On September 21, the non-fungible token (NFT) fantasy football platform Sorare announced the company raised $680 million in a Series B funding round led by Softbank. The capital raise gives Sorare a new valuation of around $4.3 billion and the company plans to open a U.S.-based office.

Sorare Reveals $680M Capital Raise

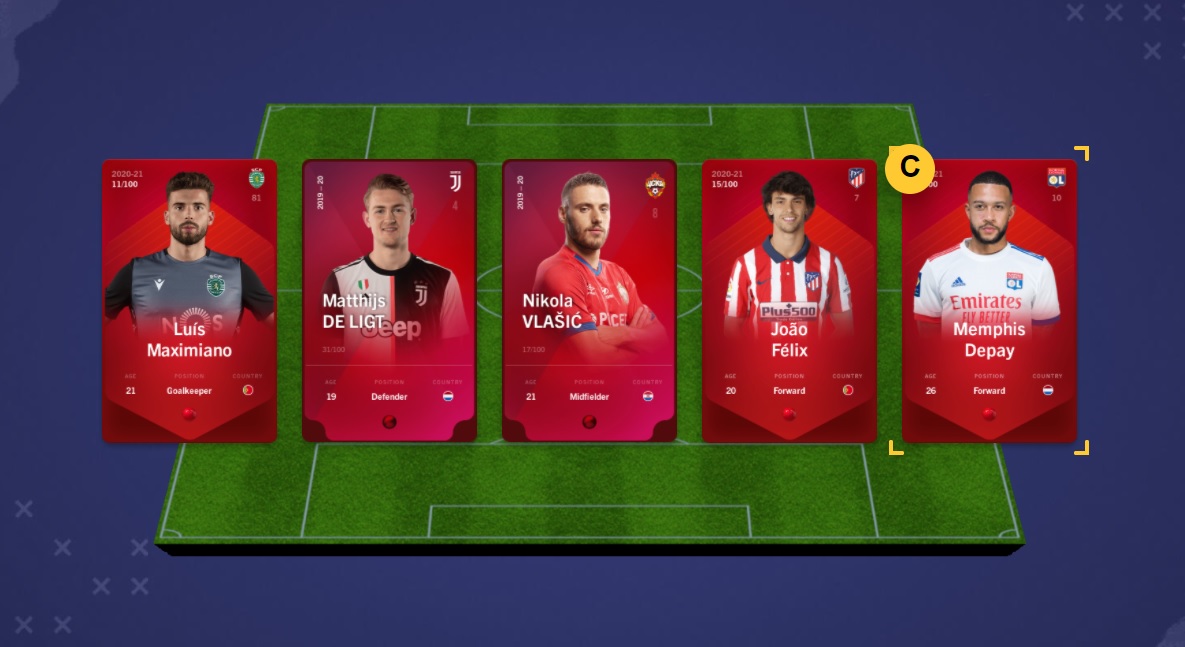

Non-fungible token (NFT) assets have seen phenomenal growth this year and the company Sorare aims to tether the billion-dollar NFT industry to the multi-billion-dollar fantasy sports market. The market size of fantasy sports in the U.S. alone topped $8.4 billion in 2019.

On Tuesday, the NFT fantasy football platform Sorare revealed the company has raised $680 million in a Series B financing round led by Softbank. The latest Sorare capital raise saw participation from Atomico, Bessemer Venture Partners, D1 Capital, Eurazeo, IVP, and Liontree as well.

The capital raise is a milestone as it is one of Europe’s largest Series B funding rounds and the funds have propelled Sorare’s overall valuation to $4.3 billion today. In the announcement on Tuesday, the Sorare team said it plans to launch an office in the U.S. and “sign up the top 20 football leagues.”

Softbank: ‘Sorare Sits at the Intersection of Two Really Exciting Industries’

Sorare also has plans to expand into other types of sports and so far, the company has licensed players from 180 football teams, including Juventus, Real Madrid, and Liverpool. According to Sorare, the startup saw $150 million in cards swapped on the platform since January 2021.

“The number of monthly active paying Sorare users grew by 34X between Q2 2020 and Q2 2021, with quarterly sales increasing by 51X over the same period,” the company further highlighted in the announcement.

“Sorare sits at the intersection of two really exciting industries in digital collectibles and fantasy sports,” said Marcelo Claure, CEO of Softbank Group International and COO of SoftBank Group. Claure added:

It’s evident from Sorare’s amazing growth this year alone that football fans around the world have been eagerly waiting for the ‘game within the game.’

Sorare is not the only NFT platform seeing a large multi-million-dollar capital raise in 2021, as a number of other NFT market platforms have been raising funds. The NFT market Rarible raised over $14 million and revealed plans to launch on the Flow blockchain.

Opensea raised $100 million at the end of July and became a unicorn company. Enjin obtained $20 million in a token sale for the Efinity NFT marketplace that supports the Polkadot blockchain. The Mark Cuban-backed NFT marketplace Mintable also gathered $13 million in a Series A funding round during the first week of July.

What do you think about the Sorare NFT platform raising $680 million in a Series B financing round? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.