On-chain data shows exchanges observed Ethereum outflows of over 100k ETH yesterday. Here’s what it may mean for the coin’s price.

More than 100,000 Ethereum Exited Exchanges Yesterday

As explained by an analyst in a CryptoQuant post, the netflows showed a large negative spike yesterday as more than 100k ETH exited exchange wallets.

The “netflow” is an indicator that reveals the net movement of coins moving out of or into exchange wallets. Its value is calculated by taking the difference between the inflows and the outflows.

When the metric has positive values, it means there is a net amount of coins moving into exchange wallets. Such a trend may mean investors are bearish on the crypto as they are sending coins from their personal wallets for selling on exchanges.

On the other hand, values in the red are seen when investors are withdrawing a net amount of coins. Negative values of the indicator would therefore suggest holders are currently bullish on Ethereum.

Related Reading | Ethereum Scarcity: After London Fork, ETH’s Supply Change Drops To Almost Zero

Now, here is a chart that shows the trend in the value of the ETH all exchanges netflow over the past fifteen days:

Looks like the indicator has recently shown a huge negative spike | Source: CryptoQuant

As the above graph shows, around 103k ETH was withdrawn from exchanges yesterday. At current rates, this amount of Ethereum is worth about $490 million.

Now, here is what the analyst thinks this trend may suggest. Firstly, this is bullish in the long term as it suggests there is demand from big players like institutional investors at the current price levels.

Related Reading | This Is Hilarious: Bitcoin Denier Steve Hanke Is Into Ethereum Now

Secondly, in the short term, however, this may either end up being neutral or bearish. The quant believes so because the whale responsible for this huge outflow could be done buying for now so buying power might drop afterwards, leading to a possible price drop.

ETH Price

At the time of writing, Ethereum’s price floats around $4.7k, up 0.1% in the last seven days. Over the past thirty days, the coin has accumulated 20% in gains.

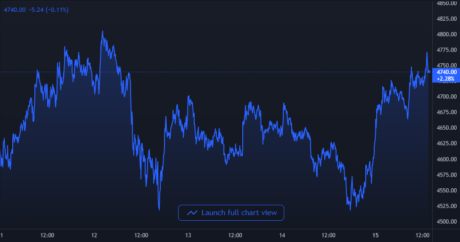

Below is a chart that shows the trend in the price of ETH over the last five days.

ETH's price seems to have recovered from the crash down to $4.5k | Source: ETHUSD on TradingView

Over the last few days, Ethereum has shown high volatility as the price has fluctuated between $4.8k and $4.5k multiple times.

Currently, ETH seems to have recovered somewhat from the crash that occurred after the crypto set a new all-time high. However, if volatility keeps up, it’s hard to say if this recovery would stand for too long.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com