There are less than a handful of days left in September, and therefore only a few days left for Bitcoin to make it a month to remember. In order to make it one for the history books, the cryptocurrency must hold above two key levels, both converging together at this crucial monthly close.

How the candle closes in September, could set the stage not only for the rest of 2020 but long into 2021 and beyond.

Why Bitcoin’s September Monthly Candle Close Is The Most Crucial To Crypto Yet

Bitcoin price is always at a pivotal moment or junction as regularly pointed out by crypto analysts and the media alike. And while most moments are indeed important, few are as critical as this monthly candlestick close, taking place on Wednesday, September 30.

While that day isn’t typically an important one, because it is the monthly candle close in Bitcoin and other cryptocurrencies that makes it especially notable.

Related Reading | How Bitcoin’s 2020 High Compares To Past Bull Market “Tops”

The reason behind the substantial importance is related to the price action playing out on that specific timeframe.

In technical analysis, the most weight is given to the highest timeframes when it comes to overall trend changes. For example, daily growth is great and all for bulls, but its when large green candles start showing up on weekly and monthly timeframes do you know its turning into a bull market.

Bitcoin’s monthly close for September has so much on the line, figuratively and literally. And it’s actually two lines that are converging at once, coinciding with what is the most critical monthly close in crypto potentially yet.

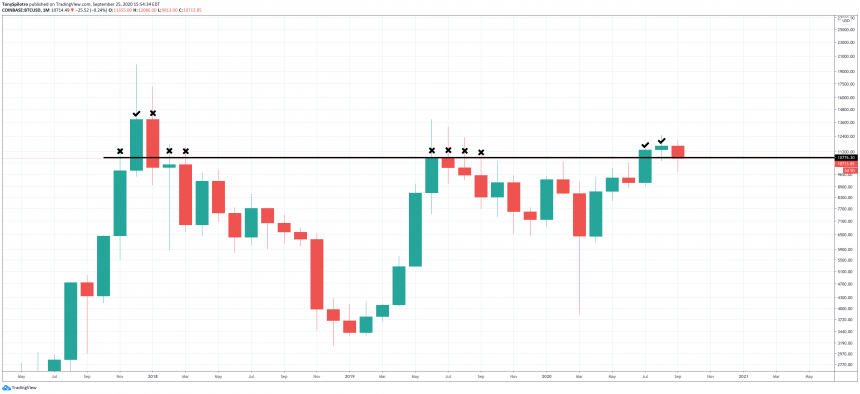

BTCUSD Monthly Price Chart Horizontal Resistance Turned Support Retest | Source: TradingView

The Tale Of Two Of The Most Important Bear Market Lines Converging At Once

In the chart above, Bitcoin price is retesting downtrend “meme” line resistance turned support. A close above this level followed by a reversal with volume would confirm a breakout according to pure technical analysis rules.

In addition to resistance headed downward or support lines heading up, support and resistance also exists horizontally as well. It also tends to exist at rounded numbers, such as $10,000, or repeating characters like $6666.

As crucial as the retest of the downtrend line is, another retest of horizontal resistance turned support holding is also going on. In the chart below, Bitcoin is also holding another line that has been tested far more than the downtrend line has been.

BTCUSD Monthly Price Chart Horizontal Resistance Turned Support Retest | Source: TradingView

Both trend lines being retested as support says that there’s something special going on in the month of September 2020, and the outcome could set the stage for the rest of the year and beyond.

Related Reading | Bitcoin Bouncing From Bull Market Support Points To 2021 As The Year Of Crypto

If Bitcoin really is breaking out into a bull market, this monthly close could confirm it. After that, there could be no looking back at any prices below either of those trend lines, ever again.

Featured image from Deposit Photos, Charts from TradingView