Bitcoin price is struggling to overtake $9.6K even as Federal Reserve policy appears to be driving new investors into BTC.

Stephen Roach, a faculty member at Yale University and former chairman of Morgan Stanley Asia, believes that the supremacy of the U.S. dollar is likely to be challenged and the greenback could decline by as much as 35%. This impending dollar weakness could benefit gold and cryptocurrencies.

Several large traders have been accumulating Bitcoin (BTC) and according to on-chain data this has boosted the number of whales — traders holding 1,000 or more of the top-ranked cryptocurrency on CoinMarketCap — to 1,882. Usually, large traders build huge positions when they expect a sustained uptrend.

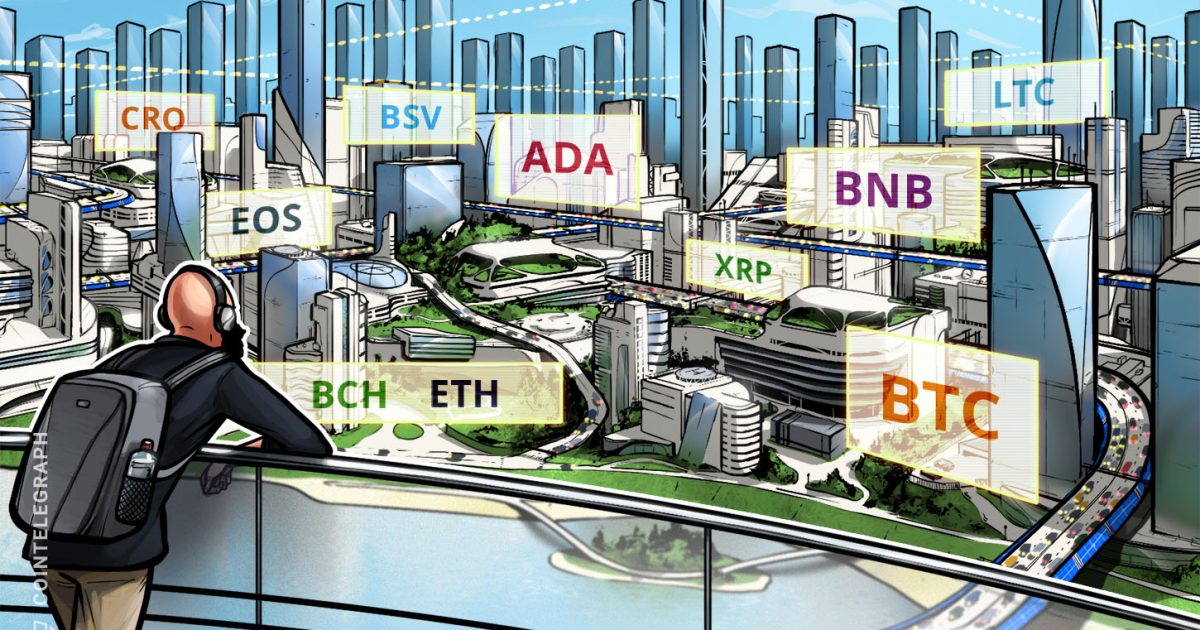

Daily cryptocurrency market performance. Source: Coin360

Another interesting development is that investors over the age of 55 had largely stayed away from crypto assets but new data shows they have started investing in cryptocurrency.

Bitcoin financial services firm River Financial Inc., said that its clients have doubled every month in 2020 and 77% of the volume growth has come from the investors above the age of 55.

This shows that the current economic environment and the huge stimulus measures delivered by the central banks are attracting new investors into the crypto space.

BTC/USD

Although the rebound off the lows on June 15 indicated strong demand at lower levels, the bulls are struggling to push Bitcoin (BTC) above $9,600. This suggests selling by the bears at higher levels.

BTC/USD daily chart. Source: Tradingview

The 20-day exponential moving average ($9,489) has flattened out and the relative strength index is close to the midpoint, suggesting a balance between supply and demand.

A break below the 50-day simple moving average ($9,355) and $8,910.04 support zone will tilt the advantage in favor of the bears. Below this zone, a drop to the critical support at $8,130.58 is possible. The bulls are likely to defend this level aggressively.

On the upside, if the bulls can propel the price above the resistance line of the symmetrical triangle, a retest of $10,500 is likely. A break above this level could start a sustained uptrend.

ETH/USD

Ether (ETH) rebounded sharply from the 50-day SMA ($218) on June 15 but the bulls are struggling to push the price above the immediate resistance of $239.35. This suggests that the bears are unwilling to throw in the towel easily.

ETH/USD daily chart. Source: Tradingview

The 20-day EMA ($233) has flattened out and the RSI is just above the 50 level, which suggests that the bulls are losing their grip.

If the bulls fail to push the second-ranked cryptocurrency on CoinMarketCap above $239.50 within the next few days, the bears will again try to sink the price below the 50-day SMA. A close (UTC time) below the 50-day SMA could drag the price to $196.875 and then to $176.112.

