Bitcoin (BTC) is failing to retake $10,000 due to a fresh wave of miner selling, fresh data suggests ten days after the halving.

Compiled by monitoring resource CryptoQuant, the figures show that over the past five days, combined outflows from BTC mining pools spiked 600% — from 1,066 BTC to 7,426 BTC on May 20.

Bitcoin miners sell into $10,000

The change mimics that seen in the week before the halving on May 11, when miner outflows increased from around 2,100 BTC to a high of nearly 5,000 BTC on May 10.

CryptoQuant’s data also confirms a correlation between increased miner selling and Bitcoin price bottoms.

Sales in the week before the halving coincided with Bitcoin’s “pre-halving dump” of over $1,200, while this week also saw negative price performance — from $9,950 on May 18 to press time levels of $9,340.

Sustained offloading would have a negative knock-on effect on Bitcoin price growth, slowing the upward trend to keep markets more averse to five figures.

Bitcoin mining pool outflows 1-year chart. Source: CryptoQuant

Exchange reserves keep plummeting

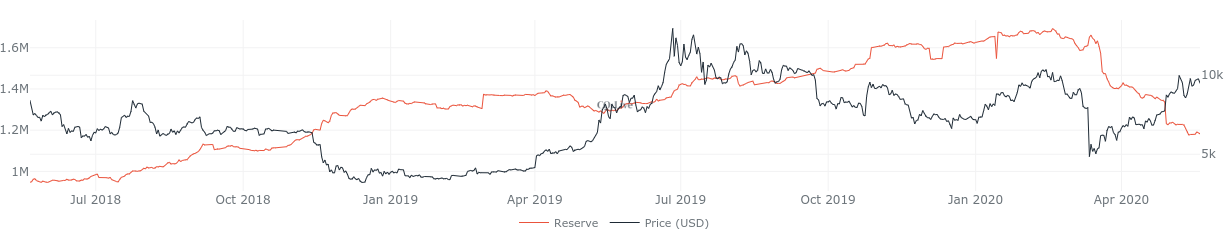

Beyond outflows, meanwhile, change is afoot on exchanges. According to CryptoQuant, total exchange holdings fell dramatically on March 12 during Bitcoin’s crash but kept falling as the price recovered.

As of Wednesday, reserves across 17 major exchanges totaled 1.18 million BTC — the lowest value since November 2018. At that time, BTC/USD traded at near its lows of $3,100.

Bitcoin exchange reserves 2-year chart. Source: CryptoQuant

A lack of interest in trading Bitcoin delivers clear signals on market sentiment, but the change in correlation with price-performance puts the current situation at odds with previous behavior.