Bitcoin and a few altcoins have bounced off their recent lows, suggesting that the sentiment remains to buy the dips.

Bitcoin (BTC), gold, crude oil, and the US equity markets all rose sharply throughout the second quarter of this year. This shows that investors’ appetites remain strong as they are confident that central banks will continue to keep the money supply flowing.

While monetary easing can be a short-term solution, if it is not rolled back at the right time it can destroy the economy in the long-term, as seen in Zimbabwe.

Although the top-ranked asset on CoinMarketCap has been stuck in a range for the past few days, the participation from both institutional investors and retail investors has been increasing. This shows that informed investors have been buying Bitcoin for the long-term.

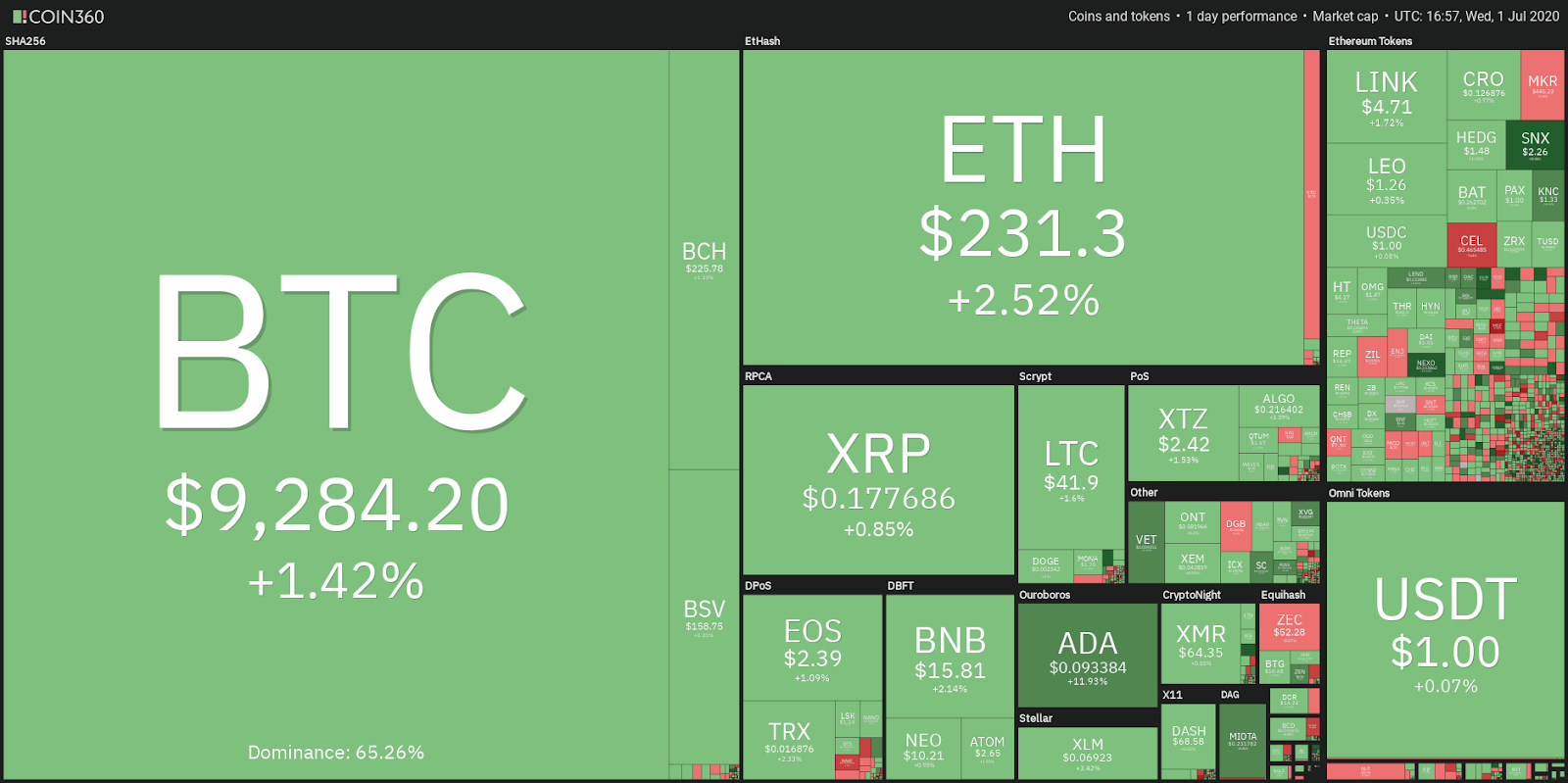

Daily cryptocurrency market performance. Source: Coin360

The third quarter has historically been the weakest quarter for the US stock markets, according to CFRA Research chief strategist Sam Stovall. If history were to repeat itself and the correlation between Bitcoin and the S&P 500 remains high, Bitcoin’s price action might remain subdued for a few more weeks.

BTC/USD

The bears were unable to take advantage of the breakdown from the trendline of the ascending triangle on June 27 as there was no follow up selling in Bitcoin (BTC) below $8,825. This indicates that selling dries up at lower levels.

BTC/USD daily chart. Source: Tradingview

Currently, the bulls are attempting to push the price back above the trendline. Even if they are successful, they will face stiff resistance at the 20-day exponential moving average ($9,314) and also at the 50-day simple moving average ($9,428).

A breakout of the 50-day SMA will signal strength and is likely to attract further buying, resulting in a move to $10,000.

This view will be invalidated if the BTC/USD pair turns down from the overhead resistance. In such a case, the bears will try to sink the price below $8,825 and if they succeed, a drop to $8,638.79 and $8,130.58 is possible.

ETH/USD

The rebound off $216.06 has reached the 20-day EMA ($230), which is likely to act as a stiff resistance, but if the bulls can push Ether (ETH) above this resistance a rally to $253.556 is possible.

ETH/USD daily chart. Source: Tradingview

