Institutions have not left the Bitcoin (BTC) market even in the face of a 50%-plus bearish correction earlier this year, shows data provided by Glassnode.

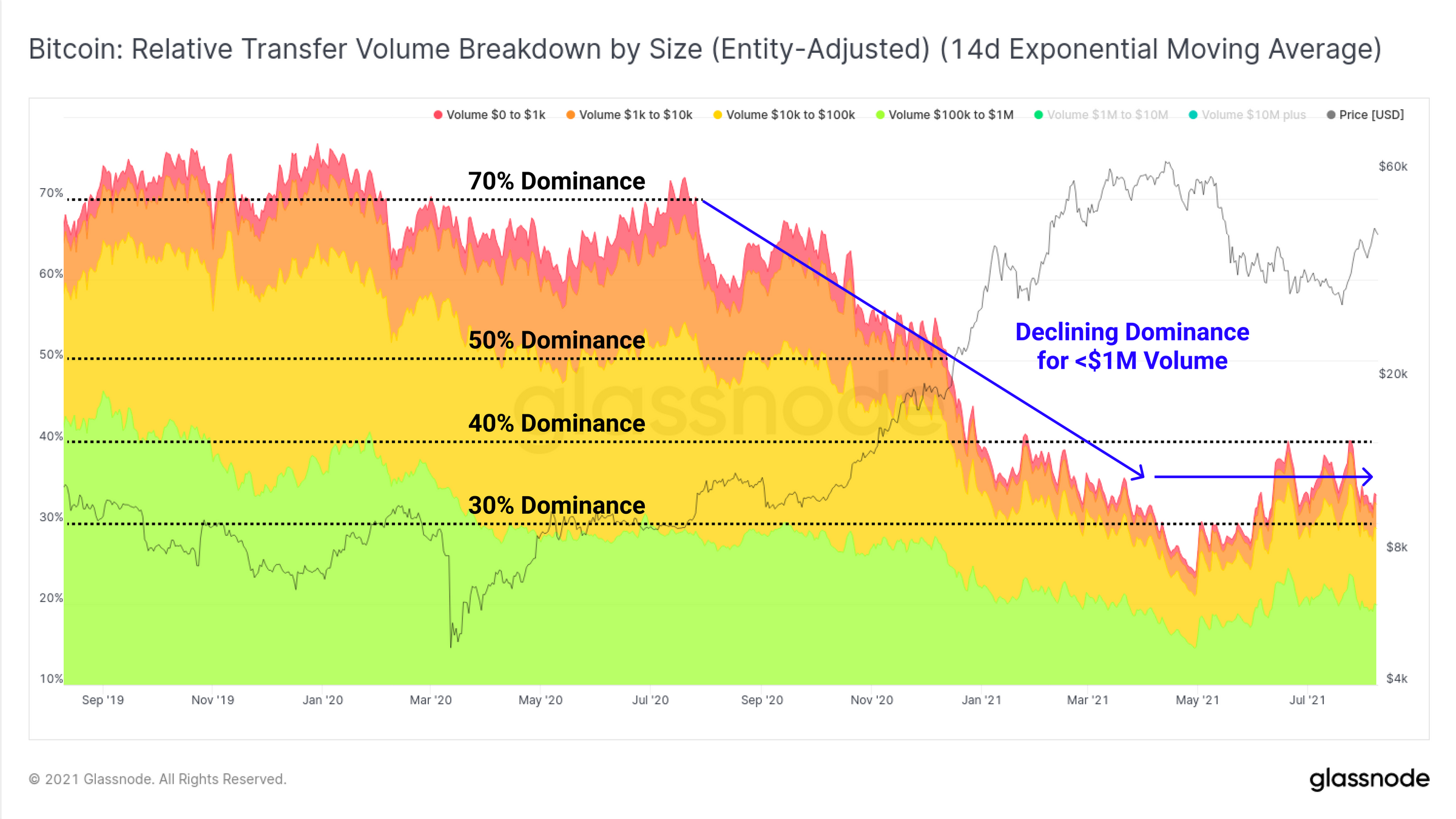

The blockchain analytics platform reported on Monday that the dominance of Bitcoin transactions exceeding $1 million has surged twofold since September 2020 — from 30% to 70% of the total value transferred.

Since retail investors do not typically engage in large-volume transactions, Glassnode guesses that the institutional investors might have been behind the spike in the $1 million–$10 million transaction group.

Moreover, the platform noted that the Bitcoin network processed the said bulky transactions as the BTC/USD exchange rate traded lower from $65,000 to below $30,000 in the second quarter of 2021.

“As the market traded down to the lows of $29k in late July, the $1M to $10M transaction group spiked markedly, increasing dominance by 20%,” wrote Glassnode in a report from Monday.

“This suggests that these large-size transactions are more likely to be accumulators than sellers and is again, fairly constructive for price.”

