SUKU, a blockchain startup that tracks luxury goods among other things, is moving its high-end sneaker authentication system to Hedera Hashgraph, after the fees on Ethereum became too high.

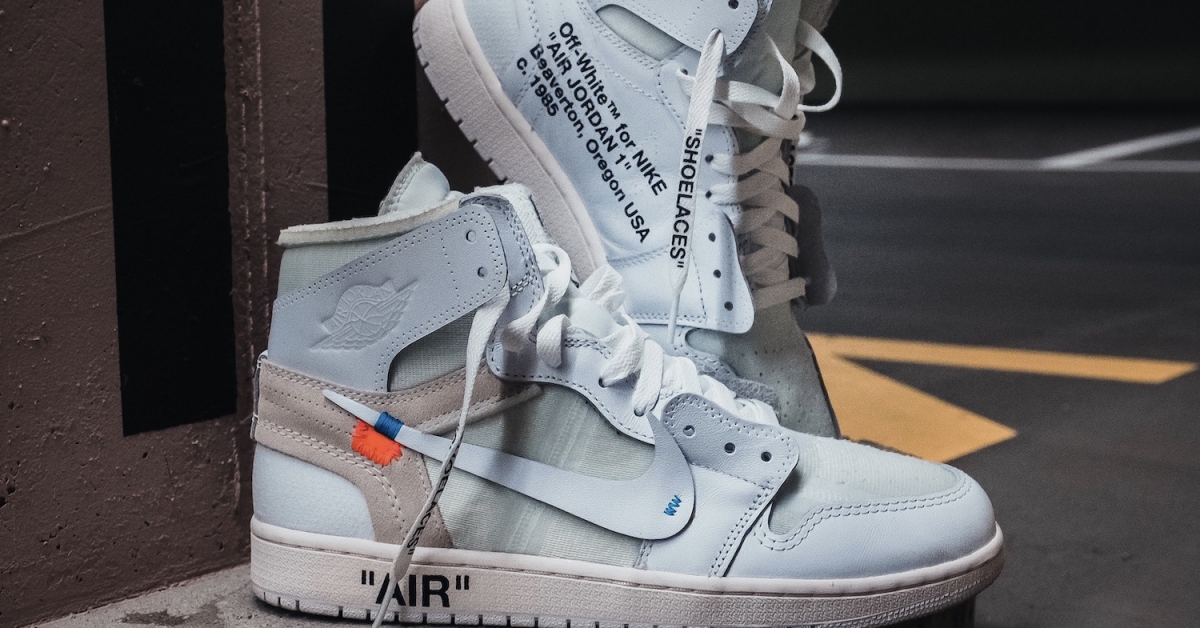

The first SUKU application to migrate to Hedera is called INFINITE, and it uses non-fungible tokens (NFTs), one-of-a-kind digital watermarks, to authenticate and enable easy secondary trading in limited-edition kicks, which tend to command prices of $2,000 and upward.

The sneaker authentication app has a physical NFT tag inside the shoe, combined with the unforgeable identity token. (It’s not the first time rare and valuable sneakers have been crossed with NFTs.) The cost of creating an NFT on Ethereum at current gas prices is over $80, as opposed to $1 to mint a one-off token on Hedera, explained Yonathan Lapchik, CEO of Citizens Reserve, the creator of SUKU.

“Don’t get me wrong, we love Ethereum,” said Lapchik. “But now we are getting a lot of users of the app and we need to make those fees as low as possible, and on Ethereum it really wasn’t possible to scale.”

Lapchik said the INFINITE app is now being integrated into three sneaker authentication platforms, including StockX, the iconic secondary sneaker marketplace. The secondary market in rare trainers is well established but it lacks the kind of digital titles that tend to accompany luxury watches, for example.

“We are really tackling the issue of tags that authenticate sneakers that really don’t work nowadays,” said Lapchik. “If you have a pair of sneakers and want to resell back to the platform you got them from, or to someone else, you need to get them authenticated again. What we’ve built is valuable for secondary marketplaces, but also for brands.”

The SUKU blockchain journey started some three and a half years ago, using a mix of Quorum, the privacy-centric fork of Ethereum designed by JPMorgan, as well as the public chain. SUKU continues to be enterprise-focused (its OMNI platform also does supply chain track-and-trace), and hence Hedera is well suited to the firm’s needs, said Lapchik.

Under the hood, Hedera uses a variation of distributed ledger technology that can handle very high transaction volume but isn’t really blockchain. The network is governed by the Hedera Governing Council, which includes firms like Google, IBM and LG running nodes.

A key part of the migration, SUKU will be the first firm to leverage Hedera’s Token Service in a way similar to the non-fungible ERC-721 token standard on Ethereum, Lapchik said.

“We have created the same foundation that we have with ERC-721 and brought that to Hedera Token Service NFTs,” he said.