Conversely, if the second-ranked cryptocurrency on CoinMarketCap turns down from the 20-day EMA, a retest of $216.006 is possible. A break below this support can result in a deeper correction to $200 and below that $176.112.

The 20-day EMA is flattening out and the relative strength index has risen to the midpoint, which suggests a balance between supply and demand. This could keep the ETH/USD pair range-bound for a few more days until the bulls drive the price above $253.56 and resume the uptrend.

XRP/USD

The relief rally in XRP could not scale above the $0.18 level, which shows a lack of buying support at higher levels. If the bears sink the price below $0.173278, a retest of the recent lows at $0.169012 is likely.

XRP/USD daily chart. Source: Tradingview

Both moving averages are sloping down and the RSI has been trading near the oversold zone, which suggests that bears are at an advantage.

A break below $0.169012 is likely to attract further selling that can drag the price to the support line of the descending channel. A break below the channel could intensify selling resulting in a drop to $0.14.

This bearish view will be invalidated if the bulls can push the fourth-ranked cryptocurrency on CoinMarketCap above the descending channel.

BCH/USD

After rising above $217.55, the buying in Bitcoin Cash (BCH) has dried up, which has resulted in a tight range trading for the past two days. A bounce off the current levels is likely to face stiff resistance at the moving averages.

BCH/USD daily chart. Source: Tradingview

The 20-day EMA ($232) is sloping down and the RSI is in the negative territory, suggesting that bears have the upper hand.

If the fifth-ranked cryptocurrency on CoinMarketCap slips below $217.55 a drop to the critical support at $200 is possible.

For this bearish sentiment to change the bulls will have to drive the BCH/USD pair above the 50-day SMA ($239).

BSV/USD

The relief rally in Bitcoin SV (BSV) fizzled out at $162.53 on June 28, which suggests that the bulls are hesitant to buy at higher levels. However, the bounce off the lows today indicates that lower levels are attracting some buying by the bulls.

BSV/USD daily chart. Source: Tradingview

Both moving averages are sloping down and the RSI is close to the oversold zone, which suggests that the path of least resistance is to the downside.

