At a 2015 blockchain event, Nairobi-based bitcoin pioneer Elizabeth Rossiello answered an audience question about the impact on Somalians of a recent shutdown in remittance inflows after the U.S. government had labeled the country a “high-risk jurisdiction.” The AZA Group CEO’s answer was blunt: “They starve.”

Ever since then I’ve come to see governments’ demands that banks use know-your-customer (KYC) identification models to meet anti-money laundering (AML) goals as mostly counterproductive.

Western governments thought they were starving East African terrorist groups like Al-Shabaab of funds, but the terrorists still mobilized money. Instead, the measures starved the local population of food, creating a ripe recruiting environment for the terrorists.

This story is relevant because Sunday marks the 50th anniversary of the Bank Secrecy Act, or BSA, the landmark U.S. law that required banks to identify their customers and monitor their transactions.

Over time, spurred by events such as the September 11 attacks in 2001 and the 2008 financial crisis, the BSA rules have become stricter and wider. They’ve also spawned other rules for non-bank payment providers, and given rise to powerful agencies such as the Financial Crimes Enforcement Network (FinCEN). And they’ve provided the model for an international monitoring system that incorporates pretty much every financial institution in the world.

Sadly, there’s very little discussion of all this financial surveillance’s impact on people’s lives. Courtesy of Edward Snowden’s revelations about the National Security Agency monitoring our online activity, people know about the NSA. They know little of the BSA.

Exclusion

Perhaps people accept the trade-off between losing privacy and protecting society from evil-doers. Still, this system carries enormous costs.

It contributes to financial exclusion. According to a 2017 World Bank report, 1.7 billion adults are “unbanked” worldwide. For people in underdeveloped countries with untrusted state-run identity systems, the system makes them ineligible for bank accounts.

It also contributes, more broadly, to “derisking.” This trend emerged after the 2008 financial crisis, when new compliance rules imposed heavy new costs on banks, leading them to reduce exposure to countries where profitability was judged too small to be worth the risk. (Many saw the $1.9 billion fine imposed on HSBC in 2012 for facilitating Mexican drug cartels’ money laundering as a cautionary tale.)

As a result, local banks in many smaller economies – including relatively advanced ones in the Caribbean – now pay more for their critical correspondent banking relationships in the U.S., costs they pass onto their customers.

In these ways, AML-KYC models impose massive costs and foster inequity in the global economy.

In this pandemic-interrupted year, those costs will be felt even more, as remittances from rich countries to poorer ones are expected to drop by a record 19.7 percent to $445 billion, according to the World Bank. Those flows have long been seen as a major factor in poverty reduction, making AML-KYC compliance a direct barrier to prosperity.

Regulators counter that financial crime is a big, urgent problem – the United Nations Office on Drugs and Crime has estimated, for example, that between $800 billion and $2 trillion is laundered by criminals every year. But a trove of leaked FinCEN documents last month showed that large banks flagged trillions of dollars of suspicious transactions to authorities but continued to do business with those customers.

What’s more, the high cost of compliance means those bigger banks, along with well-established money transmitters such as Western Union, enjoy a barrier to entry against digital startups, for whom upfront compliance costs can be virtually insurmountable.

In sum, a AML-KYC dragnet with huge holes in it serves the interests of incumbents. It does little to stop sophisticated big criminals from moving money around but prevents honest little guys from participating in transactions, all while protecting outdated financial dinosaurs from competition.

Enter Bitcoin

Bitcoin was, in part, inspired by a desire to challenge this model. By resolving the trust problem and creating the digital equivalent of cash, it enabled peer-to-peer online payments between strangers. No longer did you need to identify yourself, no longer did you need an intermediary.

This terrified law enforcement, which relies on financial intermediaries to do its police work. So, amid ongoing accounts of criminals using bitcoin, regulators went after the centralized, custodial exchanges that people use to move crypto funds in and out of the fiat banking system, and developed rules that roped that industry into the surveillance system. The multilateral Financial Action Task Force’s new “travel rule” has now internationalized this approach.

