Coinspeaker

Stablecoin Market Cap Hits $168B, Sets New All-Time High After 11 Months of Growth

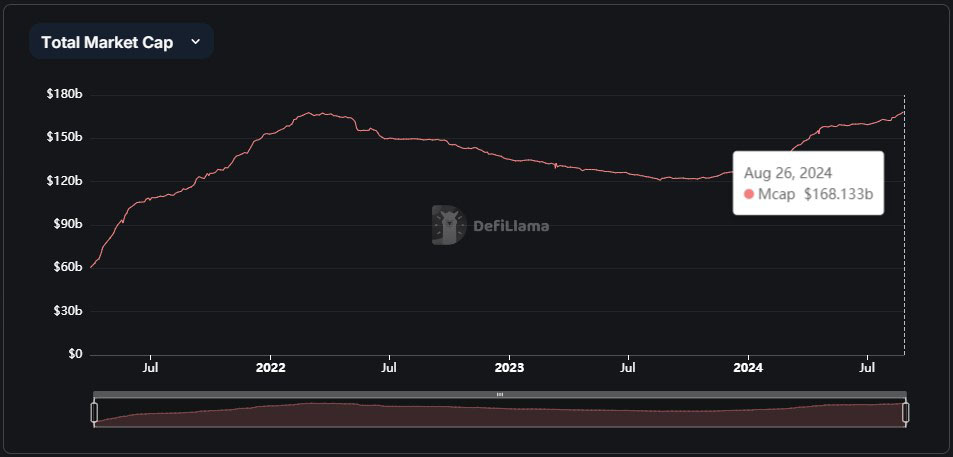

The stablecoin market has hit a new peak, reaching a total value of $168 billion as of August 26, 2024. This record caps 11 straight months of growth, showing increased investor confidence and market strength. DefiLlama data reveals that this number has now passed the previous high of $167 billion set in March 2022. However, the market saw a sharp drop later in 2022, falling to $135 billion by year-end, underscoring the volatility after the earlier peak.

Source: DefiLlama

Stablecoin Market Excludes Algorithmic Models

The current market cap excludes algorithmic stablecoins that maintain value using mathematical models instead of external assets like fiat or commodities. The recent surge is mainly due to non-algorithmic stablecoins, which have seen consistent demand and adoption over the past year.

Crypto analyst Patrick Scott, known as “Dynamo DeFi”, highlighted on X that this rise signals “new money entering crypto.” He emphasized, “And just like that, we’re at a new all-time high,” reflecting renewed interest in stable assets despite ongoing market hurdles.

And just like that, we're at a new all-time high.

Total stablecoin market cap, excluding algorithmic stables, is now at the highest point ever, surpassing its previous high from early 2022.

New money is entering crypto. pic.twitter.com/xi25HLWlPr

— Patrick Scott | Dynamo DeFi (@Dynamo_Patrick) August 25, 2024

Tether (USDT) has driven this growth. Starting in 2024 with a $91.69 billion market cap, USDT steadily increased to reach a record $117 billion by August. Circle’s USDC also expanded, surpassing $34 billion, though it remains below its June 2022 peak of $55.8 billion.

However, challenges persist in the stablecoin market. A July 2024 CCData report revealed that stablecoin trading volumes dropped by 8.35% to $795 billion due to reduced activity on centralized exchanges. The report notes that the EU’s Markets in Crypto-Assets (MiCA) regulations have added uncertainties, particularly for USDT’s future in Europe. These regulatory pressures have further slowed trading volumes, which remained just above $46 billion in August.

Stablecoins Lead in Crypto Recovery

Despite the regulatory hurdles, the overall market sentiment remains bullish. Analysts are closely watching whether this growth will be sustained or if future regulations could trigger another downturn. Nevertheless, this 11-month streak signifies a solid recovery and growing stability within the crypto ecosystem, driven mainly by the performance of major stablecoins like Tether and Circle.

The stablecoin market’s recent rally shows its resilience amid regulatory uncertainties and volatile market conditions. Investors and market watchers remain optimistic about future trends, although the sector’s path forward will depend significantly on how it navigates upcoming regulatory landscapes in Europe and beyond.

Stablecoin Market Cap Hits $168B, Sets New All-Time High After 11 Months of Growth