Bitcoin breached $12,000 again Tuesday, and traders see bullish crypto signals everywhere on the charts.

- Bitcoin (BTC) trading around $11,970 as of 20:00 UTC (4 p.m. ET). Gaining 2% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,524-$12,085

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin broke the $12,000 price barrier Tuesday, hitting $12,085 on spot exchanges such as Coinbase. The last time the price hit that level was back on Aug. 21. While the Tuesday rally lost some steam, analysts are seeing some highly bullish signals in the crypto market.

William Purdy, an options trader and founder of analysis firm PurdyAlerts, says recent weekly closes for bitcoin have been hitting new highs for 2020.

“Bitcoin’s weekly price is now consistently holding above the $11,500 pivot, which it has failed to do since March 2018,” Purdy said. “Four of the past weeks have closed above $11,500, unlike the late May 2019 run-up into $13,900, which continuously faced rejection at that price.”

Meanwhile, the U.S. Dollar Index, which measures the greenback against a basket of other currencies, continues to be a fundamental driver for bitcoin, according to some stakeholders.

“The weaker the dollar gets, the more positive it becomes for BTC,” said Rupert Douglas, head of institutional sales for crypto brokerage Koine. While the index is up 0.21% Tuesday, it’s still sustaining lows not seen since 2018.

One other bullish sign for crypto: The ETH/BTC trading pair, which highlights the strength of ether versus bitcoin, is trending way up Tuesday as some traders are selling BTC for ETH.

Read More: Ethereum Transaction Fees Set a Record Again

“I am keeping a close eye on the ETH/BTC pair, as ETH is at a key level not seen since January 2019,” said Jason Lau, chief operating officer for cryptocurrency exchange OKCoin.

“With bitcoin just crossing that $12,000 resistance level and [ether] at dollar price levels not seen since June 2018, there is certainly bullish sentiment across the market,” added OKCoin’s Lau.

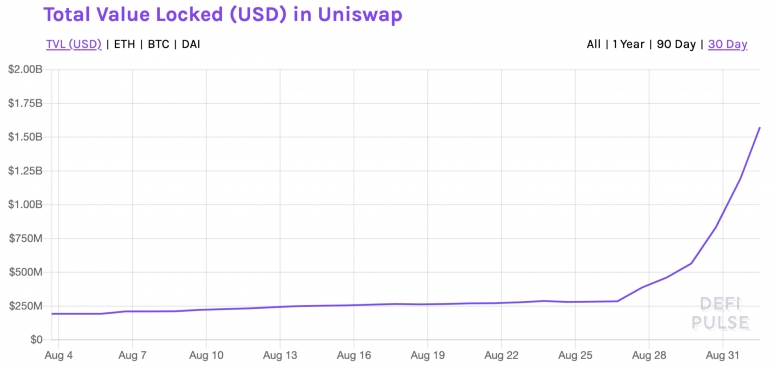

Over $1.5 billion locked in Uniswap

As for ether, the second-largest cryptocurrency by market capitalization was also up Tuesday, trading around $478 and climbing 8.9% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Read More: Ether Price Hits 2-Year High

The amount of value locked in the decentralized exchange Uniswap is now more than $1.5 billion, a whopping 462% from the paltry $280 million of only a week ago.

Why has there been such ridiculous growth of crypto locked in Uniswap? The rise of decentralized finance (DeFi) project SushiSwap protocol, which offers generous incentives to users staking crypto, has caught on with Uniswap pools.

Essentially, a Uniswap LP (liquidity provider) token holder who gets tokens by depositing on Uniswap can reap more rewards by swapping over to Sushi tokens, driving the growth in value locked. “The Uniswap locked value pump is due to SushiSwap,” said Peter Chan, lead trader at OneBit Quant. “It is simply staking Uniswap LP tokens for Sushi tokens,” he added.

Other markets

Digital assets on the CryptoX 20 are mostly in the green on Tuesday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil is up 0.22%. Price per barrel of West Texas Intermediate crude: $42.89.

- Gold was flat, in the green 0.10% and at $1,969 as of press time.

- U.S. Treasury bond yields were mixed Tuesday. Yields, which move in the opposite direction as price, were down most on the 10-year, in the red 4.1%.