Haunting red skies, a mounting death toll and a giant swath of smoldering devastation across 12 western U.S. states compels us to talk this week about climate change and what it means for the cryptocurrency industry.

Because, whether you like it or not, both of those things are not going away.

Sadly, the overlap between people working in crypto and people working to contain climate change is small. But the reality is that the future of cryptocurrencies and the future of our planet’s climate are closely intertwined.

Climate change is a global problem that transcends borders, yet as Californians and Oregonians learned from this month’s wildfires it delivers highly localized effects. It is, in other words, a decentralized phenomenon, one the existing centralized hierarchies of nation-states have spectacularly failed to contain.

Given the long delays in national governments even agreeing on, let alone enforcing, climate treaties, an overheating planet urgently needs a decentralized governance strategy for managing climate change, one that allows local actors to self-enroll in a platform that aligns the impact of their actions with others elsewhere in the world. It’s something that a handful of researchers in the blockchain community are trying to tackle.

There’s a lot of interest, for example, in using international blockchain frameworks to capture and immutably record environmental data generated by sensors in a decentralized network of devices. That way, local governments or impact investment funds, say, have a pool of reliable, real-time measurements with which to assess their actions.

Yale University’s Open Climate project is exploring the foundation of a global climate ledger using blockchain technology. Separately, in a column for CryptoX this week, Mattereum founder Vinay Gupta talked of using blockchain’s tracking capacity to bring transparency to the environmental impact of production along the world’s supply chains.

Money monsters

But while there are many such projects seeking to leverage blockchain solutions to improve climate data and finance green development, the mainstream view of crypto’s impact on the environment is dominated by a more narrow, emotionally fraught debate: whether electricity-hungry bitcoin miners are setting us on path to environmental ruin.

Bitcoin’s critics in this fight are led by researcher Alex de Vries, whose Digiconomist website provides metrics comparing the bitcoin mining network’s carbon emissions levels to those of countries – right now, he says it’s on par with that of Azerbaijan. De Vries and others argue that even if most bitcoin miners use renewable energy – last year, CoinShares put the proportion at 73% of total hashing power – they displace non-crypto residential and business users from those sources, leading them to tap dirty energy sources they would otherwise have not used.

I’ve argued in past columns that this perspective is valuable but overly alarmist, because it views bitcoin’s carbon emissions outlook in static terms when it is actually highly dynamic.

This is the kind of framing that’s needed for the crypto community to rise above the scary headlines of environmental disaster

Both renewable energy technology and bitcoin mining chips are constantly evolving and becoming increasingly efficient. In the near-perfect market in which miners compete for bitcoin rewards, they will be increasingly driven to tap increasingly cheap renewable solutions. That will not only make the Bitcoin network more efficient but, as it grows, will create a positive feedback loop in which renewable energy providers are further incentivized to produce better products.

The core question, though, is how quickly we can get there. It’s a question made all the more urgent by the wake-up call from California’s wildfires.

In the future, energy efficiency tends toward zero net emissions. But, as John Maynard Keynes said, in the long run we’re all dead. We need to worry about what’s happening now, in a phase when government subsidies and corruption in many parts of the world still create profitable opportunities for both bitcoiners and no-coiners to harness otherwise inefficient, carbon-heavy energy sources.

In that context, the fact that the Cambridge Bitcoin Electricity Consumption Index currently puts total annualized network usage at a whopping 67.4 terawatt hours is cause for great concern. A not insignificant proportion of that energy still comes from coal.

Managing the grid

However, as I stated at the outset, neither crypto nor climate change risks are going to disappear. In fact, both are growing in size. So, how do we make the former more compatible with containing the latter?

One could argue Bitcoin should follow Ethereum’s lead and migrate from its energy-intensive proof-of-work consensus algorithm to a proof-of-stake system. But organizing a hard fork of that nature is not only nearly impossible to coordinate across the fractious Bitcoin community, it could directly challenge its value as an unchangeable “digital gold” bet on permanence and predictability.

