The Ethereum-based peer-to-peer lending platform Aave has been in the spotlight of the cryptocurrency market after the 1,500% price increase it has enjoyed throughout the year. In July alone, LEND skyrocketed nearly 185% to reach a new yearly high of $0.38.

This price level is just a few cents below its all-time high of $0.394 that was reached by the end of the 2017 ICO mania.

Aave Skyrockets 185% Throughout July 2020. (Source: TradingView)

Given the substantial gains that Aave has posted, different metrics anticipate that it is reaching an exhaustion point. An increase in sell orders could push the DeFi token into a corrective period before the uptrend resumes.

Aave Looks Poised to Pull Back

The Tom Demark (TD) Sequential indicator has proven to be essential in determining Aave’s price action. This technical index has been able to anticipate some of the most significant exhaustion points on LEND’s 3-day chart over the past year.

In late February, for instance, after the DeFi token surged to $0.043, the TD setup presented a sell signal in the form of a green nine candlestick. Following the bearish formation, LEND went through a massive bearish impulse that saw its price plummet by nearly 62%.

The TD Sequential index was also able to accurately estimate that this altcoin was reaching an overbought territory in late April and June. After these sell signals were presented, the peer-to-peer lending token plunged by more than 23% on each occasion.

The TD Index Estimates LEND Is Poised to Retrace. (Source: TradingView)

Now, this technical indicator is once again suggesting that Aave is poised to correct. The bearish formation developed as a green nine candlestick, estimating that LEND could fall for a one to four 3-day candlesticks.

Critical Support Level to Watch Out

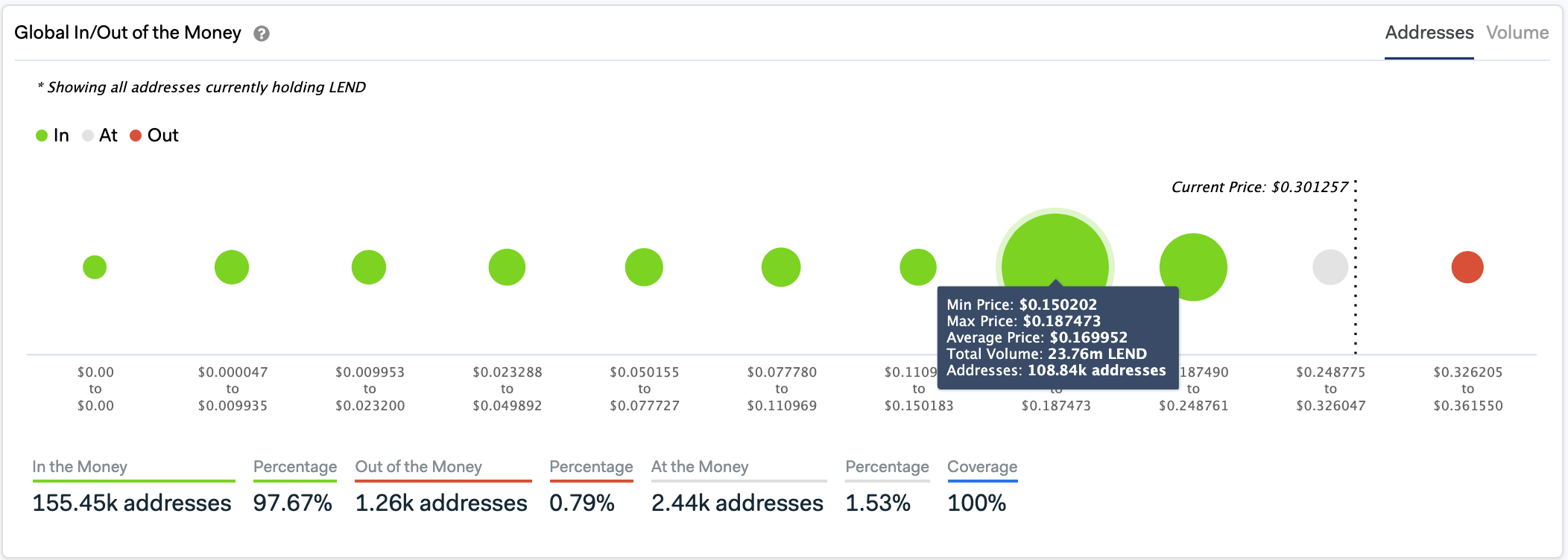

In the event of a correction, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that the most significant support level underneath Aave sits between $0.15 and $0.19. Around these price levels, the on-chain metric shows that roughly 109,000 addresses had previously purchased nearly 24 million LEND.

This massive supply barrier may be able to contain this cryptocurrency from a steeper decline. Holders within this range will likely try to remain profitable in their long positions. They may even buy more LEND to avoid prices from falling lower.

Aave May Find Support Around $0.17 In the Event of a Correction. (Source: IntoTheBlock)

It is worth noting that out of all LEND addresses, more than 97.6% are “In the Money.” Meanwhile, only 0.80% of all addresses are “Out of the Money.” These figures suggest that the investor base behind the DeFi token is confident about upwards price action in the future. If this is the case, it is reasonable to assume that the selling pressure behind it may not last long.

Featured Image by Depositphotos Price tags: lendusd, lendbtc Chart from TradingView.com