Bitcoin price has fallen by over $2,000 from its 2020 high and is currently struggling to hold support above $10,000. Or is the other way around, and bulls have been valiantly defending the key support level on daily timeframes?

Zooming out further shows yet another critical retest in progress, and one that could potentially last the entire month of September – a month that has historically been red for the cryptocurrency.

Bitcoin Bulls Defend Support At $10,000 For Seven Days Straight

It is not easy to tell from price action, but bulls may be winning the war despite the battle looking grim currently. Potential profit-taking and portfolio rebalancing may have triggered a selloff in the crypto space.

It also may be panic returning across all markets due to the stock market bubble being ready to burst ahead of the coming election.

Whatever the reason, greed turned to fear in a flash with an over $2,000 plunge from the 2020 high of over $12,000 to below $10,000.

Related Reading | “Weak Hands” Have Been Shaken Out On The Bitcoin Crash To $10,000

Each time in the past Bitcoin price went above the crucial resistance level, crypto investors claimed it would never again trade below it. And after the defense by bulls over the last week, this time it’s possibly true.

Despite repeated attempts to break below $10,000, the selloff has thus far been unable to penetrate and close below support. Only wicks have been left behind, and they’ve started to get shorter signaling a higher low on daily timeframes.

With the seventh day currently in progress, is today the lucky day for bulls when the bearish sell pressure gives in?

BTCUSD Daily Support At $10,000 Retested Seven Days In a Row| Source: TradingView

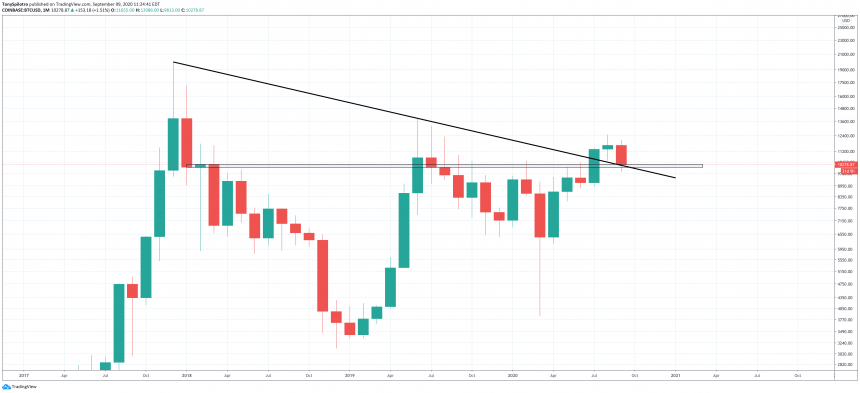

Monthly Crypto Bear Market Resistance Block Bullish Retest In Progress

The attempt to push prices below $10,000 being over is not likely, according to the same Bitcoin price chart when zoomed out on monthly timeframes. Along with a bullish retest taking place on daily timeframes, the crypto asset is also retesting a formerly bearish resistance block as resistance turned support.

Related Reading | Bitcoin Is Sandwiched Between Two Important Short-Term Targets

If confirmed, Bitcoin will not only confirm horizontal support at $10,000 as support, but it’ll also confirm the breakout of the downtrend line at the top of the multi-year symmetrical triangle. But it could take a full month or more to confirm such a critical support line.

BTCUSD Monthly Support At $10,000 Retest In Progress | Source: TradingView

Simply put, the bullish retest currently in progress and defense of $10,000 very well could be the last time the cryptocurrency trades below five-digits ever again. It also could be the final signal that the asset’s new uptrend has begun, and a powerful surge could be next.

The FOMO that could take place with Bitcoin having confirmed $10,000 resistance as support may cause it to breach above its next key level of resistance at $13,800. Beyond there, a retest of the asset’s former all-time high is the next logical target, and beyond that, new records are possible.

It all depends on how lucky the seventh daily defense by bulls ends up being. Losing $10,000 on daily timeframes doesn’t mean all is lost, however. But a monthly close back inside the triangle trend line could be disastrous for the crypto market, as false breakouts often lead to a breakdown in the opposite direction – which could mean new lows for Bitcoin.

September has historically been a red month for Bitcoin seven out of the last ten years of its existence, and it is working on its eight red candle now. Will the retest last the full month, and more importantly, can bulls withstand that much pain?