Instead, the change must come at the business level and, rather than merely having miners use more efficient, renewable resources for their own account, should be framed as a system-wide solution. It will involve tailored, grid-wide arrangements in which crypto companies are incentivized to use renewable energy and to help communities sustainably address their energy needs.

Enter Layer1. Setting aside some of the legal disputes that have lately gripped this Peter Thiel-backed mining company, its innovative business model points to a future where Bitcoin can be compatible with environmental management.

Layer1 has entered into an agreement where the Electricity Reliability Council of Texas pays the company to shut down its miners in the western Texas region during hours of peak demand. This helps the grid operator manage the difficult peaks and troughs of overall community usage and generation, a problem that becomes even more extreme as residential solar systems continue to be added to the overall supply of electricity.

In energy markets like California’s, solar production creates something known as the “duck curve.” Essentially, that means solar panels generate a surplus of electricity in the sunniest hours of the day, which is mismatched with the peak demand that hits later in the day when people return home from work and crank up their ACs. Without effective storage mechanisms, that intraday energy is wasted, imposing a large unrealized opportunity cost on the system. What’s needed is a big buyer with intraday energy needs. As Messari’s Mason Nystrom explains in this Twitter thread, bitcoin miners are well placed to fill that role.

As Layer1 CEO Alexander Liegl explained to CryptoX’s Brady Dale last year, putting bitcoin miners into this duck curve management role challenges the critics’ thesis that their hunger for electricity crowds out other uses for clean energy. “Renewable energy is still primarily under-utilized, so you don’t actually have a zero-sum game,” he said.

More than that, though, these arrangements put Bitcoin into a strategic place in the ecosystem where it actively empowers communities to pursue sustainable energy solutions. They make it easier for them to onboard home solar, for example, without overburdening the grid, which encourages the resilience of energy decentralization and contributions to decarbonization.

There’s an even wider symbiosis here, too.

Bitcoin miners are focused on turning energy into money. But in doing so they provide a vital service to owners and users of bitcoin, securing its decentralized system of value exchange from attackers so that a digital form of provably scarce money can be stored and used in a self sovereign manner. By sharing the risks and benefits of managing the energy supply between communities and miners, a common interest is forged in both environmental sustainability and the perpetuation of a peer-to-peer financial and payments system.

This is the kind of framing that’s needed for the crypto community to rise above the scary headlines of environmental disaster and position itself as an agent of positive change in the world.

The ‘musical chairs index’

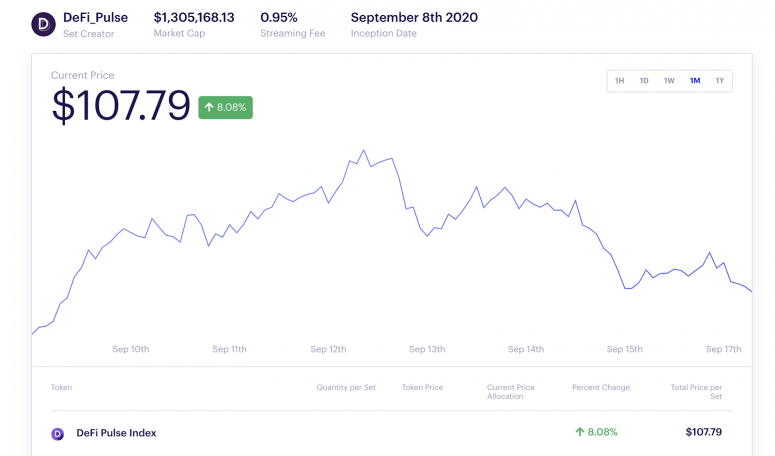

DeFi Pulse’s statistics on “total value locked” for applications within decentralized finance have become de facto benchmarks for measuring the rapid growth of the nascent DeFi ecosystem. So perhaps it was inevitable that the data provider would be the first to create an index for the fast-growing sector. After launching the DeFi Pulse Index this month to track the performance of ten of the most popular DeFi tokens on Ethereum, we can see from a Thursday midday screengrab of DeFi Pulse’s partner Set Protocol’s website that the first nine days have been pretty rocky. After opening at a value of $99.73 on Sept. 8, the index peaked at $136.03 on Sept. 12, marking a gain of 36.4% in just four days. But since then it has fallen all the way back to $107.79.

