Bitcoin has resumed its move toward $50,000 and this is likely to send altcoin prices higher.

Wells Fargo, in partnership with NYDIG and alternative assets manager FS Investments, has registered a new investment fund dubbed “FS NYDIG BITCOIN FUND I,” which will offer the bank’s wealthy clients an opportunity to gain indirect exposure to Bitcoin (BTC).

In another sign of growing institutional interest, filings submitted to the U.S. Securities and Exchange Commission by BlackRock show a 6.71% stake in Marathon Digital Holdings and a 6.61% stake in Riot Blockchain. BlackRock’s total investments in both the publicly traded Bitcoin mining firms are roughly valued at $384 million.

Coinbase CEO Brian Armstrong announced on Aug. 20 that the company’s board had approved a proposal to add $500 million worth of crypto to the balance sheet and allocate 10% of the profits earned into crypto purchases in the future.

With this move, Coinbase will become the first publicly-traded company to hold Ether (ETH), decentralized finance tokens and proof-of-stake assets on its balance sheet.

The institutional interest in crypto continues to grow and that may bode well for the sector in the future. Let’s study the charts of the top-10 cryptocurrencies and determine the critical levels to watch out for.

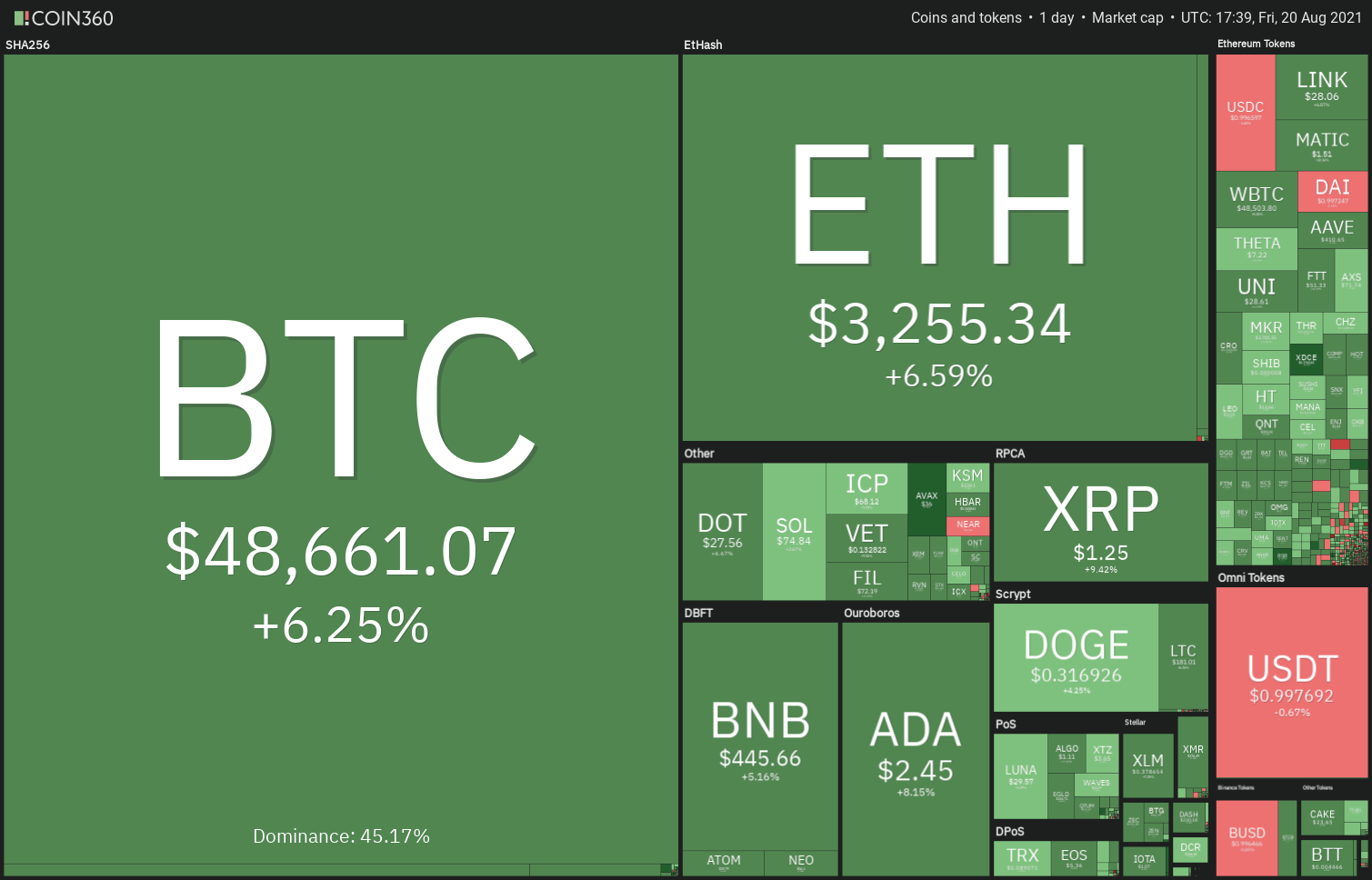

BTC/USDT

Bitcoin had been witnessing a tough tussle between the bulls and the bears near the 200-day simple moving average ($45,692) for the past few days. The bears pulled the price below the 200-day SMA on Aug. 17 but they could not break the 20-day exponential moving average ($44,183) support.

Aggressive buying at the 20-day EMA pushed the price back above the 200-day SMA on Aug. 19. The rising 20-day EMA and the relative strength index (RSI) near the overbought territory indicate that bulls are in control.

If buyers sustain the price above $48,144, the BTC/USDT pair could pick up momentum and rally to $51,500 where the bears may again mount a stiff resistance. If bulls can arrest the subsequent decline above the 200-day SMA, it will signal strength and increase the prospects of the continuation of the uptrend.

A breakout of $51,500 could lay the tracks for a possible up-move to $60,000. This bullish view will invalidate if the price turns down and breaks below the breakout level at $45,451.67.

ETH/USDT

