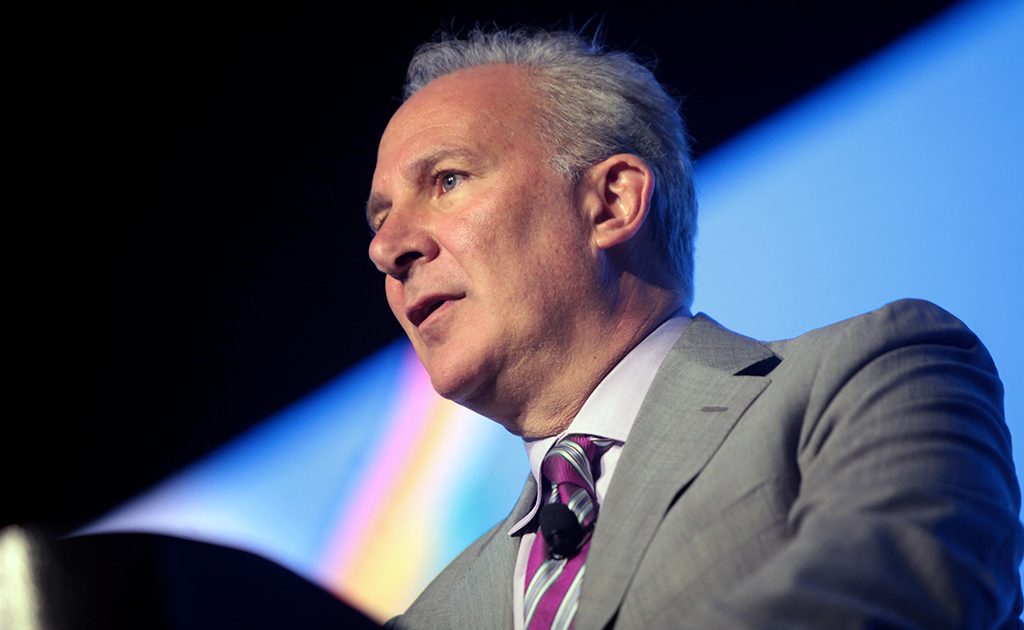

Even though we can say that Bitcoin was one of the assets that grew almost 100% this year, it seems that Euro Pacific Capital CEO Peter Schiff doesn’t agree.

In his tweet, Schiff pointed out that that Bitcoin is the only asset class that is not rallying at the moment.

Bitcoin is not disappointing those who claim its true value is that it’s a non-correlated asset. Every asset class in the world is rallying into the end of the year except Bitcoin. Not sure what value this actually adds, but at least #Bitcoin is meeting expectations on something!

— Peter Schiff (@PeterSchiff) December 27, 2019

Schiff commented bitterly that Bitcoin had finally become an uncorrelated asset, something that its supporters like to praise. However, says Schiff, for the first time around, Bitcoin stands quiet while other asset classes are rising.

He mentions a widely tracked stock market index the NASDAQ Composite that crossed the 9,000 points mark for the first time in history on Dec. 27. At the time of writing, it stood flat hanging around the 8,768.25.

There is also gold, the asset Peter Schiff personally admires, that also had quite a rally, especially for the past few days. The price of the precious metal has recently hit its seven-week high, surpassing $1,515. At the time of writing it was slightly down on $1,512.

It is the truth that stocks and gold continue to rise and that the price of Bitcoin keeps its “status quo.” Despite the bull investors tried to push the price higher, each of their actions was mercilessly refused. At the time of writing, BTC was falling 0.64% to $7,316.

Bitcoin is the Top Performer in 2019

Still, what Schiff seems to be forgetting is the fact we mentioned before – even though the last quarter wasn’t bullish for Bitcoin, it still managed to rise by around 90%. And, this my friends, is better than any other known asset.

Of course, when Schiff tweeted his point, Crypto Twitter went wild.

Most profitable investments of the decade:

Bitcoin: +62,500%

Ethereum: +17,900%

Netflix: +4,280%

Domino’s Pizza: +3,000%

Abiomed: +2,000%

Lululemon: +1,300%

Amazon: +1,250%

NVIDIA: +1,180%

Mastercard: +1,100%

Apple: +840%

Visa: +760%

Google: +350%— Ryan (@Ry4nMcC) December 27, 2019

Remind me again of the best ROI asset for 2019

— 🎩Sir Lam₿o M🌔🌖N (@SirLamboMoon) December 27, 2019

Peter Shiff, you should invest in a butt cream company pic.twitter.com/l67B82C7CR

— Satoshi Jimenez (@SatoshiJimenez) December 27, 2019

Peter Schiff is right about one thing. Bitcoin is twirling from its store of value plot to become the world’s one and only uncorrelated asset. This means that if assets such as stocks, commodities, and bonds are performing badly, Bitcoin will still continue to trade as usual.

Also, let’s not forget that any big political commotions (Venezuelan riots, Brexit, Impeachment, Hong Kong protests…) are causing the local currency to fall and Bitcoin to get stronger since a lot of people are looking at it as the safe haven.

We should also add that, compared with real-estate, commodities, etc, Bitcoin (and cryptocurrencies as such) are much more “bankable” if needed.

But, let’s really compare the Bitcoin rise with other assets’ in 2019:

• Nasdaq: +33.98 percent

• S&P 500: +30.80 percent

• Dow Jones: +24.23 percent

• Gold: +17.83 percent

• Bitcoin: +96.81 percent

Gold appreciation 2019 – 17.92%

Bitcoin appreciation 2019 – 86.4%Boomer OK.

— My2Sats [BTC/LN/RTL] ⚡ (@Suheb__) December 27, 2019

Use Only Your “Play Money”

Be it as it may, Bitcoin might not be the completely safe-haven asset since it’s still pretty volatile. In spite of the fact that it is perfectly clear it isn’t one today, that doesn’t mean it might not become a risk-off asset during the next downturn, or the one after that.

Bitcoin’s volatility and 24/7 trading tend to frustrate any try to compare its daily returns with those of other assets. Schiff wasn’t totally wrong when he warned people not to put their life savings in Bitcoin. He said:

“A lot of people got suckered into this pump-and-dump scheme because they heard all the stories about young kids taking their Bar Mitzvah money into bitcoin and bought a Lambo. Pretty soon, it is going to be stories about people who lost their life savings because they put real money instead of play money into Bitcoin.”

As in every other game, you play with the money you can afford to lose. It was always like that, however, you’re not wrong to expect something in return. For now, Bitcoin, if played right, seems to get the biggest awards.

Experienced creative professional focusing on financial and political analysis, editing daily newspapers and news sites, economical and political journalism, consulting, PR and Marketing. Teuta’s passion is to create new opportunities and bring people together.