Stablecoin Tether (USDT) is clearly the preference among investors but will not see a retail use case, Samson Mow says.

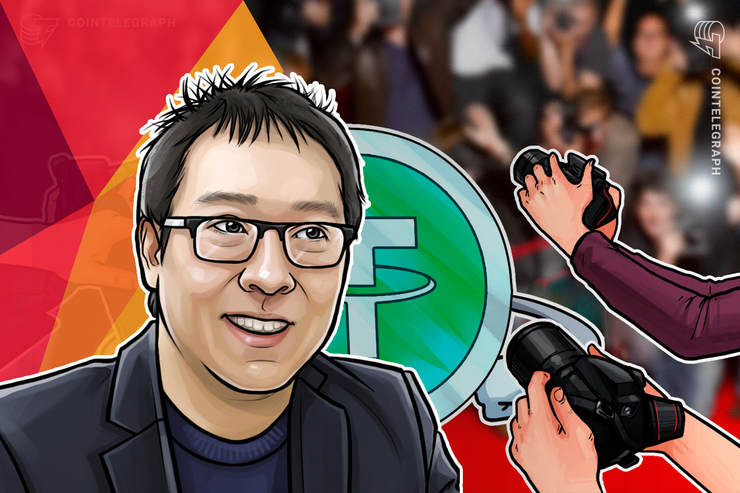

The Blockstream CSO, who was speaking at CryptoX’s ongoing BlockShow conference on Nov. 15, noted that Tether’s first-mover advantage placed it in another league from the increasing number of other stablecoins on the market.

Mow: Tether won’t be big in retail

Mow made the comments during a panel dubbed “The progress of stablecoins — if any? Can I use it yet?” It featured representatives of several stablecoin companies, along with Chia Hock Lai, president of the Singapore FinTech Association.

“Tether is controversial because it’s the king of stablecoins,” he summarized, wearing a Tether T-shirt. “So it’s no surprise that everyone is trying to come at the king.”

Continuing, Mow noted but dismissed the public struggles USDT’s issuer is facing, including a United States lawsuit:

“Daily trading volume is $20 billion per day — 100 times larger than the next biggest stablecoin. So we see stupid things like theories about one whale manipulating Bitcoin price — billion-dollar lawsuits etc.”

Nonetheless, for all its success, Tether is unlikely to find a home among everyone consumers, as its utility lies elsewhere.

“I don’t think stablecoins will be adopted in retail use cases. They’re used mainly for traders to take advantage of arbitrage opportunities,” Mow added.

National digital currencies could kill off stablecoins

The panel also discussed the impact of national digital currencies issued by central banks on stablecoins, as well as Facebook’s Libra.

Going forward, Mow said he envisaged no threat from Bitcoin (BTC), but national digital currencies such as China’s could disrupt stablecoins’ use case.

“Stablecoins are a mid-step toward hyperbitcoinization. They’re a temporary thing. The main threat they face is from the national cryptocurrencies. How open will those national cryptocurrencies be? …But stablecoins will then have no reason to exist with a national cryptocurrency,” he continued.

He additionally foresees more USDT — and other stablecoins — migrating from the Ethereum network to Blockstream’s Liquid sidechain to avoid well-known congestion issues.

Mow added that Japanese yen, Canadian dollar and Australian dollar stablecoins are currently being developed to launch on the Liquid network in the near future.

As for Libra, he said, it is already too late:

“I think Libra is doomed.”