The net gain of just over 8% for the nine days would be a good return for a normal traditional finance investor. But against the massive moves in DeFi token prices in recent months it seems positively anemic. The result also seems to contradict DeFi Pulse’s own metrics, which show a very strong 29% gain in the DeFi sector’s overall TVL for the same period, from $6.82 billion to $8.78 billion. Amid the breathless buzz around high-flying new entrants like SushiSwap, an automated money maker (AMM), and decentralized lending and borrowing protocol Aave, it feels as if this index isn’t capturing the reality of the industry.

We shouldn’t be surprised. While we should applaud DeFi Pulse for having a go at this, it was always going to be challenging to build an index at this very early stage, with so much change underway. The team chose 10 names to compile the index. But within days it felt old. There’s no Aave and there’s no SushiSwap, a fork of the index member Uniswap that was specifically designed to suck liquidity from its AMA. Sushi’s launch led to a sharp drop in Uniswap’s price. However, it was more than offset by a very sharp opening rally in Sushiswap – followed by a sudden drop after its anonymous founder dumped his tokens and then a big rebound when the founder returned the funds to the protocol. Overall, the impact of these new launches has been to greatly increase the value of the entire DeFi sector.

In short, the entire sector is functioning like a giant game of musical chairs, with newcomers suddenly emerging and rapidly surging into prominence within the industry, supplanting the positions of others. Overall, despite the gut-wrenching volatility, the impact of these new launches has been to greatly increase the value of the entire DeFi sector overall. But it’s not captured in an index, which by definition has a static makeup. Great to see these initiatives take shape, but it’s fair to say that this one might be a tad early.

The global town hall

CHINESE CONSUMER COMEBACK. For a brief period, COVID-19 looked like it would stall the geopolitical competition that had been brewing between the U.S. and China, as more immediate priorities took over. But it may also have exacerbated the tension as President Donald Trump sought to pin blame for the global pandemic on China, using derogatory, arguably racist terms to describe it. And, if anything, U.S. mistrust of Chinese technologies grew even further in this time, with Washington forcing social media site TikTok to sell its U.S. operations to a U.S. buyer. Nonetheless, the real significance of COVID-19 will be measured by how quickly and how strongly each side in this battle recovers from the economic fallout. And that goes directly to the heart of the battle for the future of money, of which we’ve written extensively, with China now in the process of launching its Digital Currency Electronic Payments (DCEP) system.

In this context, the latest numbers out of China might suggest that Beijing, with a markedly lower death count and mostly reopened economy, has the upper hand. In addition to a rebound in industrial activity in China, consumer spending is also now showing signs of a strong recovery there. This is important because China’s future lies in extracting itself from depending on exports and more on domestic spending. It also relates to the focus of China’s digital currency and blockchain strategy. The DCEP will, for now at least, be targeted at domestic users, including retail. Meanwhile, the investments China is making in other aspects of blockchain infrastructure will work to make the local economy more efficient. It’s here, not only in China’s much-publicized investments and interests in foreign markets, where its challenge to U.S. global supremacy will come. A more efficient, advanced, digitally driven domestic economy will be a stronger foundation from which to project overseas power than one in which it is dependent on selling Chinese-made clothes and electronic goods to the U.S.

ECBDC. With all the attention given to China’s launch of its central bank digital currency (CBDC), it’s easy to forget that policymakers in the European Union have been exploiting central bank digital currencies for some time and that experiments are underway. So it was a welcome addition to the research on CBDCs to find this new report focusing on the geopolitical implications of a European version of the technology. It comes from the folks at dGen, a think tank that works on issues for the “decentralized generation.”

