Blackstone head honcho Stephen Schwarzman is rich. Really rich. Almost twice the market cap of bitcoin-level rich, in fact. The man who was, once upon a time, lauded as the “Master of the Alternative Universe” built his empire by taking risks.

Over the years, the billionaire CEO has traded in a wide variety of businesses including a casino, a marine theme park, and even a German camping outfit. Schwarzman is the world’s 100th richest man, according to Forbes, with a “real-time net worth” of $18.4 billion.

1% of Your Portfolio in Bitcoin. Surely a Drop in the Bucket?

With such a history of speculation, you’d think the head of one of the largest asset management firms in the world would have no problem taking a punt at possibly the most alternative investment around, bitcoin.

Sadly, a recent interview with Fortune reveals that Schwarzman, like so many suits around him, is as unimaginative and conformist as they come. When asked about frontier assets like bitcoin, the interviewee had this dull response:

“I don’t have much interest in that [Bitcoin] because it’s hard for me to understand.”

Several sentences later, the world’s 100th richest man contradicted himself when asked if Blackstone would ever invest in the blockchain:

“That would be good because it’s a sound, very interesting technology.”

As I’ve written about before, the whole blockchain but not bitcoin debate is deeply misunderstood and shows a complete lack of understanding in the technology.

Renowned venture capitalist Chamath Palihapitiya has been saying for years that investing even 1% of your net worth into bitcoin is great “schmuck insurance” against financial collapse.

I’m inclined to agree. And with Schwarzman’s sizeable war chest, I fail to see why he wouldn’t put a measly 1% into this century’s best-performing asset and quite possibly the greatest hedge in financial history.

Blackstone: An Ironic Name for a Regressive Company

The origins of the Blackstone company name are amusingly ironic. Schwarzman and his fellow co-founder Peter Peterson used parts of their name to crown the firm.

Schwarz is German for black and Peter is Greek for stone, hence the name “Blackstone.” This simple idea is known as a cryptogram and forms part of the ethos that drives cryptocurrency today, an ethos that Schwarzman doesn’t share:

“I may be a limited thinker, but that’s a problem. If they could solve that [dirty money] problem and also the problem of controlling the money supply, then it might be OK.”

Today, Blackstone manages assets worth a staggering $470 billion. That’s a mighty chunk of change. Unfortunately for Schwarzman, somebody at Blackstone forgot to tell him how money works.

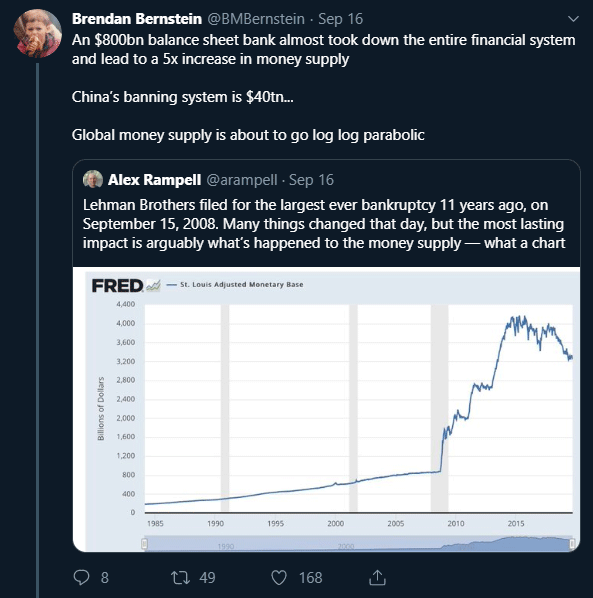

The more you create of it, the less valuable it becomes. And while bitcoin’s supply is fixed, the dollar’s supply isn’t. If anything, greenback production is recklessly out of control.

Guess Who’s Big Chums With the President?

Billionaires befriend billionaires, and Schwarzman is no different. He is a close friend and adviser to Donald Trump who now serves as the first-ever billionaire president of the U.S.

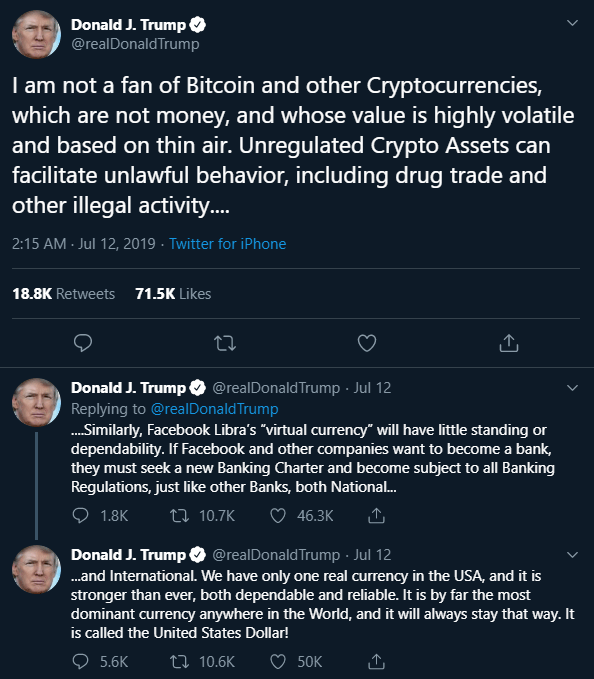

Earlier this year, out of left field, the orange president decided it was just about time to take aim at bitcoin and its cryptocurrency relatives:

The result of which leaves any presidential confidant with little choice but to follow in his tracks. Schwarzman is now 72 and his age reflects his evolution as an investor – stagnant.

“I was raised in a world where someone needs to control currencies. There’s a reason to want to control currencies, which is why governments all do it.”

If everyone else jumped off a bridge Mr. Schwarzman, would you?

As wealth inequality continues its pervasive march into the 21st century, younger generations become even less interested in the opinions of the privileged baby boomer elite.

And while the going’s good they’ll keep stacking them satoshis because, well, they have few real alternatives.

One day very soon the ‘master’ of the alternative investment may wake up to find that the alternative investment has become his master.

Last modified (UTC): September 17, 2019 9:44 PM