Ether turned down from $3,335 on Aug. 16 and the bears tried to pull the price below the breakout level at $3,000 on Aug. 17 and 18. Although the price dipped below this support, the bears could not sustain the lower levels, indicating strong buying by the bulls.

The ETH/USDT pair rebounded off the 20-day EMA ($2,981) on Aug. 19, suggesting that bulls are aggressively defending this support. The buyers will now try to push the price above the overhead resistance at $3,335. If they manage to do that, the pair could start its journey toward $4,000.

Contrary to this assumption, if the price turns down from $3,335, the pair could again drop to $3,000 and consolidate in this tight range for a few more days. A break and close below $3,000 will be the first sign that bulls are losing their grip. The pair could then drop to the 50-day SMA ($2,311).

ADA/USDT

The bulls flipped the $1.94 level to support on Aug. 17 and 18. This attracted further buying and the bulls pushed Cardano (ADA) above the all-time high at $2.47 today.

The ADA/USDT pair could now rally to $2.73 where it is again likely to face stiff resistance from the bears. If bulls bulldoze their way through this resistance, the pair could reach the psychological barrier at $3.

Although the trend favors the bulls, the RSI near 80 shows the rally is overextended in the short term. If the price slips and sustains below $2.47, the bears will try to pull the pair down to $2.20. A break below this level will suggest that the momentum has weakened in the short term. The pair could then drop to the 20-day EMA ($1.87).

BNB/USDT

Binance Coin (BNB) turned down from the overhead resistance at $433 on Aug. 17 but the bulls did not allow the price to break below the 20-day EMA ($384).

A strong rebound off the 20-day EMA has pushed the price above the stiff resistance at $433. If bulls sustain the price above $433, the BNB/USDT pair could start its northward march toward $520 and then to $600.

The rising moving averages and the RSI in the overbought territory indicate that the path of least resistance is to the upside. This bullish view will be negated if the price turns down and breaks below the 20-day EMA. That could result in a decline to $340.

XRP/USDT

XRP broke above the downtrend line of the descending channel and the overhead resistance at $1.07 on Aug. 13, which completed a rounding bottom pattern. The bears tried to pull the price back below $1.07 but the bulls foiled their attempt.

