 500, the highest concentration in 40 years.

Goldman Sachs said their leadership wouldn’t last forever. Other high-growth stocks have the potential to take some of those top spots one day.

David Kostin, head of U.S. equity strategy at Goldman, said in a note:

Index leadership is difficult to maintain. The list of companies comprising the top positions in indices is not immutable.

In 2000, the current five market leaders represented just 3% of the S&P 500.

FAAMG share prices have plunged during the last two weeks, driving the stock market lower.

The mega-cap tech selloff tells us it’s time to look at better opportunities in the stock market.

The ‘Rule of 10’ Stocks Could Drive the Next Rally

Goldman used the so-called “Rule of 10” criteria to identify stocks with strong prospects for secular growth. According to the investment rule, these stocks have experienced sales growth of at least 10% each of the past two years and are expected to increase revenue at the same rate for each of the next two years. The bank said stocks meeting these criteria have a solid reputation for beating the market.

Goldman found 21 companies in the S&P 500 with the potential to become future index leaders.

The group’s median stock is expected to increase sales growth by 18% from 2018 to 2022, compared to 4% for the S&P 500’s median stock. The median return has come to 21% so far this year.

These stocks will not necessarily supplant the current five largest companies. But they have the potential to significantly increase their rankings and in the process generate strong returns for portfolio managers owning the shares.

The majority of these names also fit into five high growth trends–computerization of healthcare; digital transformation of business; workflow automation; e-commerce and digital payments, and advancements in life sciences.

Goldman has identified many healthcare stocks that are experiencing top growth, including Abiomed, Align Technology, Edwards Lifesciences, Intuitive Surgical, and Vertex Pharmaceuticals. The healthcare sector has seen a tailwind this year on optimism about a breakthrough in a coronavirus treatment and vaccine.

Work-From-Home Stocks Are Poised For Strong Growth

Many software companies are well-positioned to take advantage of the digital transformation amid the pandemic. Autodesk, Adobe, Salesforce, and ServiceNow are some of the most popular work-from-home bets this year.

Salesforce surged to an all-time high at the end of August after reporting better-than-expected revenue and earnings for the second quarter. Shares have plunged amid the tech selloff, but the stock is still up almost 50% this year.

Goldman chose MasterCard and PayPal as potential winners in the digital payments arena. PayPal saw its revenues increase 22% in the last quarter due to a massive shift to digital payments amid the pandemic. Shares of PayPal are up about 60% year-to-date. Watch the video below:

Netflix and Twitter also figure in the Rule of 10 stocks. While Netflix is up more than 40% for the year, the streaming service still has plenty of room to grow.

The streaming video leader ended the second quarter with 193 million subscribers worldwide. In the third quarter, it plans to add 2.5 million new subscribers.

RBC Capital Markets analyst Mark Mahaney has a price target of $610 for Netflix. He sees the company reaching 500 million subscribers by 2030:

By 2030, we believe Netflix will have a global subscriber base of 475 million to 525 million, implying 57% penetration of global fixed broadband households excluding China (vs. 29% today).

Goldman’s Rule of 10 growth stocks could lead the next stock market rally. FAAMG stocks could lose their place as market leaders soon.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The writer owns shares of Microsoft.