Meanwhile, U.S. authorities have demonstrated they will apply the BSA to crypto software providers, most notably with the giant fine imposed this week on coin mixer Helix, whose privacy-protecting features were allegedly used by AlphaBay, the defunct “darknet” market.

That case underscores the far-reaching power this international system affords the U.S. government. The dollar’s reserve status means foreign banks need to maintain correspondent banking relationships with U.S. banks, which then become the gatekeepers of the world – and, effectively, agents of Washington’s interests.

Now, crypto-inspired technology is providing more tools for people, and even governments, to avoid the U.S. gatekeepers. This week, Russia’s central bank said it could use a digital ruble as a tool to avoid U.S. sanctions.

Sustainable system?

This system is broken. It has become a leviathan – too big, too comprehensive. Giant fines have skewed the risk-versus-payoffs for banks, which impose compliance on everyone regardless of size. (This is despite AML guidelines typically allowing ID exemptions for transfers of up to $1000, and in the U.S. up to $3,000.)

It’s time to scale down, not up.

“There is a principle in design that in order to optimize the system, to maintain the most positive outcome, we have to sub-optimize the sub-systems,” crypto compliance expert Juan Llanos said during this week’s episode of the Money Reimagined podcast. “That means we may have to learn to live with a little money laundering. We might have to live with the risk that someone in Somalia might be a criminal trying to get through the cracks.”

A more open mind from regulators toward cryptographic technologies that help regulators manage system-wide risks without imposing strict identity requirements on everyone would also be welcome. Research by the MIT-IBM Watson AI Lab into how to identify system risks within otherwise anonymous bitcoin transaction flows offers one potential way forward.

The test is whether policymakers can respond to the human cost of the existing approach.

“Is this the system that really promotes prosperity in our world?” C-Labs General Counsel Brynly Llyr asked during the same podcast episode. “I mean, yes, money laundering is very serious, tax evasion is very serious, but when we look at the remittance markets and the folks who are relying on … transfers of $50 and $100 … is this really what we want our system to be cracking down on? Is this the best use of our resources?”

Battling global currencies

Bitcoin surged over $13,000 this week and, for once, the move was fueled not by the “risk-on” inflow that follows a rise in equity prices, but by some real news: PayPal’s announcement it would allow people to use cryptocurrencies inside its payment app. Still, the bigger meta-narrative around digital currencies remains tied to the fate of the world’s dominant fiat currencies. As Money Reimagined has explored previously, much will depend on the titanic monetary battle between China and the U.S.

So, I decided to check in on two charts of each country’s currency, using the best non-correlated measures available. That meant avoiding the circular relationship in which the Chinese yuan is quoted in U.S. dollar terms and vice versa and, instead, using a standardized measure of each currency’s performance against a trade-weighted basket of multiple currencies. What that gave me was a lesson in how powerful central banks are.

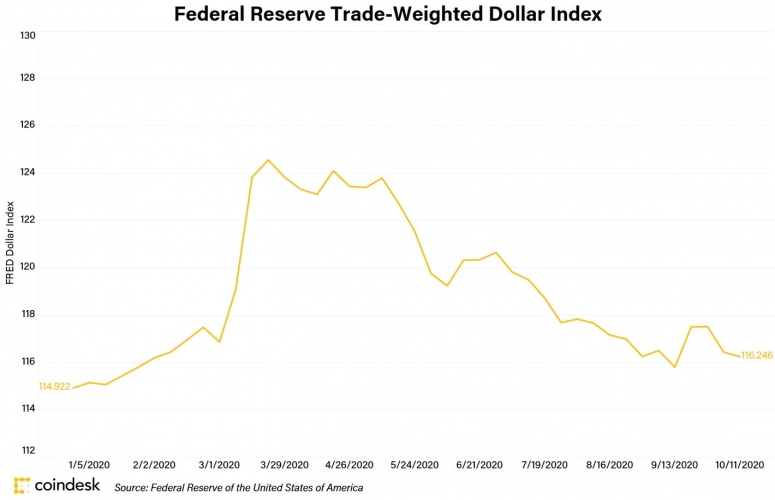

The first chart, courtesy of Shuai Hao, CryptoX’s data visualizer, concerns the dollar:

The image above is of the Federal Reserve’s trade-weighted dollar index. It offers an unsurprising but telling story: After the initial COVID-19 panic of mid-March, when a global scramble for dollars sent the greenback soaring against all currencies, the Fed’s unprecedented monetary expansion efforts sent it back down again.

