The famous author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, has warned that the U.S. dollar is “about to implode.” Among the investments he suggested are cryptocurrencies bitcoin, ethereum, and solana.

Robert Kiyosaki Foresees Dollar Imploding, Blames Biden for Inflation

The author of Rich Dad Poor Dad, Robert Kiyosaki, is back with more warnings about the imminent collapse of the U.S. dollar. He also suggested investors buy some cryptocurrencies, naming three in particular: bitcoin, ether, and solana.

Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

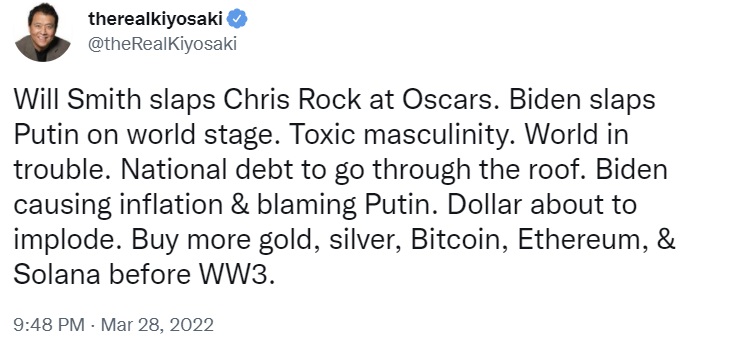

Kiyosaki tweeted Monday warning that the world is in trouble. “National debt to go through the roof,” he wrote, emphasizing that the dollar is “about to implode.” The famous author insisted that President Joe Biden is causing inflation. He then suggested that investors buy more gold, silver, bitcoin, ethereum, and solana before the third world war breaks out.

Kiyosaki has repeatedly warned about the end of the U.S. dollar. He also recently said that we are in the biggest bubble in world history.

Kiyosaki Recommends Bitcoin, Ethereum, and Solana

While Kiyosaki has recommended bitcoin (BTC) many times in the past, and ethereum (ETH) occasionally, he has not recommended solana (SOL) until now. In November last year, he said he was buying more bitcoin and ethereum as inflation escalated.

Many people questioned why he is advising investors to buy solana. SOL supporters see the Rich Dad Poor Dad author’s recommendation as very bullish for the price of the cryptocurrency while others disagree about it being a good investment. One person suspected that Kiyosaki is being paid to promote solana, stressing that the famous author “likes hard money.”

Another celebrity investor who has been into solana lately is Kevin O’Leary. The Shark Tank star, aka Mr. Wonderful, has been on Kiyosaki’s Rich Dad show and Kiyosaki previously said O’Leary “knows what he is talking about.”

In January, O’Leary said that Solana and Polygon will be two of the most successful projects. However, O’Leary, being a paid spokesperson for crypto exchange FTX, may have been influenced by FTX CEO Sam Bankman-Fried, who said solana could be the next bitcoin. Bankman-Fried and his team have been working on projects built on Solana. “Who’s working on that? Sam Bankman Fried and his team. Why wouldn’t ya bet that horse?” O’Leary said.

Despite his crypto recommendations, Kiyosaki warned earlier this month that the government will seize all cryptocurrencies after they launch a “Fed crypto.” Nonetheless, he subsequently said that the Russia-Ukraine war has given rise to crypto as a safer haven than fiat money.

What do you think about Kiyosaki’s predictions and crypto suggestions? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.