The report warns that if the eurozone doesn’t introduce a CBDC by 2025, its ranking as the second-most important world reserve currency will be overtaken by China. On the other hand, it sees a unique opportunity for Europe to assert more international leadership if it produces a well-designed CBDC. The key words there are “well-designed.” The authors warn that European leaders need to be alert to pressures within the eurozone to offer a weakened version of the euro to boost export competitiveness and alleviate pressure in some of the weaker states of the region. Similarly, if different countries in the eurozone start introducing their own national digital currencies with the overarching structure of the euro, it could weaken the euro. They advise European authorities to work with, not against, private-sector developers of digital currencies, such as stablecoin issuers, in the rollout of a CBDC and related payments infrastructure.

NFTs MEET DEFI. While DeFi has generated the most excitement in the cryptocurrency space this year, quiet gains are also being registered in the market for non-fungible tokens, or NFTs. These unique pieces of digital property have sparked the imagination of many who see them as a way to transform rights management for digital media and art, reinvent gaming and create new mechanisms for brands to engage with their markets. The myriad ideas spawned by the NFT movement haven’t, however, so far shown a great deal of real-world traction.

Now, the NFT movement is hitching to the DeFi zeitgeist to crossbreed a new form of finance with a new form of digital property. This summer, as we reported last week, Robinhood-obsessed day traders from the non-crypto world have started to invest in NFTs that give them fractional ownership of expensive art pieces – even though many likely don’t know they’re buying a crypto product. And this week we reported that NFT gamemaker Dapper Labs, the creator of CryptoKitties, has now integrated Centre’s USDC stablecoin into its top-ranking NBA Top Shot game, a move that has generated $2 million in revenue and more than 58,000 transactions.

But it’s the DeFi-meets-NFTs combination that looks most enticing. Consider RARI, the new governance token introduced by the NFT marketplace Rariable. Much like governance tokens issued by AMAs and lending protocols in the DeFI universe, the RARI incentivizes people to participate in the market, in this case to buy and sell NFT-defined art. As reported by Mason Nystrom of Messari, Rarible volumes have surged since the RARI was introduced, topping $6 million in total. The marketplace’s monthly turnover number is on target to reach a figure ten times that of once-reigning NFT market, OpenSea. DeFi experiments such as yield farming and liquidity mining are showing that if you want people to use your protocols, give them an incentive.

Relevant reads

China’s BSN to ‘Localize’ 24 Public Blockchains by Making Them Permissioned. When we first reported in July that China would incorporate six public blockchains into its national Blockchain Services Network, it was seen as a hint that the government, contrary to expectations, may see value in allowing a somewhat more open system. In the latest news from reporter David Pan, that appears to have changed: the list of integrated public blockchains has expanded to 24, but there’s a twist: the networks will have to be “localized,” which appears to be a euphemism for converting them into a private, permissioned network.

Uniswap Recaptures DeFi Buzz With UNI Token’s Airdropped Debut. One minute it was knocked off its perch by SushiSwap. Next minute it is back. With a dramatic airdrop of its new UNI governance token, with a listing on Coinbase, the Automated Market Maker (AMM) is happily grabbing headlines again, as Muyao Chen reports. How long will it last before some other protocol steals the limelight?

How a Hacker Launched a Decentralized Network to Track Internet Censorship. Read this great report by Benjamin Powers on the Cypherpunk-inspired OONI network, which uses decentralized architecture to track and record instances of internet censorship around the world. This is the stuff that matters.

Say Hello to the Singularity. CryptoX contributor Ben Goertzel, the AI programmer behind Sophia the robot, is here to tell you that DeFi mania is well and good, but it’s insignificant compared to what he sees as the real relevance of blockchain technology: its role in defining humankind’s future in a world dominated by artificial intelligence. And like everything about the “singularity,” a concept that the founder of SingularityNET is heavily engaged in, blockchain’s contribution can go either way. It can help protect humanity, Goertzel says, or it can become a tool of “the hegemons.”