If the bears can sink the sixth-ranked cryptocurrency on CoinMarketCap below the $146.20–$135 support zone, the downtrend is likely to resume. The next target objective on the downside is $110.

Conversely, the first sign of strength would be a breakout and close (UTC time) above the breakdown level of $170.

LTC/USD

For the past three days, Litecoin (LTC) has been trading in a tight range of $40.5–$42, which shows that the bulls are struggling to carry the price higher. The 20-day EMA ($43) is sloping down and the RSI is in the negative zone, suggesting that the bears have the upper hand.

LTC/USD daily chart. Source: Tradingview

If the bears again sink the seventh-ranked cryptocurrency on CoinMarketCap below $41, a retest of $39 will be on the cards. A break below this critical support could signal the start of a new downtrend, with a short-term target objective of $35 and below it $32.50.

However, if buying picks up and the bulls are able to push the price above both moving averages, a rally to the resistance of the $39–$51 range is possible. The next trending move is likely to start after the LTC/USD pair breaks out of the range.

BNB/USD

The bulls are trying to propel Binance Coin (BNB) back above the overhead resistance at $15.72. Above this level, the recovery is likely to hit a wall at the 20-day EMA ($16).

BNB/USD daily chart. Source: Tradingview

If the eighth-ranked crypto-asset on CoinMarketCap turns down from the current levels or the 20-day EMA, the bears will attempt to sink the price below the immediate support at $14.80. Below this level, a drop to $13.65 is possible.

However, if the buyers can push the price above the 20-day EMA, a move to the 50-day SMA ($16.54) and then to $18.1377 is possible. The next trending move is likely to start after the BNB/USD pair breaks out of the large $13.65–$18.1377 range.

ADA/USD

Cardano (ADA) has broken out of the symmetrical triangle and the overhead resistance at $0.0901373, which indicates a resumption of the up move.

ADA/USD daily chart. Source: Tradingview

The pattern target of the breakout of the triangle is $0.10686 but it is unlikely to be a straight dash to the target as the bears might attempt to stall the uptrend at $0.10.

However, as both moving averages are sloping up and the RSI is close to the overbought territory, the advantage remains with the bulls.

This view will be invalidated if the ninth-ranked cryptocurrency on CoinMarketCap turns down from the current levels and plunges below $0.0901373.

CRO/USD

Crypto.com Coin (CRO) hit a swing high of $0.133539 on June 30, which was just below the target objective of $0.135202 as suggested in the previous analysis. A series of higher highs, supported by the upsloping moving averages, confirms an uptrend.

CRO/USD daily chart. Source: Tradingview

However, the bearish divergence on the RSI is warning that the uptrend might be weakening and a minor correction or consolidation is likely.

Sometimes, in strong uptrends, such divergences are invalidated as the asset continues the uptrend but traders should remain cautious when a divergence develops because several times they forecast a correction.

If the bears sink the 10th-ranked cryptocurrency on CoinMarketCap below the 20-day EMA ($0.116), it will be the first warning that the uptrend is weakening. A break below $0.11 will signal the likelihood of a deeper correction.

This view will be invalidated if the CRO/USD pair breaks above $0.133539 and resumes its journey towards the target objective of $0.135202 and then $0.15306.

EOS/USD

Although the bulls purchased the sharp dip on June 27, they are struggling to carry EOS higher, which suggests that buying dries up at higher levels. The price has been consolidating close to the $2.3314 support for the past three days.

EOS/USD daily chart. Source: Tradingview

If the price does not move up, the bulls might lose interest and that could result in another fall towards $2.1926.

The downsloping 20-day EMA ($2.49) and the RSI below 40 level suggests that bears have the advantage in the short-term. If the bears can sink the 11th-ranked cryptocurrency on CoinMarketCap below $2.1926, the decline can extend to $1.80.

This bearish view will be invalidated if the EOS/USD pair bounces off the current levels and breaks above the moving averages.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.