Bitcoin price (BTC) returned to sideways trading on Oct. 14 after a sudden dip on Sunday evening saw markets lose 2% in minutes.

Cryptocurrency market daily overview. Source: Coin360

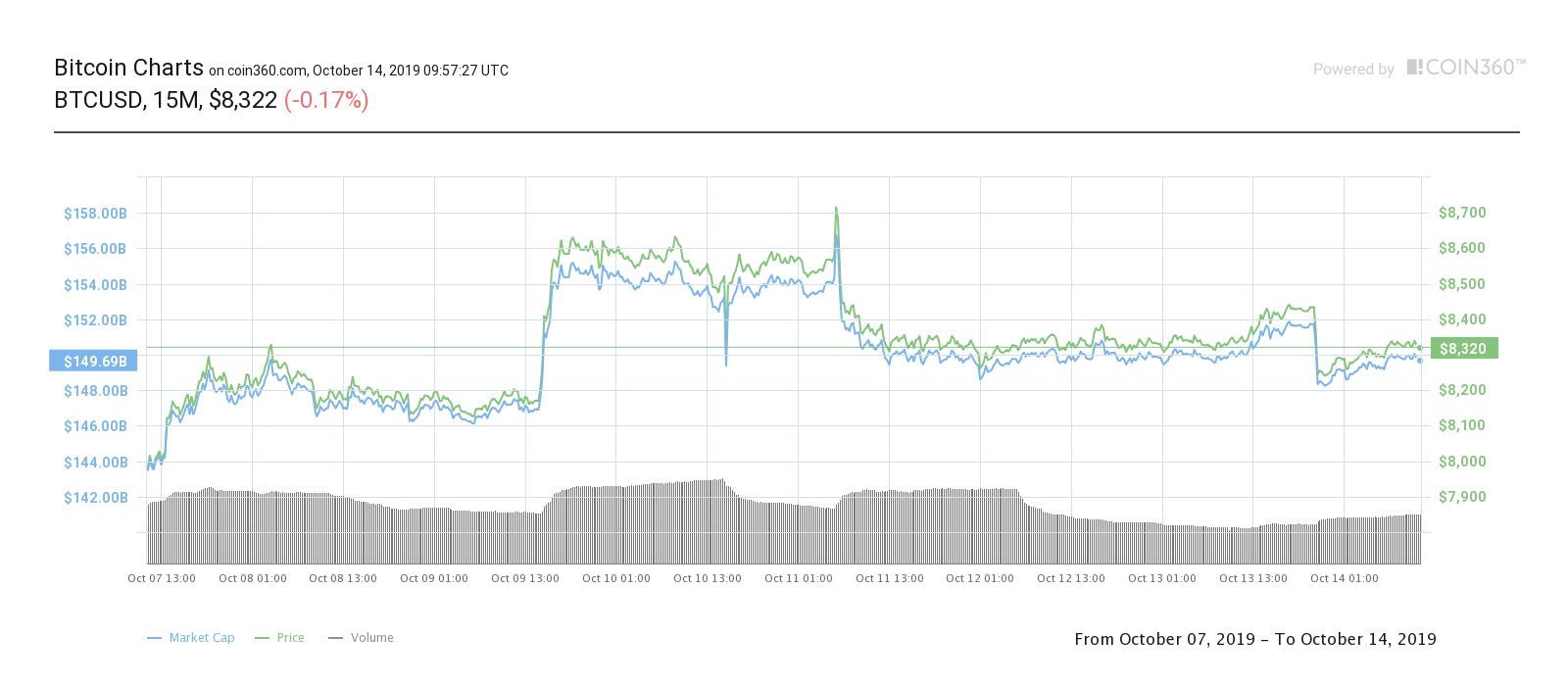

Bitcoin claws back lost ground

Data from Coin360 showed the largest cryptocurrency fluctuating around $8,300 at press time, having made up some of the ground lost during the downturn.

BTC/USD spent much of the weekend grinding upwards, reaching local highs of $8,460 before dramatically reversing to bottom out at $8,200 minutes later.

Since then, a slow recovery has been underway, paring 50% of the losses.

Bitcoin seven-day price chart. Source: Coin360

The behavior mimics multiples occasions in recent weeks and months, during which Bitcoin punctuated periods of flat activity with sudden volatility either up or down.

Various theories blamed traders and institutional investor settlements for the erratic behavior. This time, analysts told CryptoX, it was likely combined selloffs by significant bagholders, which triggered the momentary market slump.

