By Francisco Rodrigues (All times ET unless indicated otherwise)

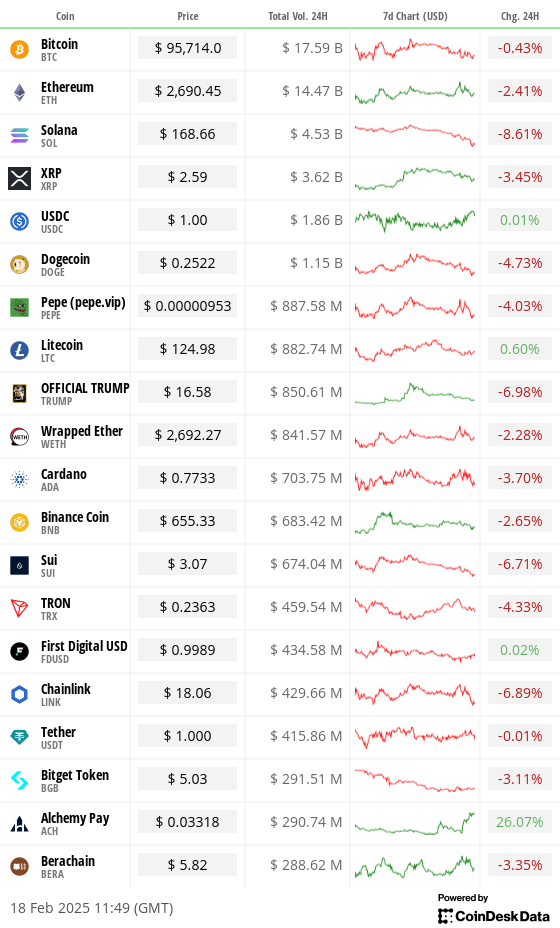

While bitcoin (BTC) is little changed over the past 24 hours, down just 0.7%, the broader market is in a bearish mood following the Libra token debacle, which has led to accusations of fraud and calls for the impeachment of Argentina’s President Javier Milei.

The CoinDesk 20 Index is down around 2.3% over the past day, and the near- to medium-term market movement probably hinges on how the U.S.-Russia negotiations in Riyadh go. The talks are focusing not only on ending the conflict in Ukraine, but also on “normalization” of ties between the countries.

An additional layer of uncertainty comes from FTX Digital Markets, the Bahamas-based subsidiary of FTX, which starts repaying creditors today. In total, FTX’s repayment program will be around $16 billion.

The liquidity injection will come in the form of stablecoins. First up are creditors with claims under $50,000, who will receive roughly 119% of their adjudicated claim value, with 9% annual interest accrued since November 2022.

The effect the repayments will have is unclear. While some analysts say the amount being repaid now is “too small to move the needle,” others suggest that FTX’s historic interest in the Solana ecosystem means some of these funds will flow toward it.

Investors have recently turned their attention to ether. U.S.-listed spot ETFs offering exposure to the second-largest cryptocurrency by market capitalization are seeing a cumulative net inflow of $393 million this month. That compares with a net outflow of $376 million for spot bitcoin ETFs.

These inflows come ahead of Ethereum’s Pectra upgrade entering its testing phase on the Holesky testnet. Pectra should bring a number of improvements to scalability and security and will let users pay for gas fees with tokens other than ether.

Elsewhere, individual investors are bearish amid trade-war threats, reduced interest-rate cut expectations, and consistent inflationary surprises. A survey from the American Association of Individual Investors found that bearishness among investors is at a two-year high, the Wall Street Journal reports.

This pessimism, however, is often a contrarian indicator. Institutional investors’ risk appetite has also dropped this month over the potential effects of a potential trade war amid the lowering odds of a Fed rate cut. Stay alert!

What to Watch

- Crypto:

- Macro

- Feb. 18, 10:20 a.m.: San Francisco Fed President and CEO Mary C. Daly delivers a speech in Phoenix. Livestream link.

- Feb. 18, 1:00 p.m.: The Fed’s Michael S. Barr took, vice chair for supervision, gives a speech titled “Artificial Intelligence in the Economy and Financial Stability” in New York. Livestream link.

- Feb. 19, 2:00 p.m.: The Fed releases minutes of the Jan. 28-29 FOMC Meeting.

- Earnings

- Feb. 18: CoinShares International (CS), pre-market

- Feb. 18: Semler Scientific (SMLR), post-market

- Feb. 20: Block (XYZ), post-market, $0.88

- Feb. 24: Riot Platforms (RIOT), post-market, $-0.18

- Feb. 25: Bitdeer Technologies Group (BTDR), pre-market, $-0.53

- Feb. 25: Cipher Mining (CIFR), pre-market, $-0.09

- Feb. 26: MARA Holdings (MARA), post-market, $-0.13

Token Events

- Governance

- Unlocks

- Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $78.6 million.

