- The U.S. stock market faces gloomy prospects as U.S.-China relations worsen.

- Strategists warn that the U.S. and China face an “all-out cold war,” as the dispute between the two countries intensifies.

- Equities remain vulnerable heading into Q4 without stimulus and clarity on vaccines.

The U.S. stock market faces a new threat in the fourth quarter that exceeds the pandemic. Strategists fear that the U.S.-China dispute is turning a new corner, which could significantly worsen over time.

Fitch Solutions researcher Darren Tay fears a “new cold war” could be materializing due to “diametrically opposed values.”

Stock Market Has Many Risks

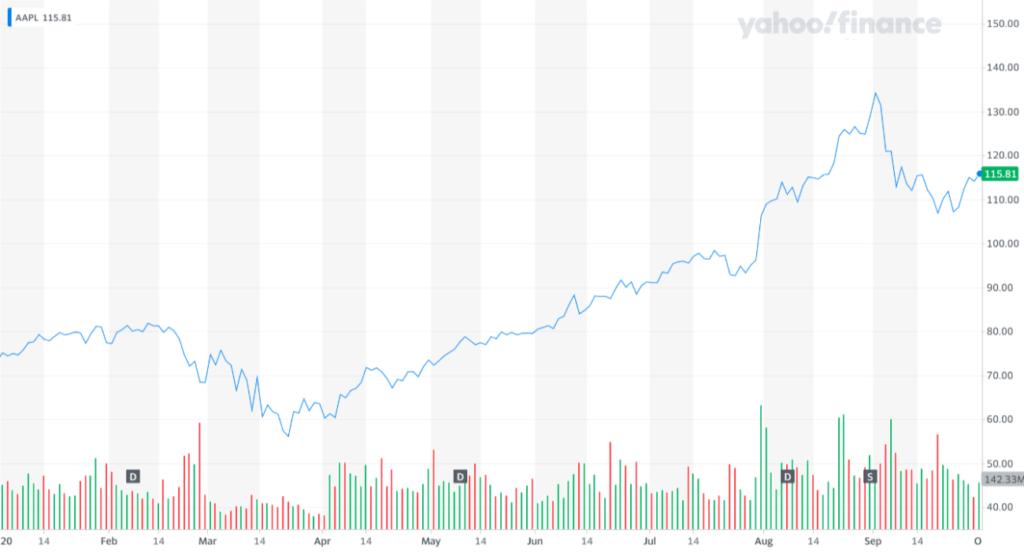

The stock market remains vulnerable heading into the fourth quarter due to a lack of stimulus and surging COVID-19 cases.

The intensifying conflict between the two superpowers adds additional pressure to an already strained financial market.

Strategists in the U.S. and China are reluctant to predict a complete decoupling. But, Darren Tay emphasized there would be a clear consumer shift in the two regions.

Chinese consumers would have less trust in American products, and vice versa. As a result, it could isolate each country’s respective technology markets.

Tech companies have been the largest catalyst of the U.S. stock market in recent months. Particularly after the March crash, tech giants, including Apple, Microsoft, and Amazon, carried the U.S. equities market to recovery.

If the dispute between the U.S. and China evolves into a long-time “cold war,” it would place immense pressure on technology companies. In the longer term, that could suppress the growth of global stocks. Tay said:

It’s easy to imagine an American consumer not trusting a Chinese tech company to be scrupulous in terms of safeguarding their privacy, and likewise, for a Chinese consumer with regard to U.S. tech companies.

The U.S. has already imposed direct restrictions on Chinese technology and semiconductor firms. After the initial “ban” on TikTok and WeChat, the U.S. government moved to restrict Chinese chipmaker SMIC.

The problem is that the tension between the two nations has reached a point where companies expect restrictions.

According to an anonymous source cited by Nikkei Asia, SMIC was preparing for potential restrictions in the U.S.:

SMIC has been on very high alert since the start of this year, when the industry became aware that the U.S. could further restrict Huawei’s non-American suppliers from using American technologies, which in fact later happened in May.

If tech conglomerates are consistently alert to restrictions from other governments, it could hinder overall business productivity.

Investor Confidence Might Struggle to Recover

The long-lasting conflict between the U.S. and China poses two major threats to the stock market.

First, it could cause investor confidence to further fade amid heightened uncertainty due to the pandemic.

Second, it might cripple the appetite for tech stocks as investors in both nations fear reactive countermeasures.

A potentially contested election could raise market uncertainty and correlation, economists explain. Watch the video below:

The timing of the latest U.S.-China fallout remains the most significant risk to the stock market at a time of heightened anxiety about the election.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com.