- The median U.S. home price hit a new record in April, but the reason why is anything but an optimistic indicator.

- The apparent heat in the housing market is superficial at best.

- The true health of the market will be revealed once the deferral benefit is over.

The housing market is a puzzle for many observers, as median home prices continue to soar despite widespread unemployment and economic devastation.

It would appear that the housing market is immune to the effects of the coronavirus pandemic. But a closer look suggests that the real estate market is merely inching closer to the cliff’s edge.

April Home Price Spike Was Anything But Healthy

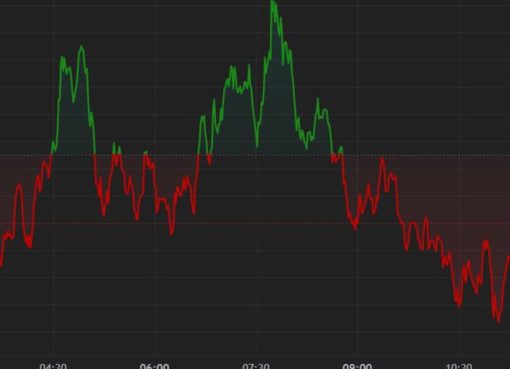

At first glance, the data appears somewhat bizarre. Home prices are up, but home sales took a near-unprecedented nosedive.

CNBC reports that sales of existing homes dropped 17.8% in April. The single-month decline is the largest since July 2010 – when the government’s homebuyer tax credit expired.

But here’s the reason prices didn’t fall too, and it’s not an especially good one. The impact of the home sales decline was cushioned by an even sharper decrease in the supply of homes.

As Taylor Marr, Redfin’s lead economist, explains:

The supply of homes for sale declined even more dramatically than homebuyer demand in April.

Last month, housing market inventories fell 19.7% year-over-year to 1.47 million units for sale. The severe drop in supply pushed the median home price to an all-time high of $286,600.

While sellers have the upper hand, they have no reason to celebrate. The gloomy economic backdrop suggests that the housing market is facing an inevitable – if not imminent – collapse.

The Housing Market Crisis Will Arrive Once the Mortgage Deferral Benefit Ends

The housing market is managing to stay afloat even in the midst of sky-high unemployment figures, but that can’t continue forever.

Since the coronavirus outbreak, over 38.6 million Americans have filed for jobless insurance. The unemployment rate skyrocketed to an unofficial estimate of 17.6% at the end of last week, the highest level since the Great Depression.

The soaring unemployment figure is a long-term threat to the U.S. housing market. Many jobs won’t come back, but the benefits that come with the coronavirus rescue bill – including mortgage forbearance and deferment – will come to an end.

At some point, homeowners – including those whose jobs never return – will need to start their regular mortgage payments again.

Otherwise, they’ll have to sell their homes to avoid foreclosure. Housing inventories will skyrocket, depressing prices and causing the residential real estate market to crater.

And those inventories could pile up quickly. Moody’s Analytics warned last month that as many as 30% of Americans with mortgages could default on their home loans in the aftermath of the pandemic.

The awful home sales figures in April suggest that the market is starting to crack. Government assistance has kicked the can down the road. But if the employment situation doesn’t reverse quickly, the only thing those programs will have done is delay the inevitable.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.

This article was edited by Josiah Wilmoth.