- Feb. 28: Optimism (OP) to unlock 1.92% of circulating supply worth $34.23 million.

- Token Launches

- Feb. 18: Ethena (ENA) to be listed on Arkham.

- Feb. 18: Ronin (RON) to be listed on KuCoin

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Token Talk

By Francisco Rodrigues

- Donald Trump supporters are set to receive around $50 worth of the official TRUMP tokens if they bought merchandise from the websites associated with the U.S. president.

- The token was unveiled just days before Trump took office and have lost more than 70% of their value since then.

- Solana-based decentralized exchange Jupiter has started accumulating USDC using 50% of the collected protocol fees to buy back JUP tokens. The buybacks haven’t yet started.

- JUP’s price is down more than 12% over the last 24 hours over the protocol’s apparent involvement in the LIBRA cryptocurrency debacle.

Derivatives Positioning

- SOL’s price may continue to fall, seeing that perpetual futures open interest has risen by 5% in the past 24 hours, accompanied by a negative cumulative volume delta (CVD). This combination indicates net selling pressure in the market.

- The CVD for most major tokens is negative, indicating a bearish sentiment.

- BTC and ETH front-dated or short-term puts continue to be pricier than calls on Deribit. The sentiment is bullish after February expiry.

- Block flows featured an April expiry bitcoin bull put spread, involving strikes $85K and $100K and outright longs in puts at $94K and $90K strikes. Ether bull call spreads crossed the tape as well.

Market Movements:

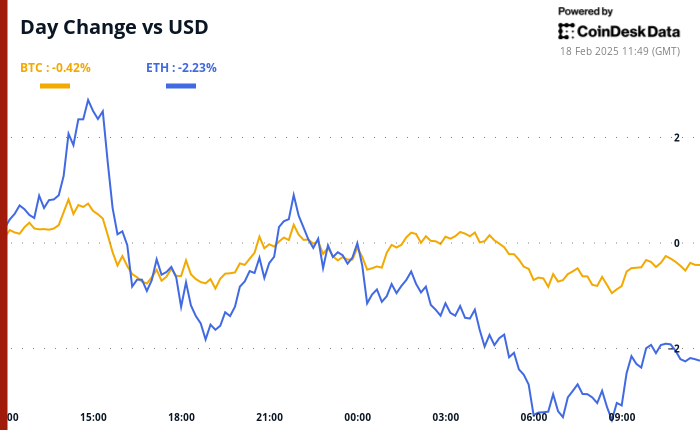

- BTC is down 0.69% from 4 p.m. ET Monday to $95,802.76 (24hrs: -0.57%)

- ETH is down 2.88% at $2,698.31 (24hrs: -1.89%)

- CoinDesk 20 is down 2.23% to 3,161.95 (24hrs: -3.03%)

- Ether CESR Composite Staking Rate is up 27 bps to 3.18%

- BTC funding rate is at 0.0078% (8.5541% annualized) on Binance

- DXY is up 0.36% at 106.94

- Gold is up 0.97% at $2,922.9/oz

- Silver is up 0.70% to $32.99/oz

- Nikkei 225 closed 0.25% at 39,270.4

- Hang Seng closed +1.59% at 22,976.81

- FTSE is up 0.18% at 8,783.43

- Euro Stoxx 50 is unchanged at 5,520.7

- DJIA closed Friday -0.37% at 44,546.08

- S&P 500 closed unchanged at 6,114.63

- Nasdaq closed +0.41% at 20,026.77

- S&P/TSX Composite Index closed -0.84% at 25,483.2

- S&P 40 Latin America closed +2.12% at 2,490.30

- U.S. 10-year Treasury rate was up 3 bps at 4.51%

- E-mini S&P 500 futures are up 0.1% to 6,151.5

- E-mini Nasdaq-100 futures are up 0.21% at 22,282

- E-mini Dow Jones Industrial Average Index futures are down 0.15% to 44,676

Bitcoin Stats:

- BTC Dominance: 61.17 (0.85%)

- Ethereum to bitcoin ratio: 0.02813 (-1.71%)

- Hashrate (seven-day moving average): 790 EH/s

- Hashprice (spot): $53.47

- Total Fees: 6.93 BTC / $663,706

- CME Futures Open Interest: 174,200 BTC

- BTC priced in gold: 32.8 oz

- BTC vs gold market cap: 9.31%

Technical Analysis

- The chart shows the market dominance of Tether’s USDT, the largest dollar-pegged stablecoin.

- Its dominance rate seems to have bounced off the March 2024 low, teasing a bullish double bottom pattern.

- In other words, USDT could become more dominant, which usually happens during market-wide price corrections.

Crypto Equities

- MicroStrategy (MSTR): closed on Friday at $337.73 (+3.94%), down 0.6% at $335.76 in pre-market.

