Summary:

- Institutional demand for Bitcoin is rising as CME BTC Futures are now ranked second

- The open interest of the CME Bitcoin futures eclipses that of Binance, Bitmex and even Bybit

- This is a sign of continual institutional interest in Bitcoin

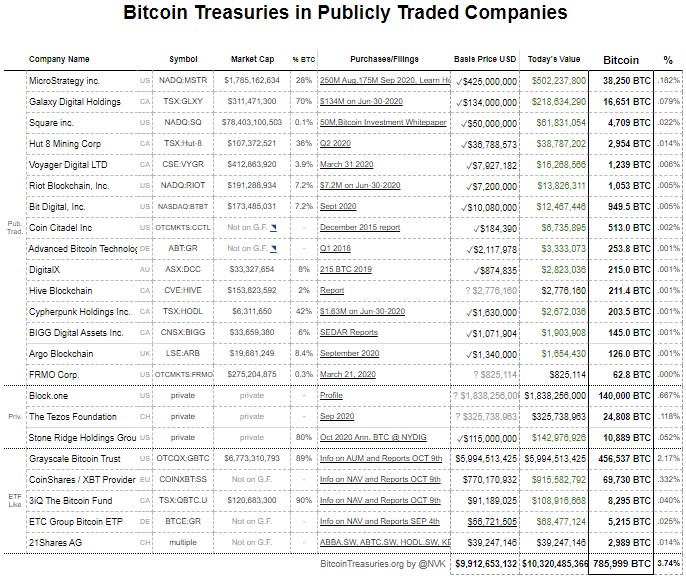

- Outside of futures platforms, 785,999 BTC is currently held by publicly traded companies

The demand for Bitcoin (BTC) has continued to spread outside regular retail traders. According to data from Arcane Research, the CME Bitcoin futures market is now the second-largest with an open interest of nearly $800 Million. This means that the CME BTC futures market is trading more Bitcoin futures contracts than popular exchanges such as Binance, Bitmex, Huobi and Bybit. Only OKEx has a higher Bitcoin open interest than the CME Group.

Below is the observation by the team at Arcane Research and an accompanying chart illustrating the open interest on each major crypto exchange.

The institutional demand for bitcoin exposure is growing!

CME is currently the second largest futures market for bitcoin, with an open interest of nearly $800 million.

Data: @skewdotcom

Read more in our weekly market update next week: https://t.co/HnsMugFPJX pic.twitter.com/7Vs9ZlzzFX

— Arcane Research (@ArcaneResearch) October 23, 2020

Institutional Bitcoin FOMO is Here

With the CME Bitcoin futures now ranking second, institutional investors are also buying and holding Bitcoin. Such purchases of Bitcoin are directly being added to the treasury of the corresponding companies in a move which Weiss Ratings has defined as ‘Institutional FOMO at its finest’.

Institutional FOMO at its finest. We’re already seeing the “#Bitcoineffect” where companies announcing they are adding #BTC to their Treasury tends to boost their price. Let that sink in: Buying Bitcoin is seen as a positive catalyst for a company’s stock. We’ve come a long way.

The team at Weiss was commenting on a tweet by the CEO of Gemini, Tyler Winklevoss, which predicted that more companies and even countries, will buy Bitcoin and add the digital asset to their treasuries. Below are both tweets by Weiss Ratings and Mr. Winklevoss.

Institutional FOMO at its finest. We’re already seeing the “#Bitcoin effect” where companies announcing they are adding #BTC to their Treasury tends to boost their price. Let that sink in: Buying Bitcoin is seen as a positive catalyst for a company’s stock. We’ve come a long way. https://t.co/yRLX2mlzGE

— Weiss Crypto Ratings (@WeissCrypto) October 22, 2020

785,999 Bitcoin Held in Company Treasuries

In terms of the exact number of Bitcoins being held by publicly trading companies in the United States, BitcoinTreasuries.org is tracking each purchase with the aggregated amount currently at 785,999 Bitcoin. This is an impressive amount that is roughly 4% of Bitcoin’s current circulating supply. The current list of companies buying and holding Bitcoin can be found below and courtesy of BitcoinTreasuries.org. The list includes known companies such as Microstrategy, Square and Grayscale.