For regular CryptoX contributor filbfilb, the short-term performance of Bitcoin revolves around whether support above $7,800 holds. The weekend uptick fizzled when it encountered Bitcoin’s 200-day moving average.

“If this thing really is bullish I don’t really want us to lose the lows on this wick from last night,” he told subscribers of his dedicated Telegram trading channel about Sunday’s dip.

Fellow contributor Michaël van der Poppe held similar feelings. For him, an area near $7,400 remained crucial.

“Overall not the worst,” he summarized on Twitter.

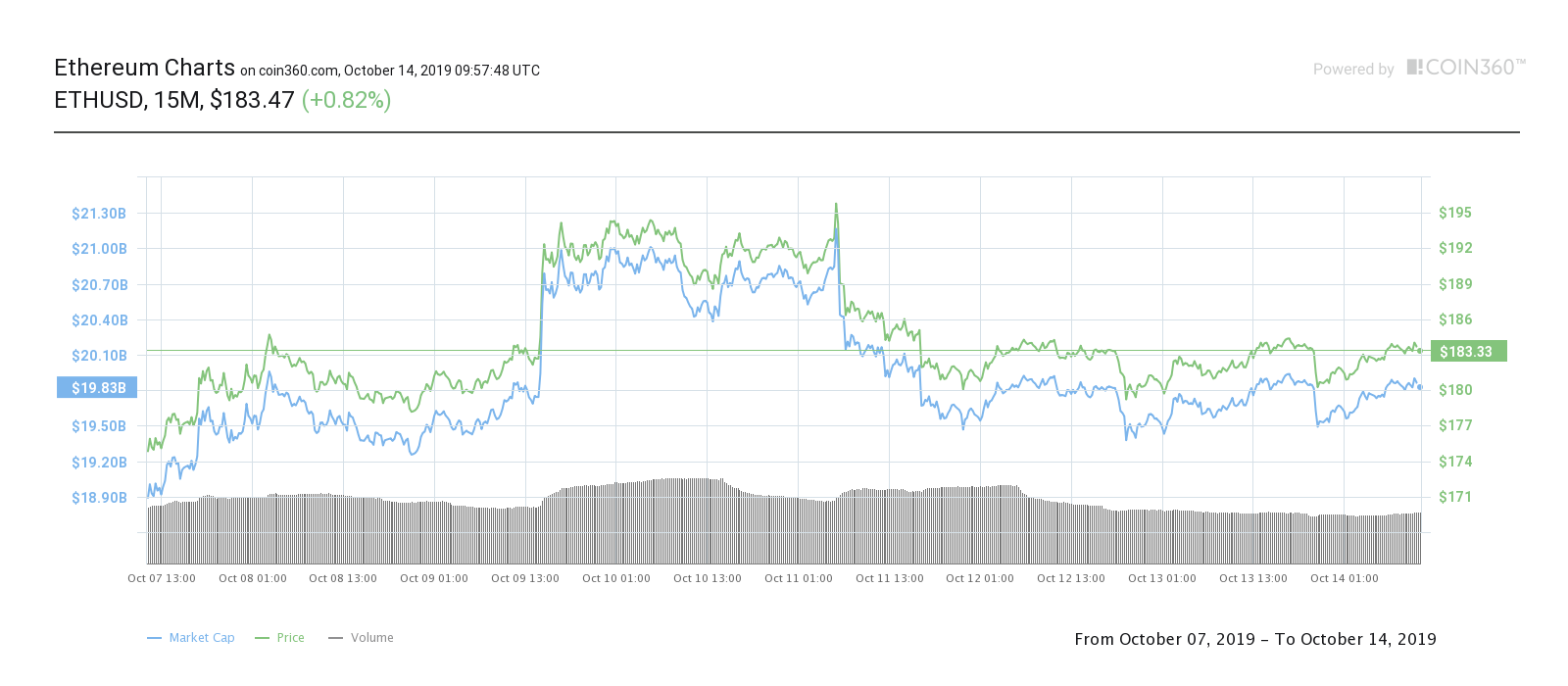

Altcoins see a glimpse of promise

For altcoin investors, the picture was one of rare contrast to Bitcoin, with many assets making modest gains overnight.

Ether (ETH), the largest altcoin by market cap, began the week up 0.8% to just over $183.

Ether seven-day price chart. Source: Coin360

Others put in a stronger performance, with XRP up 4.3% to $0.29, and Binance Coin (BNB) gaining 3% to pass $18 per token.

By contrast, Bitcoin SV (BSV) fell 3.5% to $86 over the same period.

The overall cryptocurrency market cap was $226.1 billion at press time, with Bitcoin’s share at 66.4%.