Conversely, if the bulls can propel and sustain the price above $239.50, a move to $253.556 is likely. A break above this level could resume the up move with a target objective of $288.599.

XRP/USD

The rebound from the June 15 lows is facing resistance at the 20-day EMA ($0.19). This suggests that the bears are aggressively defending the higher levels. The bears are now likely to again attempt to sink XRP below the support line of the symmetrical triangle.

XRP/USD daily chart. Source: Tradingview

If successful, a new downtrend is likely. The first support is at $0.162 and below that $0.144. The 20-day EMA is gradually sloping down and the RSI is in the negative territory, which suggests that bears have a slight advantage.

Conversely, a break above the 20-day EMA will be the first sign of strength. The fourth-ranked cryptocurrency on CoinMarketCap is likely to pick up momentum after it breaks out of the downtrend line of the symmetrical triangle.

BCH/USD

Although Bitcoin Cash (BCH) rebounded from the low of $224.35 on June 15, the bulls are struggling to push the price above the moving averages. This suggests that bulls are buying aggressively at lower levels but buying interest dries up at higher levels.

BCH/USD daily chart. Source: Tradingview

If the fifth-ranked cryptocurrency on CoinMarketCap turns down from the moving averages, a drop to $217.55 is likely. If this support cracks, the decline can extend to the critical support of $200. A break below this level could start a new downtrend.

Conversely, if the bulls can scale the BCH/USD pair above the moving averages, a move to $255.46 and above it to $280.47 is possible. A breakout of this resistance could signal the start of a new uptrend.

BSV/USD

Bitcoin SV (BSV) pulled back from $165.380 and closed (UTC time) above $170 on June 15. This suggests demand at lower levels but the bulls have not been able to carry the altcoin above the 20-day EMA ($186).

BSV/USD daily chart. Source: Tradingview

This suggests a lack of demand at higher levels. The 20-day EMA is sloping down and the RSI remains in the negative territory, which suggests that bears have the upper hand.

If the sixth-ranked cryptocurrency on CoinMarketCap breaks below the $170–$165.38 support zone, a new downtrend is likely. The first support on the downside is $146.2 and if this cracks, a drop to $120 is possible.

This bearish view will be invalidated if the BSV/USD pair can breakout of the moving averages and the $200 resistance.

LTC/USD

Litecoin (LTC) has again reached the moving averages, which are close to the center of the large $39–$45 range. Both moving averages are flat and the RSI is just below the 50 level, which suggests a balance between bulls and bears.

LTC/USD daily chart. Source: Tradingview

If the seventh-ranked cryptocurrency on CoinMarketCap once again turns down from the moving averages, a drop to $39 is possible. This is a critical support to watch out for because if this gives way, the decline can extend to $32.50.

Conversely, if the bulls can push the LTC/USD pair above the moving averages, a rally to $51 is likely. A breakout of this resistance could start a new uptrend that can carry the pair to $64.

BNB/USD

Although the bears broke below the $15.72 support on June 15, they could not sustain the lower levels. Strong buying again propelled Binance Coin (BNB) back into the $15.72–$18.1377 range.

BNB/USD daily chart. Source: Tradingview

However, the bulls are struggling to push the price above the moving averages, which suggests a lack of urgency to buy at higher levels. If the price turns down from the current levels, the bears will make another attempt to break below $15.72.

If the price closes (UTC time) below $15.72, the eighth-ranked crypto-asset on CoinMarketCap can drop to $13.65.

Alternatively, if the bulls can propel the BNB/USD pair above the moving averages, a rally to $18.1377 is likely. A breakout of this level might start a new uptrend.

EOS/USD

EOS has been range-bound between $2.3314–$2.8319 for the past few days. On June 15, the bulls stepped in to support the altcoin at $2.4208. If the bulls can push the price above the moving averages, a move to $2.8319 is likely.

EOS/USD daily chart. Source: Tradingview

The bears are likely to defend the $2.8319 resistance aggressively. If the price turns down from this level, the ninth-ranked cryptocurrency on CoinMarketCap is likely to extend its stay inside the range.

If the EOS/USD pair turns down from the moving averages, the bears will attempt to sink it below the critical support at $2.3314. If successful, a new downtrend is likely.

