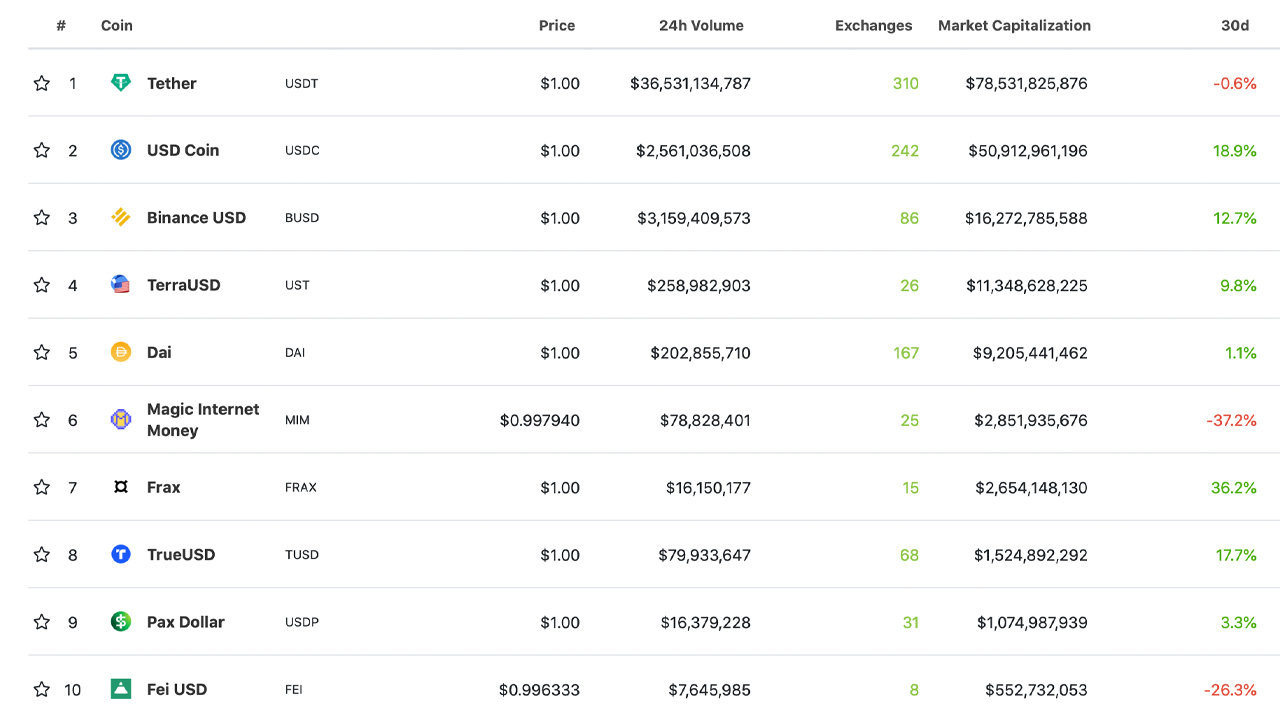

As the entire lot of 12,333 digital currencies hovers just above $1.8 trillion in value, the stablecoin economy has recently swelled to $178.8 billion or 9.9% of the entire crypto economy. Out of the top five stablecoins, usd coin (USDC) saw its market capitalization jump the most, increasing 18.9% during the last 30 days. The 18.9% increase has pushed USDC’s market capitalization above the $50 billion mark.

USDC Market Cap Rises Above $50 Billion, Stablecoin Represents 2.83% of the Crypto Economy’s USD Value

Stablecoins continue to grow in 2022, as numerous fiat-pegged token projects have seen their issuance levels increase during the first month of the year. At the time of writing, the USD value of all the stablecoins today is $178.8 billion.

Tether (USDT) is the largest stablecoin project in terms of market capitalization, with a valuation of around $78.5 billion. USDT’s overall valuation represents 4.34% of the entire crypto economy’s $1.8 trillion. Tether, however, saw no growth during the last month as the overall valuation has remained static.

USDC, on the other hand, has grown 18.9% over the last 30 days and the market valuation is now over $50 billion. USDC’s market capitalization is 2.83% of the entire crypto economy’s USD value.

Both USDT and USDC combined represent 7.17% of the fiat value of all the coins in existence today. While these caps are much smaller than bitcoin’s (BTC) 39.2% dominance and ethereum’s (ETH) 17.7% dominance, they still represent the third and fifth largest crypto valuations.

Stablecoin FRAX Grew More Than 36% Last Month

Meanwhile, out of the top five stablecoins by market cap, the third-largest USD-pegged token, BUSD, saw its capitalization increase by 12.7% to $16.2 billion this month. Terra’s stablecoin UST increased by 9.8% to $11.3 billion in 30 days.

Makerdao’s DAI saw its $9.2 billion market capitalization increase by 1.1% this past month. The Avalanche-based magic internet money (MIM) saw its $2.8 billion valuation slide 37.2% lower than it was last month. The seventh, eighth, and ninth-largest stablecoin markets saw their market caps rise.

The seventh-largest USD-pegged coin frax (FRAX) has a market capitalization of $2.6 billion which has increased 36.2% during the last month. Trueusd’s (TUSD) cap spiked 17.7%, and pax dollar (USDP) rose by 3.3% over the last 30 days.

The tenth-largest stablecoin, fei usd (FEI), has decreased by 26.3% this past month. Both FRAX and USDC saw the largest increases last month.

What do you think about the stablecoin economy’s increase during the last month and USDC’s rise past $50 billion? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.