Bitcoin is knocking at the gates of $17,000 while Ethereum’s transaction growth in 2020 is a positive indicator of future financial use cases.

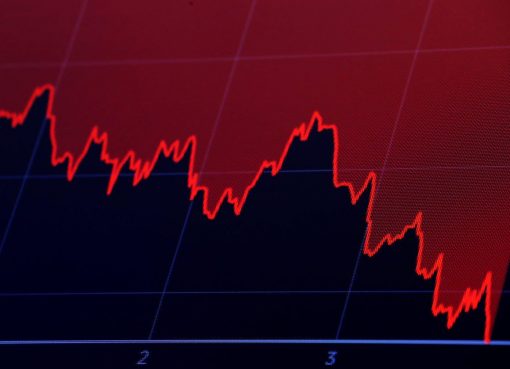

- Bitcoin (BTC) trading around $16,829 as of 21:00 UTC (4 p.m. ET). Gaining 6.1% over the previous 24 hours.

- Bitcoin’s 24-hour range: $15,792-$16,851

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin’s price made big gains Monday, turning bullish out the gate from a weak weekend and hitting as high as $16,851, according to CryptoX 20 data.

“Bitcoin has accelerated to the upside on positive short-term momentum, upholding overbought conditions following its recent breakout above former resistance from 2019,” said Katie Stockton, a technical analyst for Fairlead Strategies.

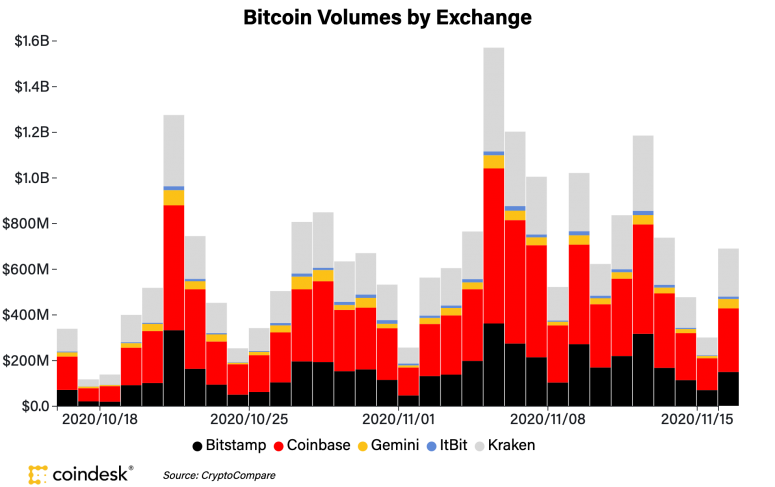

Momentum, as measured in the form of volume, was at $688 million as of press time, higher than the past month’s $404 million daily average on major spot exchanges.

“The next resistance is final resistance from 2017 near $19,500,” Stockton added. Based on CryptoX 20 data, the last time bitcoin was at this price level was back on Jan. 6, 2018, when the daily high was at $17,211.

In addition to bitcoin’s bullish run, global equities were also up Monday across the board, boosted by positive economic news – and promising results for another COVID-19 vaccine – in the face of a resurgence in the coronavirus pandemic:

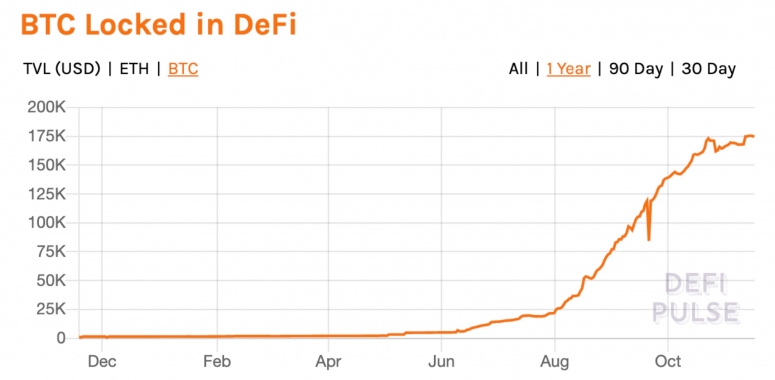

According to several analysts, the climbing value of bitcoin is also giving the world’s oldest cryptocurrency an increasing use as value storage for lending, both from centralized players and in decentralized finance, or DeFi. Since November 2019, the amount of bitcoin “locked” in DeFi, for example, has skyrocketed from 1,422 to 174,673 BTC, a 12,183% increase.

“Lending has gained popularity in 2020 with players like Nexo, BlockFi and others with strong growth throughout the year,” said Jean Baptiste Pavageau, partner at quant trading firm ExoAlpha. “DeFi also allows the retail market to access those popular lending solutions thanks to the Ethereum network.”

“It actually provides a strong use case for BTC beyond the digital gold narrative, as it’s used as a pooling and yielding instrument,” said Vishal Shah, an options trader and founder of crypto exchange Alpha5. Shah also speculates that all this bitcoin on the Ethereum blockchain may decrease the separation between blockchains. “It may actually create a chain-agnostic paradigm.”

Uniswap, tether dominate Ethereum transactions

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Monday trading around $462 and climbing 4% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

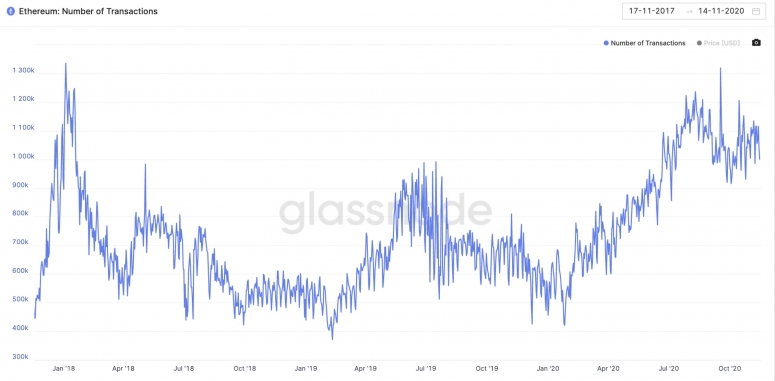

Since the start of July, the Ethereum network has been averaging over one million transactions per day, according to data aggregator Glassnode. That number of transactions was first experienced three years ago during the 2017-2018 crypto market bubble.

Token swapping and stablecoins are a big part of this, as 35% of the network’s transactions are on Uniswap (18.93%) and involve tether (16.42%) on Monday, according to Eth Gas Station.

“I think this is proof of the continued traction that Ethereum has been seeing as a platform during the second half of 2020,” noted Ben Chan, vice president of engineering for oracle provider ChainLink.

Uniswap’s transaction dominance in particular is a bullish sign on decentralized finance, or DeFi, according to Chan. “Unlike tether, which can move to other chains, DeFi is more sticky because assets and components of the ecosystem in themselves perpetuate a network effect.”

Other markets

Digital assets on the CryptoX 20 are all green Monday. Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Oil was up 3%. Price per barrel of West Texas Intermediate crude: $41.31.

- Gold was in the red 0.12% and at $1,886 as of press time.

- The 10-year U.S. Treasury bond yield climbed Monday, up to 0.905 and in the green 0.19%.