The strong rebound off $1.07 on Aug. 18 shows that the bulls successfully flipped this level into support. The XRP/USDT pair could now rally to $1.70. This level could act as stiff resistance but if bulls overcome this hurdle, the pair may rally to $1.96.

Alternatively, if the price turns down from $1.35, the bears will try to pull the pair below $1.07 and the 20-day EMA ($1.01). If they succeed, the pair could drop to the 200-day SMA ($0.84). Such a move will suggest that traders offloaded their positions at higher levels.

DOGE/USDT

Dogecoin (DOGE) broke and closed above the $0.29 resistance on Aug. 14, which cleared the path for a rally to $0.35. The bears mounted a stiff resistance at this level on Aug. 16 and pulled the price back to the breakout level at $0.29.

The bulls successfully defended the breakout level at $0.29 on Aug. 21, suggesting that the sentiment is positive. If buyers thrust the price above $0.35, the DOGE/USDT pair could rally to the next overhead resistance at $0.45.

Conversely, if the price turns down from the current level or $0.35, the bears will again try to sink the pair below the 20-day EMA ($0.27). If they manage to do that, the pair could decline to the next support at $0.21.

DOT/USDT

Polkadot (DOT) turned down from the 200-day SMA ($27.52) on Aug. 17 but the correction was short-lived as the bulls bought the dip on Aug. 18. The buyers have pushed the price above the 200-day SMA today.

The DOT/USDT pair will complete a V-shaped bottom if it rises and closes above the $28.60 resistance. This setup has a target objective at $46.83.

However, such a move may not be easy because the RSI has risen deep into the overbought territory, indicating that the rally is overextended in the short term. That could result in a minor correction or consolidation in the next few days.

If the price rebounds off the 20-day EMA ($21.86), the bulls will again try to propel the price above $28.60. Alternatively, a break below the 20-day EMA will suggest that the pair may extend its range-bound action in the near term.

SOL/USDT

Solana (SOL) rose above the $44 resistance on Aug. 13. The bears tried to pull the price back below the breakout level on Aug. 14 but failed to sustain the lower levels. This shows that bulls were in no hurry to dump their positions.

The SOL/USDT pair broke above the all-time high at $58.38 on Aug. 16 and has continued its journey higher. The strong rally of the past few days has pushed the RSI above 89, suggesting that the up-move is overextended in the short term.

This could result in a few days of consolidation or a minor correction where the price may retest the breakout level at $58.38. If bulls flip this level into support, the rally may resume and reach the psychological mark at $100.

The bears will have to pull and sustain the price below $58.38 to weaken the bullish momentum.

Related: Bitcoin attacks last resistance before $50K with BTC price daily close now crucial

UNI/USDT

The failure of the bulls to sustain Uniswap (UNI) above the overhead resistance at $30 attracted profit-booking, which dragged the price lower on Aug. 16. Although bears pulled the price below the moving averages on Aug. 18 and Aug 19, they could not sustain the lower levels.

The strong rebound off the 20-day EMA ($26.60) on Aug. 19 suggests that the sentiment remains positive and the bulls are buying on dips. The bulls will now again try to push the price above the overhead resistance at $30.

If they succeed, the UNI/USDT pair could start a new uptrend. The first target on the upside is $37 and if this level is crossed, the pair could retest the all-time high at $45.

Conversely, if the price turns down from $30, the pair may drop to the 20-day EMA. A break and close below this level could pull the price down to $23.45.

BCH/USDT

Bitcoin Cash (BCH) broke above the 200-day SMA ($651) on Aug. 13 but the bulls could not build upon this advantage. Sensing an opportunity, the bears pulled the price back below the 200-day SMA on Aug. 17 but could not crack the support at the 20-day EMA ($613).

This suggests that the sentiment has turned positive and traders are buying on dips. The bulls pushed the price back above the 200-day SMA on Aug. 19 and will now try to thrust the BCH/USDT pair above $714.66.

If they can pull it off, the pair could rally to $800 and then to $864.28. On the other hand, if the price turns down from the current level or the overhead resistance and breaks below the 20-day EMA, the pair could slide to $546.83.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.