Lex Sokolin, a CryptoX columnist, is Global Fintech co-head at ConsenSys, a Brooklyn, N.Y.-based blockchain software company. The following is adapted from his Fintech Blueprint newsletter.

Everything seems to be getting connected: finance, culture, art, technology, media, geopolitics. It is either a fantastic time to be working in our industry or we are slowly going nuts from information overexposure. Let’s tug on a few strings as they relate to my thesis for what is happening next.

At the core of the answer is the question about the computing paradigm. How does software operate? Where does it operate? Who secures it? And, of course, in the spirit of our common interest, how does this impact financial infrastructure?

We know financial infrastructure is both (1) top-down, deriving from the powers of the state over money and the risk-taking institutions that are entrusted to safekeep such value and (2) individual human behaviors like paying, saving, trading, investing and insuring. Throughout time, people want to apply inter-temporal utility maximization functions (a measure of value depending on time) to their assets, then aggregations of people in super-organisms (i.e., corporations, municipalities) have the same financial needs.

Financial infrastructure is just our collective solution for enabling activities using the latest technology – whether that is language, paper, calculators, the cloud, blockchain, or some other reality-bending physical discovery. We have progressed from mainframe computers to standalone desktops and laptops running local software, to the magnificence and efficiency of cloud computing accessed through the interface of the mobile device, to now open source programmable blockchains secured by computational mining. These gears of computational machine enable core banking, portfolio management, risk assessment, and underwriting.

Some companies, like Fiserv or FIS, still provide software that runs on a mainframe (hi there, COBOL-based core banking), among other more modern activities. Some companies, like Envestnet, still support software that runs locally on your machine (see Schwab Portfolio Center acquisition), among other more modern activities.

Let’s be honest. This is last century stuff.

Today, all software should at the least be written to be executed from the cloud. You can see this thesis proven out by the massive revenues Google, IBM, Amazon and Microsoft generate in their financial cloud divisions. Technology firms should host technology; they are far better at this than financial institutions.

The venture capital strategies of embedded finance, open banking, the European Union’s Payment Service Directive and API all revolve around the premise that banks are behind on cloud technology and do not know how to package and deliver financial products to where they matter. Financial products are purchased where customers live and experience them. That is no longer the branch, but the attention platforms and other digital brand experiences.

See also: Lex Sokolin – Software Ate the World, Here’s How It Eats Finance

Nobody has proven this out as well as Ant Financial, the Chinese fintech powerhouse. Proximity payments and QR-code based shopping rode the mobile and cloud networks of Alibaba. You would not be able to design this user experience, nor this attention platform, without a technology footprint that began with cloud computing and the internet.

It is less banking enablement software (i.e., the narrow ambition of banking-as-a-service), and more the data, media, and e-commerce experience of Amazon or Facebook, with financial product monetization included.

More than 60% of Ant’s revenue comes from fintech product lead generation, with capital risks passed on to the underlying banks and insurers, which Ant also digitizes. Remember that the chassis for credit scoring comes from the tech giant and its artificial intelligence pointed at 700 million people and 80 million businesses, not the other way around from the banks. This therefore incorporates the types of enabling fintech that Refinitiv and Finastra dream about.

Programmable blockchain

So far we have abstracted all the complexities of actually standing up these operating businesses, and instead described them as financial infrastructure derivatives of the computing paradigm of the moment. This is based on the premise that people will always re-invent financial infrastructure, and use the tools of the time to make it over and over again.

As a comparison, we have always needed light, but the technology of light – from fire, to gas lamps, to incandescent bulbs, to LEDs – evolves progressively by ingesting new available scientific components. The next computing paradigm is running mutualized (i.e., open source, shared, communal) software on blockchain networks for digital assets.

In early 2017, I articulated a version of this thesis at Autonomous Research. In this scenario, a human relationship remains between the client and some representative of the financial product, whether that representative is a CFA-bearing Series 7 adviser at Goldman Sachs via Zoom or a superstar developer Andre Cronje via Twitter. There is a trust link and reputational capital. But, underneath that, the relationship is largely automated, AI-driven data gathering, which is normalized and processed into software that connects into blockchains, which is then underwritten by a financial firm.

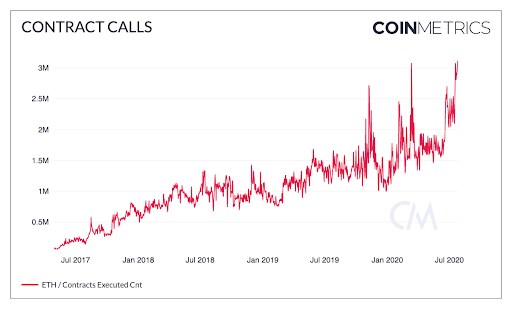

“Software Robots and Automated Workflows,” in this current phase of fintech evolution, have become smart contracts on programmable blockchains. Ethereum, the leading such chain, experiences more than three million “contract” calls per day by its embedded software. Below is a chart, via Coin Metrics, of the machine humming along and doing ever more computational work. Certainly it is not the only programmable blockchain, with several solutions even sitting on top to create additional throughput capacity and scalability, such as Cosmos, OMG and SKALE.

What does the android dream about? In large part, financial infrastructure.

It dreams of digital asset trading on Uniswap, which for the first time in history experienced more trading volume with its 200,000 users than fintech unicorn Coinbase with its 30 million.

It dreams of asset management and market making, with financial robots composing automated trading and investment strategies on Yearn Finance. It dreams of 300,000 people creating their own investment plans on DeFi aggregator Zapper (chart link here). It dreams of liquidity runs between Uniswap and SushiSwap, of yield maximization and governance tokens, and Dadaist meme art in the form of the Based Protocol.

Convergence?

I have described worlds that today are quite different: the exponential innovation of DeFi, trying to outpace regulation and automate away human involvement, and the transformative reformatting that will happen to financial incumbents over time. As DeFi collateralized assets (TVL) approach $10 billion, one narrative we may see is that crypto is a completely separate, new sphere of economics and finance. It does not need to connect to the old world. It simply needs to be left alone to perform.

In some sense, the payments industry offers a comparison. Like comparing technology differences between crypto and fintech incumbents, one can compare the technology distinctions between physical cash, credit cards, e-commerce payment processors, NFC-based proximity payments and QR codes. Each has their own logic and sphere of influence. But, in reality, one usually feeds off the accomplishments of the other. Even Ant Financial today is directing its billion users to traditional capital providers, while leveraging modern user experiences.

Market cycles mean that blockchain investments shift between incumbent transformation budgets and crypto-native building and investment. One year, it is all about Bitcoin. The next, about distributed ledgers. The next, about ICOs. The next, about digital assets. The next, about DeFi. It does not take long to recognize the swing of the pendulum.

See also: Lex Sokolin – Your Crypto Startup Needs a Recession Strategy

To combat these demand swings, you need timeless principles. To this end, I see the DeFi protocols (like Maker, Aave, Compound, Yearn, Curve, Nexus Mutual) and applications evolving towards the natural financial behaviors turned into software: paying, saving, investing, trading, insuring. All that really needs to be done longer-term is to connect them in a risk-managed way to the existing economy. Startups like Centrifuge are leading the way.

That bridge can be expressed into the consumer footprint of wallets to help users achieve their financial goals, into the developer footprints of enabling software to help financial developers maintain their financial applications, and into institutional networks for novel structures across the trillions of GDP in financial economic activity. The speed of innovation is blinding, and who knows what fortune the market will provide us. But the destination – a friction-free, open-sourced, equitable financial system – is magnificent.