Bitcoin broke above $9,250 for the first time since Friday as the leading cryptocurrency continues to trade in a tight range just above $9,000 for several weeks. But cryptocurrency markets have stayed quiet as traders expect a big move. Bitcoin was trading hands around $9,250 as of 20:00 UTC (4 p.m. ET).

Ether, the second-largest cryptocurrency by market capitalization, gained 3%, trading around $232 as of 20:00 UTC (4 p.m. ET), according to Bitstamp.

Despite trading above $9,250, bitcoin is still stuck within a tight range of a few hundred dollars above $9,000. As a result, 30-day volatility continues to decline. In fact, bitcoin’s volatility reached its lowest mark since Feb. 23, according to Coin Metrics.

As bitcoin stagnates, traditional markets soar. Tesla made an all-time high Wednesday, climbing $1,134, up more than 6% from its daily open. Zoom also bounced back toward its all-time high of $262 after dropping Friday through Monday, up 3.6% from its Wednesday open.

Why is bitcoin so quiet? There are simply “more eyeballs away from the crypto market and more towards traditional financial markets,” said Eliézer Ndinga, research associate at digital asset manager 21Shares. Many retail traders are using the popular retail equities trading platform Robinhood to speculate as traditional markets rally amid the on-going coronavirus pandemic.

“Despite various efforts to boost institutional adoption, retail traders account for 96% of all exchanges’ transfers,” Ndinga added. For many of these traders, the stock market may be more interesting than cryptocurrency markets.

Despite retail investors’ temporarily waning interest, institutional investors continue to develop the cryptocurrency market’s infrastructure. New York Digital Investments Group (NYDIG) raised $190 million from 24 investors for a new bitcoin fund, CryptoX reported Wednesday. The New York-based asset manager, which has held a New York BitLicense since 2018, raised $140 million in May for a similar investment vehicle, the Bitcoin Yield Enhancement Fund.

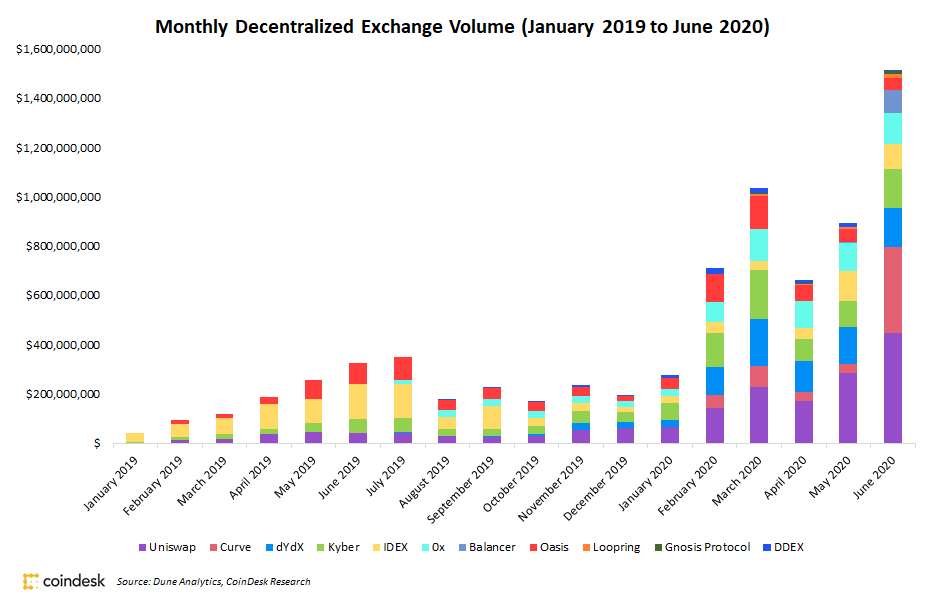

This rapid growth carries some security concerns, however. Decentralized finance analyst Jack Purdy told CryptoX the spike in trading volumes on these nascent platforms is “starting to become a bit worrisome” due to the fact that a variety of complex attack vectors still exist.

Stablecoin markets showed strength as USDC’s total circulating supply passed 1 billion tokens. Tether, the largest stablecoin, grew to $10.3 billion, according to data from Messari.

Exchange tokens were mostly up Tuesday as the entire sector gained 2.4%, according to Messari. Some of the biggest gainers were kyber network (KNC) up 11.4% and binance coin (BNB) up 2.5%. All price changes were as of 20:00 UTC (4:00 p.m. ET).

The leader in blockchain news, CryptoX is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CryptoX is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.