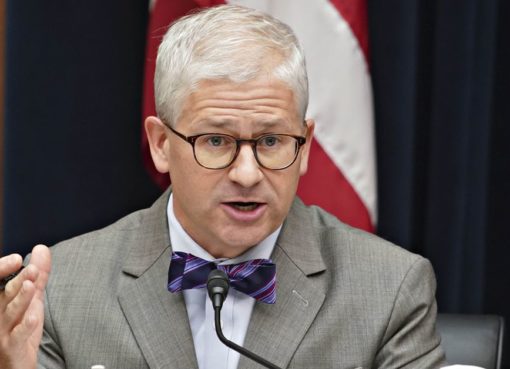

Bitcoin (BTC) proponents have ridiculed one of the cryptocurrency’s most infamous critics after he delivered a highly bearish price prediction.

In a Twitter debate on Nov. 21, commentators joined forces against Peter Schiff, who claimed BTC/USD was set for a dive as low as $1,000.

Schiff: $1,000 would “complete the pattern” for BTC

Arguing current price action correlated to a “head and shoulders” formation, the gold bug forecast a dramatic downturn would characterize markets in the future.

He summarized:

“#Bitcoin is nearing the neckline of the head-and-shoulders top I pointed out before the Oct 25th 40% pump. The right shoulder is now shrugged and the neckline slanted and parallel to the shoulders. If it breaks the price objective for the dump is $1,000 to complete the pattern.”

In a further post, he doubled down on his position. “The picture really doesn’t look any better if your long Bitcoin!” he wrote.

Another attempt saw Schiff take a photograph of a Bitcoin price chart on his computer screen, which led to ridicule.

A history of failed price predictions

Schiff is well known for his dubious Bitcoin price commentaries. Despite appearing convinced Bitcoin is doomed to fail, previous insights have proven false, something which was not lost on its supporters.

Responding to the latest tweet, the trader known as CryptoBull produced a BTC/USD chart which combined price movements with Schiff’s predictions. Schiff has yet to guess the market trajectory correctly.

Other, longer-term warnings from Schiff include Bitcoin never reaching $50,000, while gold should top $5,000. In late October, during the upward price move he referenced in Friday’s tweet, Schiff accused investors of manipulation as BTC gained 30% over gold.