Small transactions lose dominance

Glassnode provided additional volume data that showed a structural decline in small-size transaction dominance.

In detail, transactions of less than $1 million fell by half — from 70% in September 2020 to 30%–40% dominance in March–May 2021. The declines suggest that small investors capitulated their Bitcoin holdings to secure early profits.

During the mid-May crypto market crash, the dominance fell to nearly 20% but recovered back to the 30%–40% range as Bitcoin’s price consolidated above the $30,000 support level. It remained within the said percentage range during the recent run-up to levels above $46,000.

“[The data] clearly demonstrates a new era of institutional and high net worth capital is flowing through the Bitcoin network since 2020,” Glassnode asserted.

Hodl sentiment returns

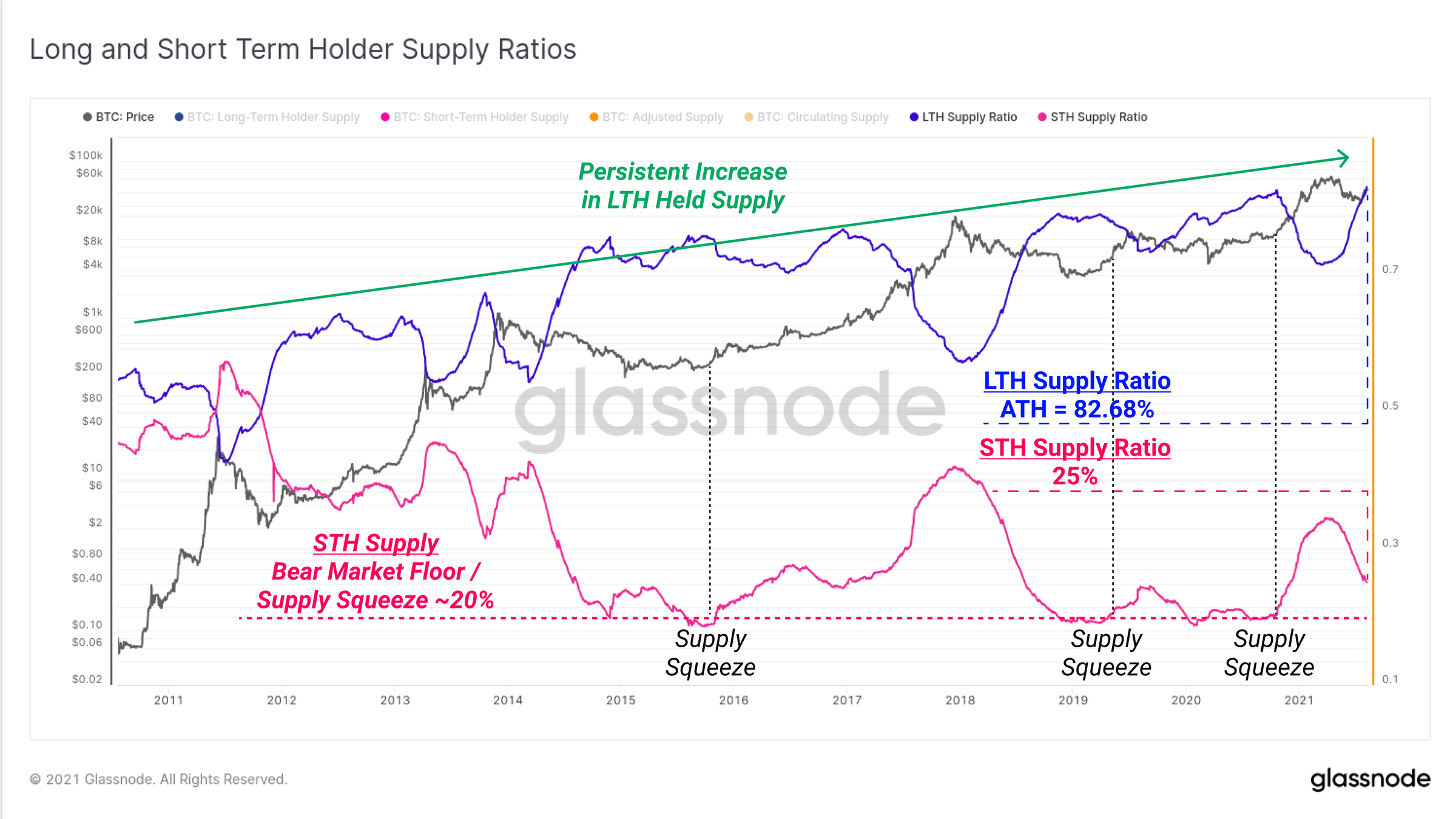

More evidence of Bitcoin accumulation came from Glassnode metrics that tracked the hodling behavior of investors.

The “Long and Short Term Holder Supply Ratios” indicator reported that the Bitcoin supply owned by long-term holders (LTH) reached an all-time high of 82.68%. Meanwhile, the short-term holders (STH) supply continued to decline, hitting 20% and suggesting holding and coin maturation in play.

