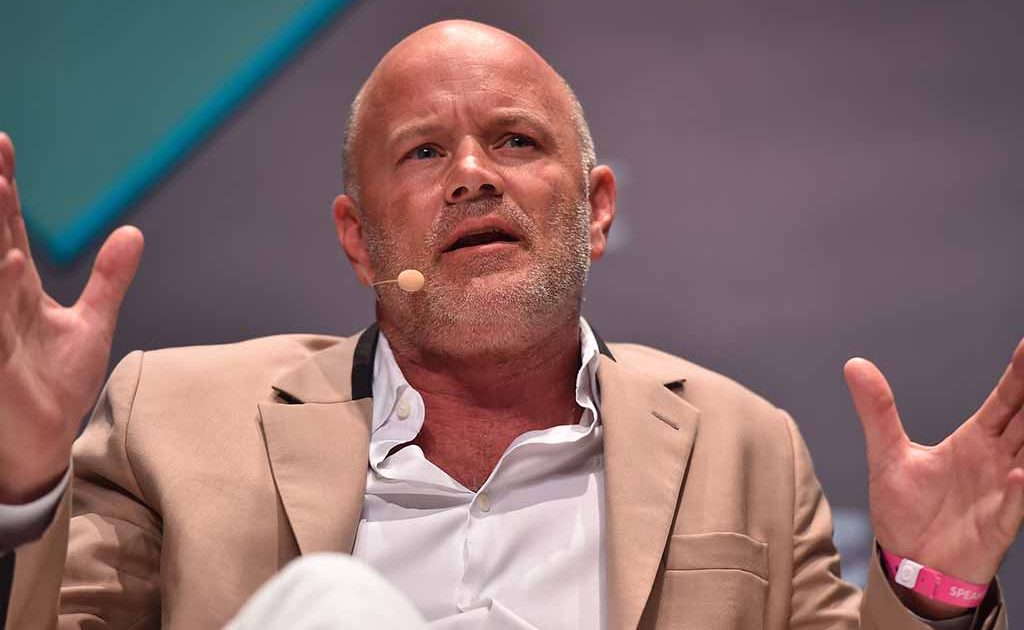

Mike Novogratz believes that the partnership with the financial education firm CAIS would help kickstart the institutional adoption of Bitcoin.

Mike Novogratz, the CEO of Galaxy Digital, believes that the next phase of Bitcoin adoption is institutional. His company recently partnered with the financial education firm CAIS to train fund managers and financial institutions on the prospects of alternative investments such as Bitcoin.

In an interview with CD, the Wall Street veteran said that the story behind Bitcoin is compelling in that it is an innovation that cannot be overlooked considering that it is an asset that has come to stay even though it started at a retail level.

Mike Novogratz Wants to Boost Institutional Adoption of Bitcoin

Novogratz believes that the partnership would help kickstart the institutional adoption of Bitcoin. He said that wealth managers have a lot to gain by getting involved with digital assets.

“And the next big group that’s going to adopt bitcoin as a store of value, as a digital gold, are the financial advisers,” he said.

The partnership which he referred to as “sweet” would help the company make a stronger case for Bitcoin adoption by institutional investors who according to him are the prime targets of the program, due to the fact that they control the most wealth in the hands of investors.

Focusing on Bitcoin Investment

The course which is packaged for fund managers and advisors is centered around Bitcoin and its market. Novogratz said that CAIS is the best fit to introduce managers to services of his company.

Galaxy Digital, the cryptocurrency merchant bank operated by Novogratz has not been as profitable anticipated. As an asset management and advisory firm, the company has been working to become a channel through which funds flow to the coin market from the capital market.

Run at a Loss

Galaxy Digital which has been struggling since inception despite a spectacular launch was among the top investors in Block.one. It lost $272 million in its first year and lost $97 million the next year (2019). Most of the losses are linked to trades that wiped off gains the company made from other sources.

One of the company’s losses came from WAX, a gaming token to which Galaxy lost $47 million.

To keep afloat, the bank downsized its workforce by 15%. That seems not to have remedied the situation as the coronavirus pandemic ensured that earnings remained low.

Novogratz believes that the key to a turnaround to the company’s fortunes is institutional involvement in the crypto space. According to him, we will see more flow of institutional funds into the crypto sphere in the next 6 months to one year.

“In one week after the coronavirus crisis started, the [Federal Reserve] did more QE than it did in the entire 2008-2009 episode.”

Novogratz said that Bitcoin is the digital equivalence of gold. He said that the next logical step in the evolution of the asset is the adoption as a store of value by the wealthiest entities.

Read Bitcoin news daily on Coinspeaker.

Chuks is a blockchain enthusiast and finance researcher that has covered the crypto sphere for several years. He believes that the evolving technology would change how we do business.