Tether (USDT) exchange inflow has recently spiked to its highest level in the last 8 months, according to data from on-chain data provider Glassnode. Exchange inflows for the stablecoin reached a 2020 high yesterday as Bitcoin (BTC) soared to $10,270, although BTC has since continued on its rally, currently sitting at $11,000.

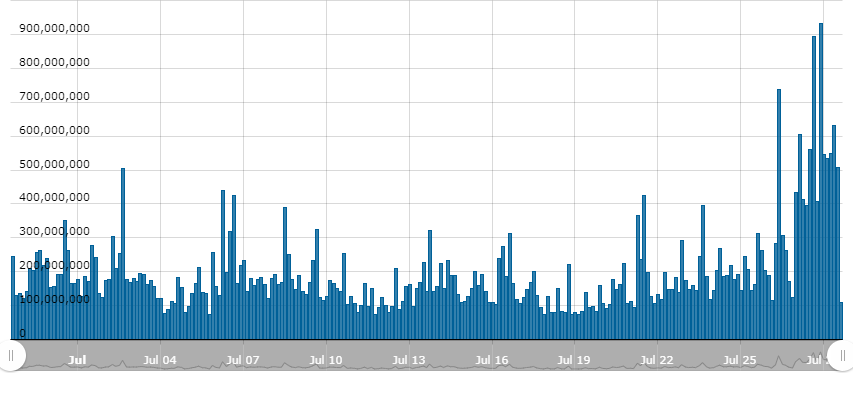

USDT Exchange inflows. Source: Glassnode

While research firms have found that there is an inverse correlation between the USDT held on exchanges and the price of Bitcoin, the inflow can also be considered as a bullish sign for Bitcoin as USDT is the fastest and most popular way to acquire Bitcoin.

USDT continues to grow on all fronts

Recently, USDT has broken through several records, having recently overtaken Ripple (XRP) as the third largest cryptocurrency by market capitalization and even surpassing the $10 billion mark this month. Currently USDT accounts for the majority of the collective stablecoin market capitalization which also recently rose above $12 billion.

Not only has the market capitalization for USDT been growing consistently (along with most of its USD-based competitors), its volume has recently picked up. Although,USDT volume is still far from it’s all-time high in March 2020, volume for the BTC/USDT pair has picked up during the past week and was largely fueled by Bitcoin’s price surge.

USDT – 24h volume (BTC). Source: CryptoCompare

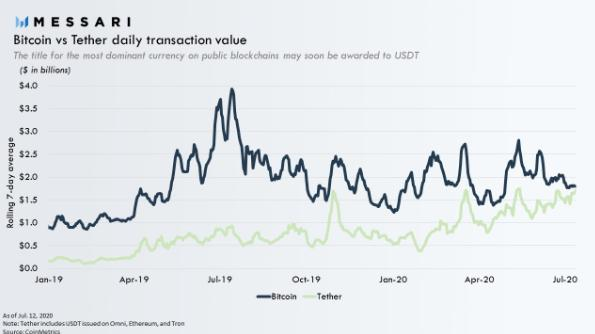

A recent report by Messari, a markets and on-chain analytics firm, showed that USDT alone may very soon surpass Bitcoin as the dominant cryptocurrency in terms of daily transaction volume.

This takes into account all the USDT transferred across Ethereum, Tron and Omni layer, a colored coin protocol on the Bitcoin blockchain itself. The growth in value settled through USDT is also largely attributed to inter-exchange settlement and the decentralized finance sector.

Bitcoin vs Tether daily transaction value. Source: Messari

The bearish scenario

The recent spike in exchange inflows along with all the other metrics around USDT may point to a bullish scenario for Bitcoin. While a growing market cap for USDT suggests demand for the stablecoin, increasing exchange inflows show demand for Bitcoin and other cryptocurrencies.

Additional demand for USDT could be attributed to the fact that only a few exchanges offer USDT-based derivatives as a means to long and short Bitcoin.

However, according to CryptoCompare analyst James Li, the recent USDT exchange inflows observed by Glassnode may not be such a positive factor for Bitcoin price when considered on its own. Li told Cryptox:

“Looking at historical patterns in the graph alone does not seem to give off a bullish signal in my opinion. Some previous large inflows were followed by price decline, and some didn’t move the price. The time when it did eventually lead to price increase was after the big drop in March but this time around, there wasn’t a drop preceding this price increase.”