Glassnode suggested that when the STH supply ratio reaches 20%, it follows with a major supply squeeze — i.e., a supply shortage that typically drives the underlying asset’s prices higher.

Related: No, Bitcoin isn’t entering a 2018-like bear cycle, new data suggests, as BTC targets $45K

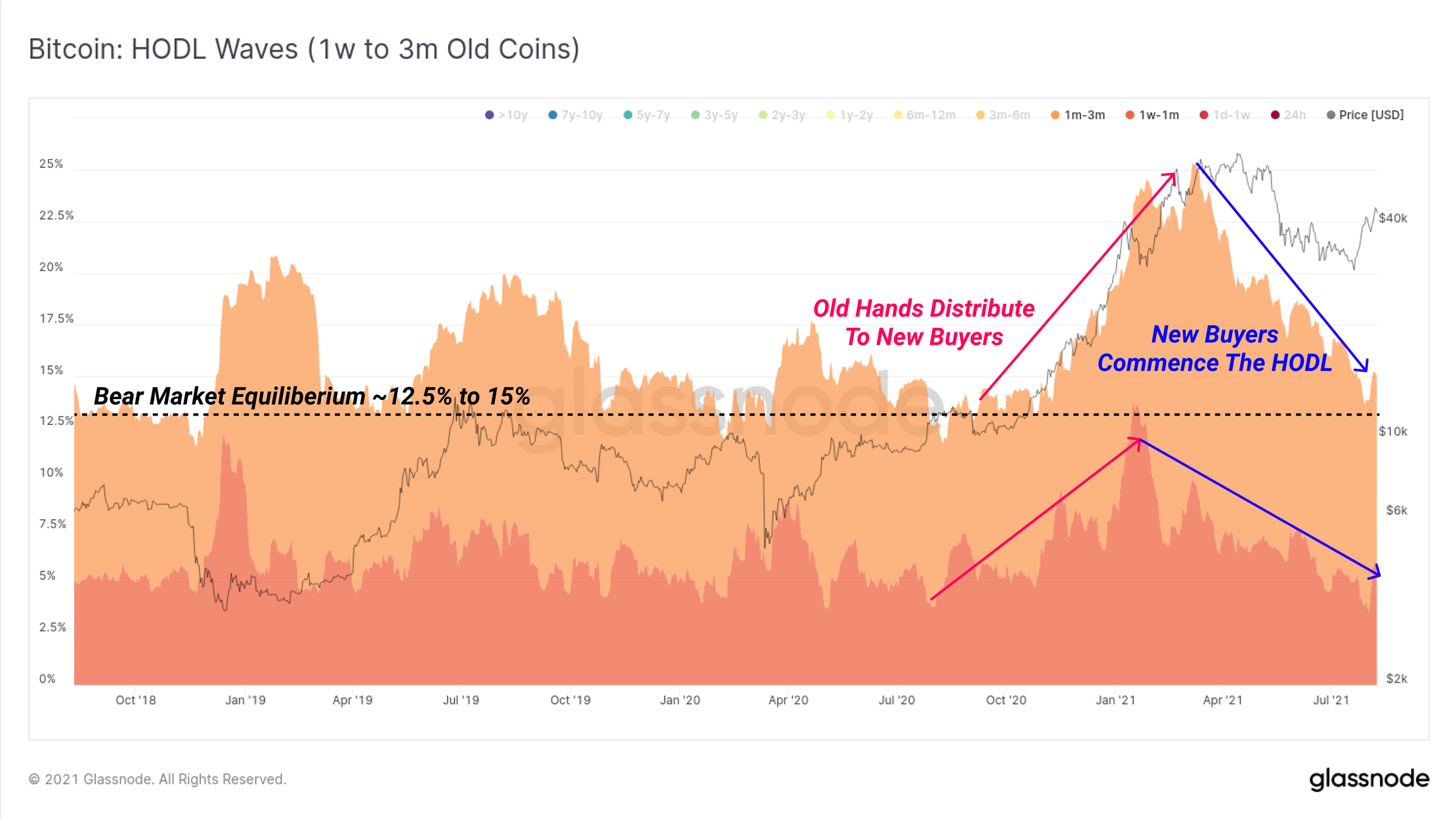

But who will accumulate the remaining 5% of the adjusted supply? A Glassnode metric suggests coins aged between one week and three months represent a large portion of the liquid supply.

“We can see that after the uptrend in Q1 (old coin distribution), these age brackets have fallen back to bear market equilibrium level of around 12.5% to 15% of supply,” wrote Glassnode, citing the chart above.

“This downtrend indicates that coin maturation is indeed in play, and that many of the 2021 bull market buyers have stuck around to become strong hand HODLers.”

Bitcoin was trading at $45,930 at the time of writing, down 0.73% from its intraday high.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.