Nasdaq is preparing to introduce 24-hour trading on its platform by the second half of 2026, pending regulatory approval.

Nasdaq appears to be adopting strategies from the crypto markets with this initiative. The aim is to give investors more flexibility, align with global markets, and enhance access to capital. Nasdaq president Tal Cohen stated that the exchange is working to ensure the necessary infrastructure and regulatory frameworks are in place before implementation.

The initiative would make Nasdaq the first major U.S. stock exchange to operate around the clock, a shift from the traditional 9:30 a.m. to 4:00 p.m. Eastern Time trading hours.

“We are excited to share that Nasdaq has begun engaging with regulators, market participants and other key stakeholders,” Cohen wrote, “with a view of enabling 24-hour trading five days a week on the Nasdaq Stock Market.”

This means the markets would still close on the weekends.

Currently, pre-market and after-hours sessions offer limited extended trading. Nasdaq’s 24-hour model could significantly impact market liquidity, allowing investors to react to global events in real-time without waiting for markets to open.

Maintaining liquidity and preventing excessive volatility outside traditional trading hours will require cooperation among exchanges, market makers, and regulators.

Nasdaq is expected to work closely with the Securities and Exchange Commission and other industry stakeholders to navigate these complexities.

Implications for crypto and Bitcoin ETFs

A 24-hour trading model matches up with the crypto market, where assets like Bitcoin (BTC) trade continuously without centralized oversight.

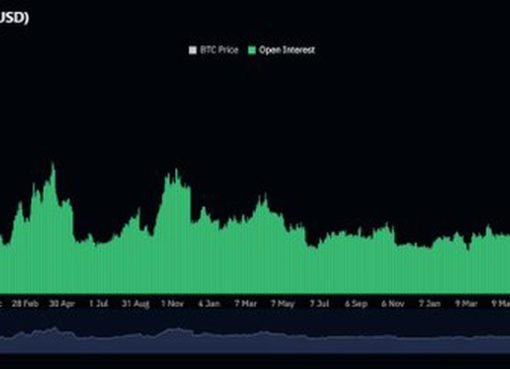

The introduction of spot Bitcoin exchange-traded funds in early 2024 has already bridged some gaps between traditional finance and digital assets. Nasdaq’s shift could further integrate crypto-related products into mainstream markets.

With spot Bitcoin ETFs, such as BlackRock’s iShares Bitcoin Trust, gaining traction, the ability to trade these instruments at all hours could enhance liquidity and price discovery. Bitcoin ETF options trading has also gained momentum, indicating growing institutional interest.