What’s remarkable is that, with the world still in a deeply troubled pandemic-choked state, the dollar has continued to fall. Does this reflect waning international confidence in the U.S. or merely a belief that the Fed will keep the money printer in overdrive but save the world in the process? Too soon to say.

This one is based on the trade-weighted yuan index produced by the China Foreign Exchange Trade System (CFETS), the trading and foreign exchange division of China’s central bank. The index’s spike in March might seem odd to the uninformed observer because that’s when the world wanted dollars. Those panicked investors weren’t scrambling to stockpile the illiquid currency of the country then worst-affected by the pandemic; they only wanted greenbacks.

But the explanation is quite simple: the People’s Bank of China’s interventionist management of its currency has for decades been dictated by a tightly managed “dirty peg” to the dollar. So when the dollar spikes against everyone else, the yuan does as well.

Why, then, did the yuan index rise after the mid-summer, even as the dollar continued to fall? Because the PBOC deliberately intervened to boost the local currency versus the dollar. Sure enough, the USD-CNY exchange rate has dropped from CNY 7.17 in late-May to CNY 6.66 now.

Is this to discourage capital outflows? Maybe it’s to offset the need for softer domestic interest rates to boost local lending, which by extension equates with a Chinese bet on the domestic economy rather than on the nation’s exporters, which favor a weaker currency. Or is China trying to take advantage of waning trust in American global leadership to assert the strength and appeal of the yuan and boost its own international standing? Or, all of the above?

What’s notable is that the yuan’s rising value coincides with the rollout of China’s digital yuan, which, although only in its experimental phase, is making waves worldwide. Stay tuned.

Global town hall

ASIA’S AMAZON. A prediction from a cryptocurrency entrepreneur stood out this week. Not another bitcoin $100,000 forecast but this two-part one, which CoinFlip Chief Operating Officer Ben Weiss shared with Business Insider: The next biggest company in the world will be blockchain-powered and it will be based in Asia. While there are strong arguments why both parts of that of that bet could prove wrong, the logic behind it is interesting to unpack.

Will the next Microsoft/Google/Amazon be built on blockchain technology? One of the problems with that is a proper public blockchain cannot be owned by a single company, and if one were to exist it would defeat the core purpose of multiparty governance. But, of course, applications that are built on top of a blockchain or which tap into users of one or more blockchains can be for-profit, which is essentially the model behind successful crypto companies such as Coinbase.

Notwithstanding those successes, and despite the billions that venture capitalists have invested in blockchain startups, it’s fair to say the high-profit “killer app” hasn’t yet been uncovered. And a good reason for that is the open-source, public foundations of blockchain technology make it hard for entrepreneurs to develop businesses with defensible market positions.

Yet, it took the internet’s original entrepreneurs some time to figure out how to make money on the web. If we believe that, in one form or another, blockchain technology will provide the scaffolding for the financial system of the future, then it’s reasonable to assume that someone will figure how to make a lot of money with it.

If so, where will this happen? Weiss argues the regulatory clarity in places like Singapore, as opposed to the ambiguity and sometimes hostility from regulators in the U.S., make for an environment that’s much more conducive to future blockchain businesses. Certainly, China is betting that by supporting a nationwide Blockchain Services Network, which includes links to public blockchains, it will create the landscape for the next big company – perhaps more of an Alibaba than an Amazon.

