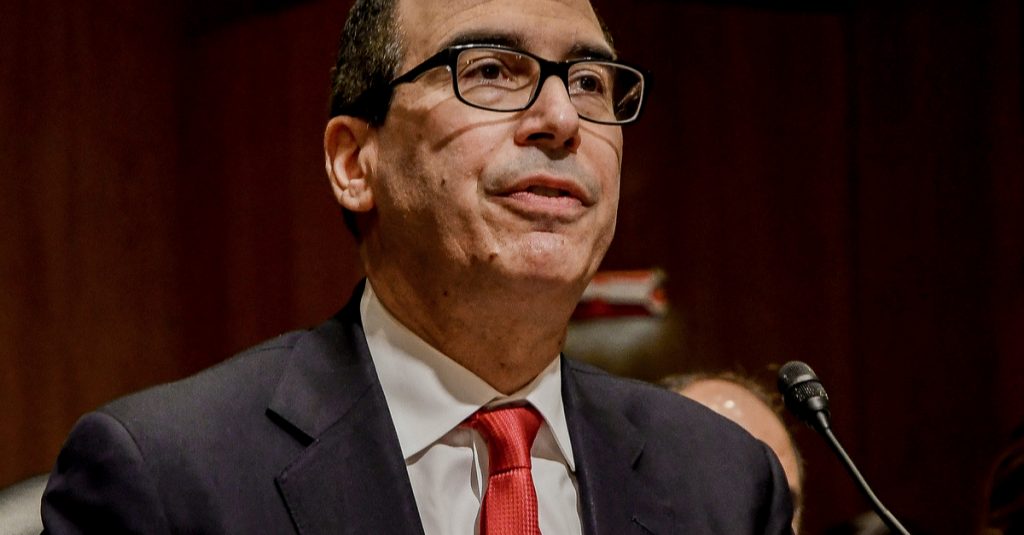

U.S. Treasury Secretary Steven Mnuchin remarked last week that a reported $1.5 trillion in missing cash — mostly one hundred dollar bills — was “sitting in bank vaults all over the world.” The famously anti-bitcoin U.S. official noted that “there’s a lot of ‘Benjamins’ all over the world” and emphasized the strength of the currency as the main reason many in other countries wish to possess it. The remarks come off as flippant to some, considering Mnuchin is one of the leading pushers for financial regulation and anti-money laundering rhetoric.

Also Read: The Myth of Authority: Mnuchin Denies USD Is Used Criminally

$1.5 Trillion in Cash Unaccounted For

In a recent interview with Fox News’ Lou Dobbs, U.S. Treasury Secretary Steven Mnuchin brushed off a question regarding a reported $1.5 trillion divot in the global cash supply. The “disappearing and unaccounted for” cash is mostly U.S. 100 dollar bills. Mnuchin prefaced his answer about the missing $1.5 trillion by saying that “the dollar is the reserve currency of the world and everybody wants to hold dollars.” He notes that in his view the U.S. is a safe place for holding and investing money. “Literally, you know, a lot of these hundred dollar bills are sitting in bank vaults all over the world. And particularly in a world of negative interest rates, you know, you can hold U.S. dollars and you don’t have to lose money,” Mnuchin stated:

So, uh, there’s a lot of Benjamins all over the world.

Anti-Bitcoin Rhetoric

Mnuchin’s nonchalant fielding of the question is interesting given his track record of decidedly pro-surveillance, pro-strict regulation of other currencies such as bitcoin. In July, Mnuchin assured the press that “Cryptocurrencies, such as bitcoin, have been exploited to support billions of dollars of illicit activity like cybercrime, tax evasion, extortion, ransomware, illicit drugs, human trafficking. Many players have attempted to use cryptocurrencies to fund their malign behavior.” He went on to call bitcoin a “national security issue.”

When confronted the same month with the fact that USD is used for the similar things by NBC’s Joe Kernen, a defensive Mnuchin retorted: “I don’t think it’s been successfully done with cash. I’ll push back on that. We’re going to make sure that bitcoin doesn’t become the equivalent of Swiss-numbered bank accounts.”

With two things now established according to Mnuchin — one, that USD is strong, and two, that it has not been used successfully for nefarious activities — it’s not to surprising that a cool $1.5 trillion that could be in the hands of criminals is of little concern to the top U.S. official.

The Strength of the USD

There’s little contention from market experts that compared to many other assets, the USD is relatively strong. Examining the steady, massive devaluation over the last 100 years of the world’s fiat currencies, however, paints a different picture than Mnuchin presents. Although the treasury secretary contrasts the dollar’s strength with negative interest rate policies across the globe, he does not mention the U.S. Federal Reserve’s current massive stimulus project, which has created over $3 trillion in freshly printed USD since September, or the fact that the interest rate in the U.S. is also heading back toward the zero bound again.

A lesser discussed notion is that — in essence — the government with the most guns wins in a world where value is determined by state decree (lit. “fiat”) and not by a currency actually possessing economically sound properties. The recent release of the declassified “Afghanistan Papers” may point to this reality, with nearly $1 trillion spent since 2001 on a conflict that, according to those involved, was without direction and which has now cost the lives of over 43,000 Afghan civilians alone. An unnamed executive with the U.S. Agency for International Development stated:

We were burning $400 million per month at one point. We lost objectivity. We were given money, told to spend it and we did, without reason.

With the above factors playing into the strength indicated by Mnuchin, it’s not hard to wonder why many wish to opt out of the “strong” currency, and utilize sound, non-violent money in the form of permissionless, peer-to-peer cash like bitcoin. After all, if Mnuchin and company are free to spend and use currencies as they wish, the argument is that peaceful people should be able to as well.

What do you think of Mnuchin’s statements on the missing cash? What about his statements on bitcoin? Let us know in the comments section below.

Image credits: Shutterstock, mark reinstein, fair use.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.