- Coinbase Global (COIN): closed at $274.31 (-7.98%)

- Galaxy Digital Holdings (GLXY): closed at C$27.65 (-2.54%)

- MARA Holdings (MARA): closed at $16.90 (-0.06%)

- Riot Platforms (RIOT): closed at $12.27 (+0.33%)

- Core Scientific (CORZ): closed at $12.51 (-0.24%)

- CleanSpark (CLSK): closed at $10.50 (-1.59%)

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.40 (+0.52%)

- Semler Scientific (SMLR): closed at $49.67 (+0.44%)

- Exodus Movement (EXOD): closed at $50.00 (unchanged)

ETF Flows

The data below is as of Feb. 14. U.S. markets were closed on Feb. 17.

Spot BTC ETFs:

- Daily net flow: $70.6 million

- Cumulative net flows: $40.12 billion

- Total BTC holdings ~ 1.180 million.

Spot ETH ETFs

- Daily net flow: $11.7 million

- Cumulative net flows: $3.15 billion

- Total ETH holdings ~ 3.791 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

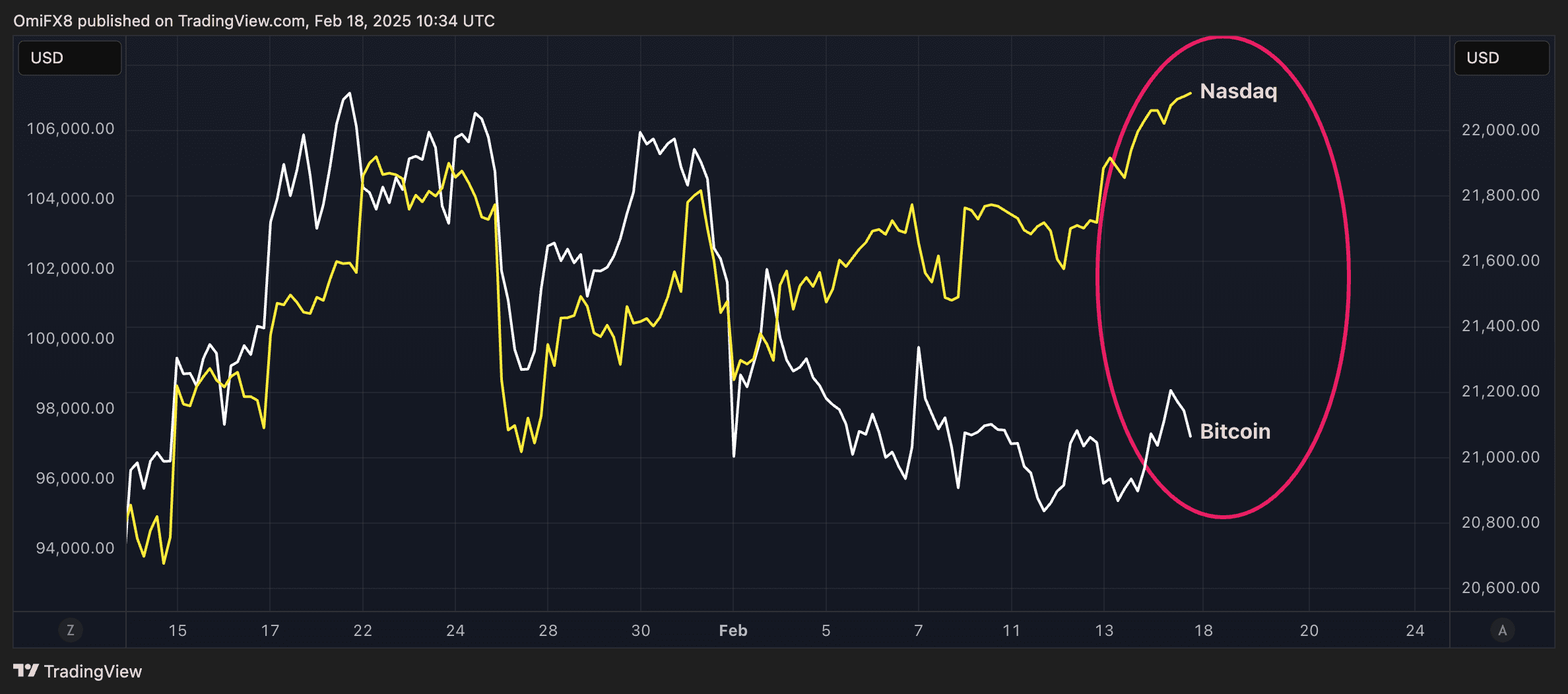

- While bitcoin remains listless below $100,000, Wall Street’s tech-heavy Nasdaq 100 has jumped close to record highs.

- If BTC’s historical positive correlation with the tech stock is any guide, BTC could soon pick up a strong bid.

While You Were Sleeping

In the Ether