In roughly 202 days, the cryptocurrency network Litecoin (LTC) will experience a block reward halving on or around Aug. 3, 2023. Litecoin will be the first major proof-of-work (PoW) blockchain to see a reward reduction before Bitcoin’s upcoming halving, which is expected to occur 203 days from now.

Litecoin Halving Set to Occur on or Around Aug. 3, 2023

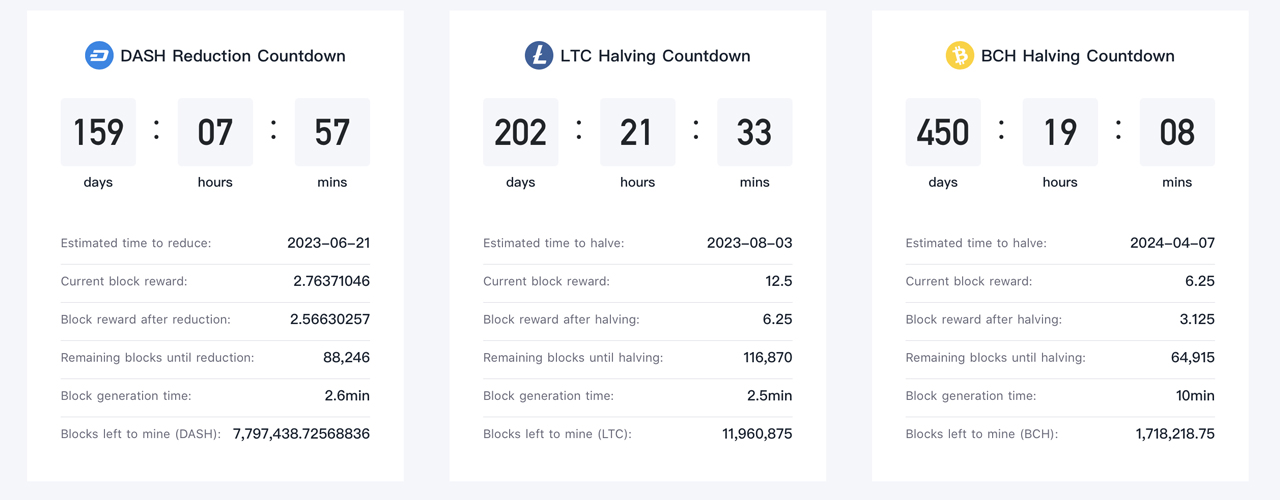

Litecoin, the 14th-largest cryptocurrency today, is preparing to experience a block reward halving in 202 days. It will be the first major proof-of-work (PoW) cryptocurrency to have a reward halving, besides the upcoming reduction scheduled to happen in 158 days for Dash. However, Dash’s reduction is different than a halving as the reward will be reduced from 2.763 Dash to 2.566 Dash. Like Bitcoin, Litecoin’s block halving cuts the reward in half (by 50%) and it will drop from 12.5 LTC to 6.25 LTC.

While litecoin (LTC) holds the 14th-largest market capitalization today, it used to be a top-ten cryptocurrency contender in the early days of the crypto market. LTC’s network has many differences from Bitcoin (BTC) as there are more coins in circulation — currently more than 72 million LTC in circulation. However, LTC is nearing its maximum supply of 84 million. Bitcoin’s block time is usually around 10 minutes per block, but LTC blocks are much faster at 2.5 minutes per block.

🔥Litecoin Halving Cycles 2W chart🔥

Something to give us some bullish vibes for short term future and real strong bullishness starting from June 2024.

💡 Next Litecoin halving will be on August 3rd 2023 pic.twitter.com/8tzlCUQICp

— Zen ☮️ (@WiseAnalyze) January 8, 2023

Two-week market statistics show that litecoin (LTC) has gained 29% against the U.S. dollar, but LTC is down 79% from the cryptocurrency’s all-time high. LTC reached an all-time high of around $410 per unit over a year ago on May 10, 2021. In addition to the difference in supply between LTC and Bitcoin (BTC), Litecoin’s proof-of-work algorithm, Scrypt, is different from SHA-256. The upcoming LTC halving will be Litecoin’s third block reward reduction since its inception.

LTC experienced its first halving on Aug. 25, 2015, and this halving reduced the block reward for miners from 50 LTC to 25 LTC. LTC block halvings occur every 840,000 blocks, or four years. The second Litecoin block reward halving occurred on Aug. 5, 2019. This particular halving reduced the block reward for miners from 25 LTC to 12.5 LTC, the current reward level for Litecoin miners today.

In addition to Dash and Litecoin, the next three blockchains that will see block reward halvings are Bitcoin Cash (BCH) in 450 days, Bitcoin SV (BSV) in 455 days, and Bitcoin (BTC) in 474 days. Ethereum Classic is expected to see a block reduction similar to Dash’s in 568 days. And, Zcash (ZEC) will see a halving in 677 days. The ZEC block reward halving will see the subsidy drop from 3.125 ZEC to 1.5625 after the halving occurs on or around Nov. 20, 2024.

What do you think will be the impact of the upcoming Litecoin halving on its mining ecosystem and price? Leave your thoughts in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.