Decentralized exchange (dex) volumes have been dropping since December 2021 according to current statistics. However, last month dex trade volumes spiked 2.37% higher than the volumes recorded in February. Despite the brief spike and with only eight days left in April, metrics show this month’s dex volumes will likely be much lower than in March.

Decentralized Exchange Volumes Slip Month After Month — April’s Dex Volumes Remain Lackluster

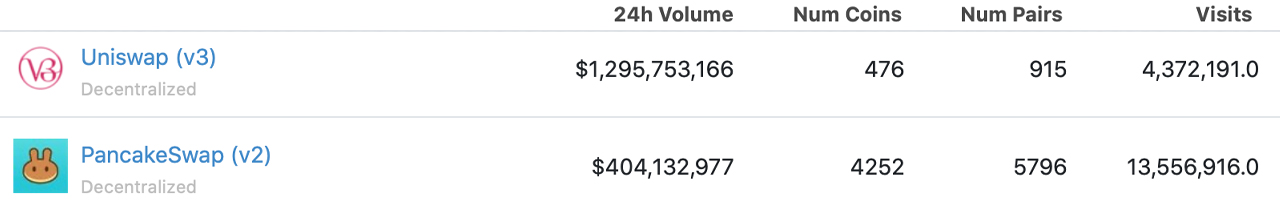

In 12 months, dex platforms recorded over $1 trillion in trade volume as they have become prominent fixtures in the crypto industry. Today, data from coingecko.com, coinmarketcap.com, dune.com, and theblockcrypto.com indicates that Uniswap version three (v3) is the largest dex by 24-hour trade volume, with $1.29 billion during the last 24 hours. Following Uniswap v3, dex platforms like Pancakeswap v2, Dydx, and Curve Finance hold the top 24-hour volume positions at the time of writing.

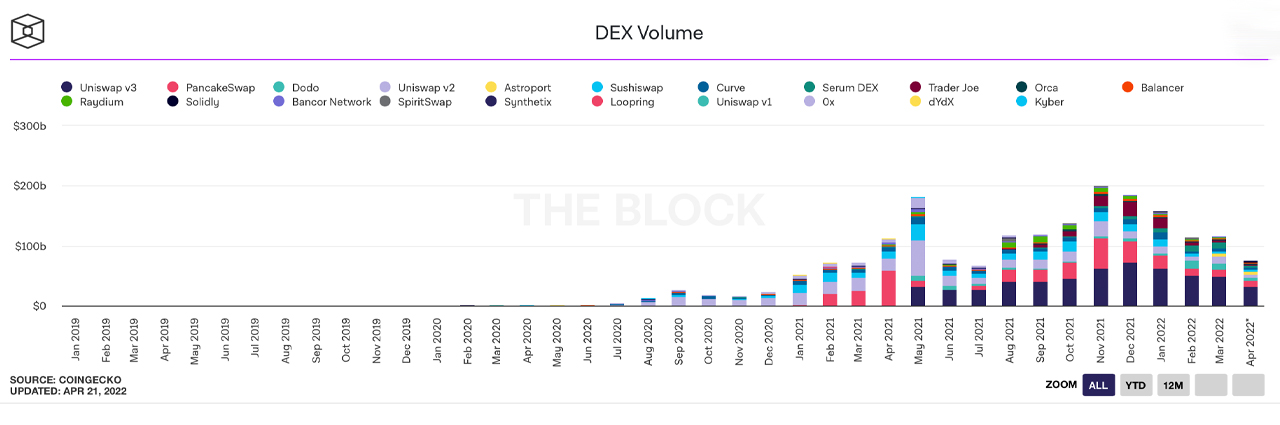

The dashboard called “DEX Metrics” on Dune Analytics, shows dex trade volume during the last seven days, out of more than a dozen dex protocols, is approximately $14 billion. The trailing seven-day metrics indicate the dex volumes recorded on the Dune Analytics’ dashboard are down 22%. Data from theblockcrypto.com’s crypto dashboard shows 30-day statistics stemming from five high-volume dex platforms and 16 smaller dex protocols.

Those statistics show a downward slide since December 2021 after $186.03 billion was recorded that month. The following month in January, dex platforms saw $157.68 billion in trade volume, and then in February, it slid to $114.37 billion. That means between December and February 2022, dex trade volume plummeted by 38.52%.

As mentioned above, there was a brief spike in dex trading volume in March, as $117.09 billion was recorded during that timeframe. However, April’s statistics look as though dex trading volumes will be lackluster and possibly lower than February. As of Thursday, April 21, 2022, current data shows that $75.11 billion in trades have been recorded so far.

While the theblockcrypto.com’s dashboard covers 30-day stats, seven-day metrics from coinmarketcap.com dex volume charts show an uninspiring week as well. The Dune Analytics’ “DEX Metrics” dashboard indicates current 30-day dex trade volume is approximately $70 billion. It will take a lot of trade volume to catch up to March’s spike and as of now, that doesn’t look as though it will happen.

What do you think about dex trading volume dropping since December? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, theblockcrypto.com dashboard, coingecko.com stats,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.