Those who plan to short the ongoing bull run must think twice, as per on-chain analyst Kim-Young Ju.

The chief executive of CryptoQuant, a data analytics firm, said in a Thursday tweet that traders have no reason to place bets on Bitcoin’s potential fall. He explained that despite the cryptocurrency’s short-term downside correction from its record high of $24,300, institutional investors buy it at local lows.

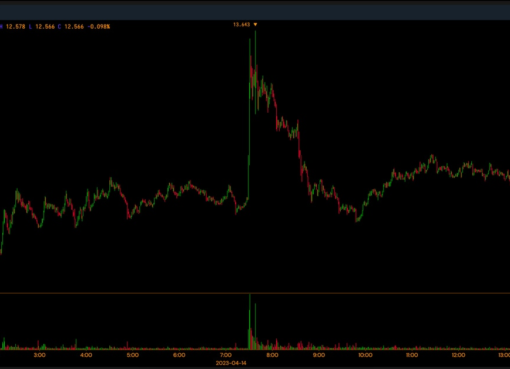

Mr. Ju highlighted that with a so-called “Coinbase Pro Outflow” indicator. The metric measures the amount of Bitcoin getting transferred from the US exchange’s wallets. He noted two instances wherein the Outflow rate surged. At that time, the cost to purchase one Bitcoin was well above $23,000. Mr. Ju said:

“The most important factor now is institutional investors. Massive [over-the-counter] deals still on-going according to on-chain metrics, and Coinbase outflow hit 24k BTC yesterday.”

Bitcoin's Outflow from Coinbase Pro trading platform. Source: CryptoQuant

In simple terms, the arrival of institutional capital into the Bitcoin market primarily as the cryptocurrency trades above $23,000 increases the level’s potential to act as strong support. Mr. Ju noted that traders would face risks of extreme losses if they attempt to trade against the institutional bets, i.e., if they will increase their short positions below $23,000 against a majority long outlook.

Predictively Bullish

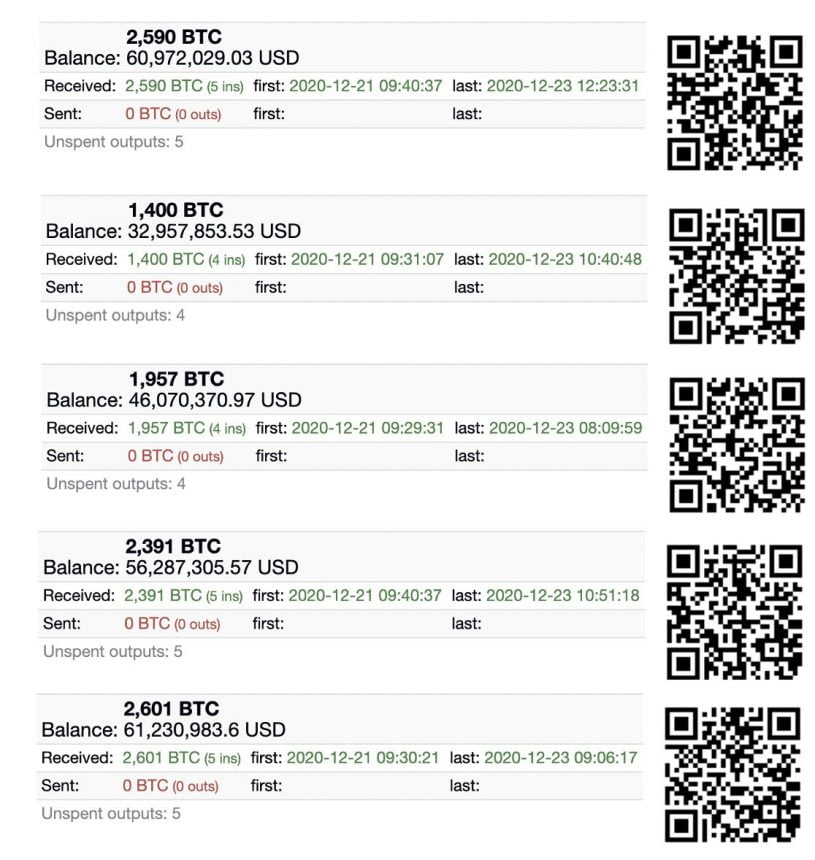

The analyst was among the firsts to spot Coinbase Pro Outflow into some cold wallets on December 18, just six days before Bitcoin hit a record high. He assumed that the trading platform is conducting OTC deals, adding that the recipient wallets are—in fact—custodial wallets.

“As I said, it went to custody-looked-like wallets. It seems that Coinbase makes a new cold wallet for each customer after the OTC deal for institutions.”

Coinbase Pro is sending a massive amount of BTC to individual wallets. Source: Kim-Young Ju

As the Coinbase Pro Outflow keeps getting higher, it signals another upside run in the Bitcoin market.

“I’m very bullish on BTC,” asserted Mr. Ju.

Bitcoin Warning

Meanwhile, Alex Mashinsky, the founder of Celsius Network, has an opposite outlook of the Bitcoin market. The analyst noted that traders should not open new long positions or buy BTC based on a short-term supply-demand movement.

“Be careful,” warned Mr. Mashinsky. “80% of the recent $8 billion in new Grayscale contributions are in-kind and much of it at 2-4X leverage. When funds finish selling we will be back at the $16k levels. About $4B in GBTC sales is going to happen in the next 3 months.”