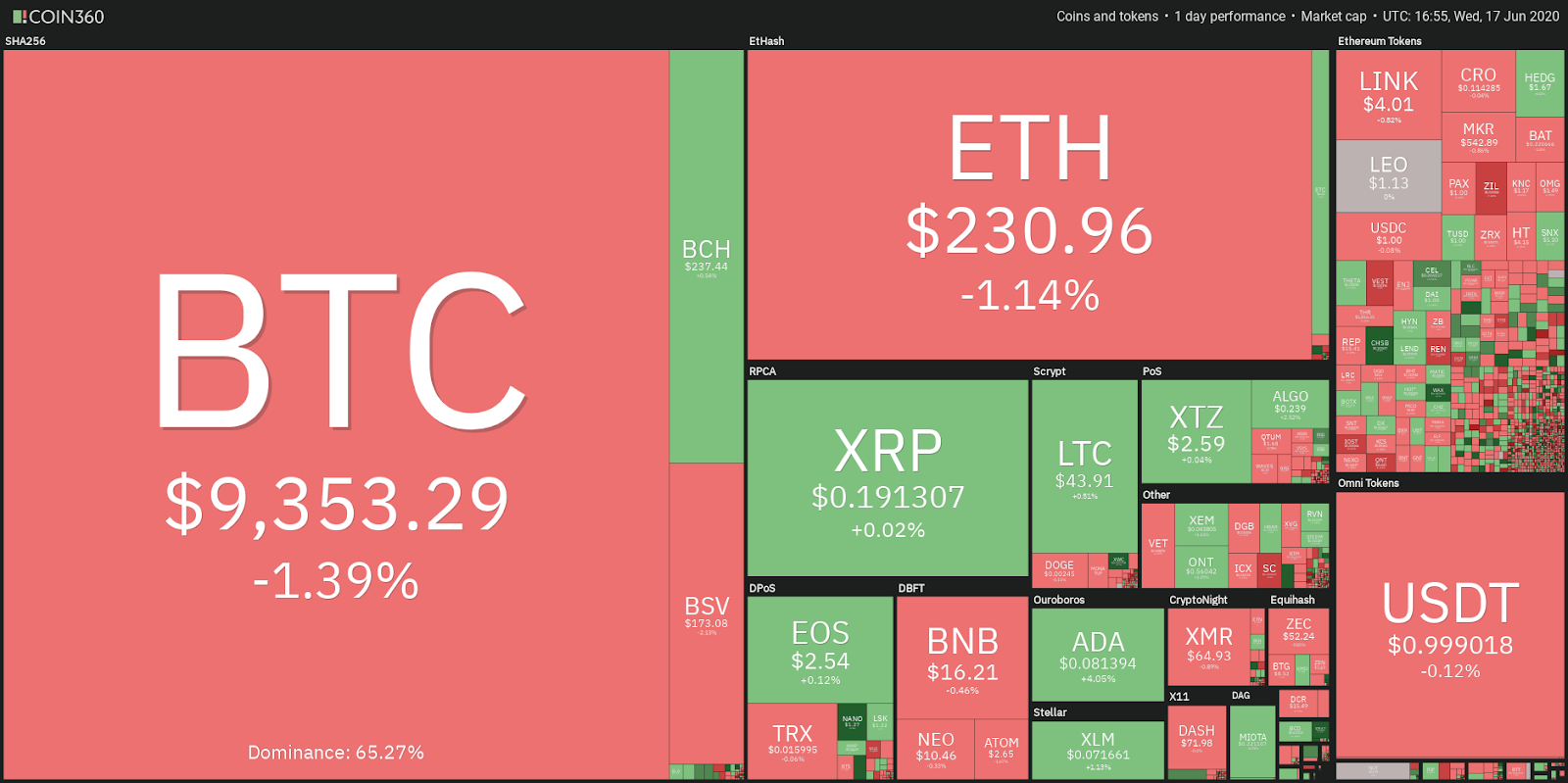

ADA/USD

Cardano (ADA) rebounded sharply from the intraday low of $0.069488, which is just below the 50% Fibonacci retracement level of $0.0705811. This suggests that the sentiment is to accumulate on dips.

ADA/USD daily chart. Source: Tradingview

Today, the bulls have pushed the price above the overhead resistance at $0.0806825, which is a positive sign. The 10th-ranked cryptocurrency on CoinMarketCap can reach $0.085 and then retest the recent highs at $0.0901373.

The 20-day EMA is gradually sloping up and the RSI is in the positive zone, which suggests that bulls still hold the advantage.

This bullish view will be invalidated if the ADA/USD pair turns down from the current levels and breaks below $0.0740613. If that happens, a retest of $0.069488 is possible. If this support also cracks the pair can drop to the 50-day SMA ($0.0634).

CRO/USD

The dip in Crypto.com Coin (CRO) on June 15 did not even reach the 20-day EMA ($0.102). This suggests that the bulls were in no hurry to book profits as they expect higher levels in the future.

CRO/USD daily chart. Source: Tradingview

Both moving averages are sloping up and the RSI remains near the overbought territory, which suggests that bulls are in command.

A breakout of $0.118234 will signal resumption of the uptrend. The next level to watch on the upside is $0.135202 and above it $0.15306.

On the other hand, if the 11th-ranked cryptocurrency on CoinMarketCap turns down from $0.118234, a few days of range-bound action is likely. A deeper correction can be expected on a break below $0.101266.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.