House passes $1T infrastructure bill with crypto tax for Biden’s approval

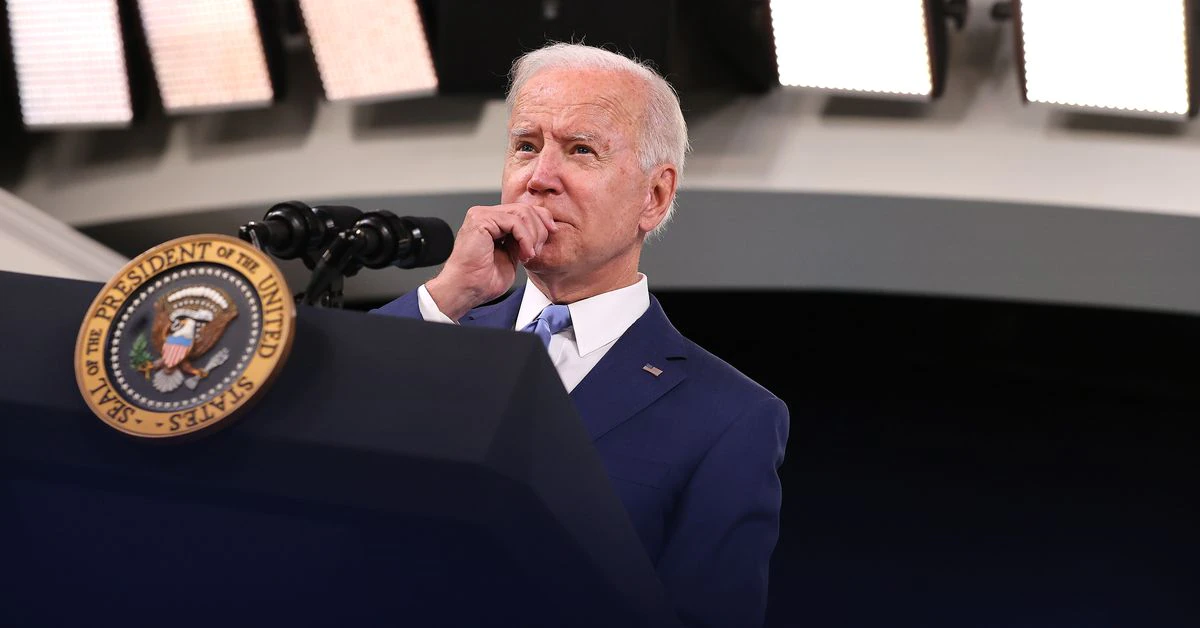

The United States House of Representatives passed the $1.2 trillion bipartisan infrastructure bill, which if signed into law by President Joe Biden, would enforce new provisions in relation to crypto-tax reporting for all citizens.The infrastructure bill was first proposed by the Biden administration aimed at primarily improving the national transport

Read More