Here, too, there are parallels with internet history. One reason why the internet took off in Silicon Valley is the U.S. government took proactive steps to open up innovation in the internet industry. First there was the 1996 Telecommunications Act, which forced telecommunications providers to open their networks to competitors, which meant startups could now use that infrastructure to offer broadband services upon which e-commerce could thrive. A similar effect was felt by the U.S. government’s antitrust lawsuit against Microsoft. There seems to be little such vision employed in the U.S. right now to pave the way for the financial transformation that cryptocurrencies and blockchain portend.

It’s too early to say whether the big, new Department of Justice lawsuit against Google this week (see Relevant Reads) signals a pro-innovation U.S. strategy to force a more decentralized internet or more of an ad hoc action. Either way, on balance, Asian governments like Singapore’s or China’s are proving to be far more assertive in laying out a path for a more decentralized future. This is not to say there won’t be another Gates, Jobs, Bezos and Zuckerberg emerging out of the U.S. But it would also be naive to assume the next wave of business innovation will be in the U.S. and not in some other region.

ASIA’S EURO. Still with Asia, the uncertainty around the future of global finance and the rise of digital currency prototypes is reviving a two-decade idea: that the region should create a common currency akin to the euro. That’s the case made by Japanese economists Taiji Inui, Wataru Takahashi, Mamoru Ishida in the wonky economist blog Vox EU. The trio argue that although Asian countries have learned how to better weather currency volatility than they did in the late-1990s, they remain vulnerable to capital flow shocks because of the asymmetric power of the dollar in the global financial system. So, they’re calling for an “Asian digital common currency as a multilateral synthetic currency comparable to the euro.”

If that sounds familiar, it should because former Bank of England governor Mark Carney, in a provocative speech last year, called for a similar solution to the problem of dollar dominance, but for the entire world. I’m not sure why, following the well documented problems the eurozone faced earlier this decade with the incompatibility between monetary union and political disunity, another region would want to replicate it. Perhaps regional governments would be motivated by geopolitical interests to keep China in check much as France supported the euro as a way to forestall German aggression. Either way, if it were to arise it would put a new spin on the idea that the post-dollar age will be marked by one of competing digital currencies: The battle might not play out between nations but between regions.

Relevant reads

In a CryptoX OpEd, Brave’s CEO and founder Brendan Eich and its senior privacy researcher Peter Snyder lay out barriers hindering efforts to protect privacy and foster the kind of open, decentralized economy that the internet was intended to be. They focus on areas of centralization and privacy-threatening surveillance that may not be on everyone’s radars: content distribution models, centralized consent systems and business models focused on building profiles of users.

When people wonder why bitcoin might be useful or valuable to people, I often ask them to put themselves in the shoes of people living in developing countries with abusive regimes for whom the movement of money through a politically controlled banking system is a challenge. Right now one of the best examples of that is Nigeria, where protesters against police brutality are turning to bitcoin for that reason. In this piece, CryptoX’s Sandali Handagama tells the human story of “why bitcoin?”

A bombshell antitrust lawsuit against Google marked a big shift in the U.S. approach to Big Tech. Years of dominance by the giant internet platforms are finally being questioned as monopoly phenomena. In this well-timed CryptoX podcast episode of The Breakdown, Nathaniel Whittemore interviews “Goliath”author Matt Stoller to put this in historical perspective. What does this have to do with crypto? As Whittemore points out at the outset, this industry’s obsession with centralization is all about how we manage power, something that Google and other big, centralized platforms have amassed like perhaps no other companies in history.

The “airdrop” of China’s new digital yuan to 2 million people in Shenzhen was seen as a huge development in the country’s march toward implementing its Digital Currency Electronic Payments system. But according to a Reuters report, picked up by CryptoX’s Daniel Palmer, those first users’ response was “meh.” Why were they underwhelmed? There was no great convenience advantage of DCEP over other electronic payment systems such as Alipay. It’s a telling response for China’s central planners as well for crypto developers. You may have political clout or your cryptocurrency might be aligned with privacy and other objectives. But convenience is likely to be the biggest reason why one payment system wins out over another.