It has been another boring day for Bitcoin. While many of its smaller counterparts incur intense uptrends, BTC has largely been trading sideways, forming an incredibly tight trading range between $9,100 and $9,100.

Analysts are now scratching their heads as to what could come next for the benchmark digital asset, as its multi-month consolidation phase has offered little insight into its mid-term trend.

It is a high probability that the cryptocurrency will not be able to garner any clear direction until altcoins start losing their momentum.

This is because investors have widely shifted their time and attention towards these smaller and more volatile tokens, subtracting from Bitcoin’s liquidity and trading volume.

Until active investors flood back into BTC, its price may remain stagnant.

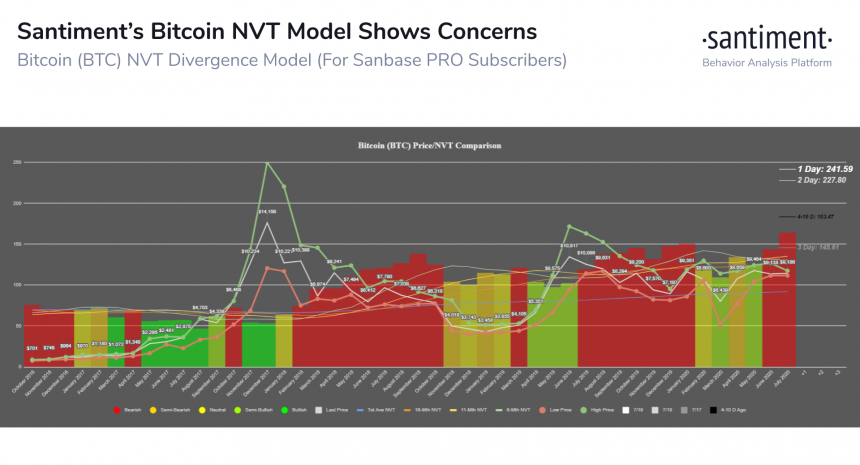

That being said, it is important to note that one model is flashing some concerning signs for the crypto, showing that a lack of token circulation seems to play into bears’ favor.

Bitcoin Struggles to Defend Crucial Support as Bulls Falter

Bitcoin has been trading between $9,100 and $9,200 for the past week. The cryptocurrency is presently trading directly between these two levels at its current price of $9,150.

Where it trends next may be largely dependent on whether or not buyers are able to break the upper boundary of this range and start navigating towards the upper-$9,000 region.

Although its crucial support has been ardently defended, a breakdown here could prove to be dire for the cryptocurrency’s mid-term outlook.

As NewsBTC reported yesterday, its essentially “open-air” down until $7,000 for the crypto.

This can be seen while looking towards its Ichimoku Cloud.

Although buyers have stopped it from piercing the upper boundary of this cloud, its inability to post any sustained bounce at this level does point to some underlying weakness.

While speaking about the importance of this level, one analyst cited in the report explained that a breakdown would likely cause a swift decline.

“BTC – daily cloud support being respected…for the time being…lots of open air down to $7K.”

Image Courtesy of Big Chonis. Chart via TradingView.

This On-Chain Data Spell Trouble for BTC

The lack of unique token circulation seen by Bitcoin doesn’t bode well for the cryptocurrency’s outlook.

According to data from analytics platform Santiment, a rise in an asset’s unique token movement typically is a sign of underlying strength, but BTC isn’t seeing this presently.

“Our BTC NVT Divergence Model continues to show a concerning lack of token circulation. Prices tend to move upward when unique token movement of an asset rises. But crypto’s #1 ranked asset is being proportionately ignored in favor of altcoins currently.”

This could suggest that downside is imminent, with any breakdown from here opening the gates for Bitcoin to see a far-reaching downtrend.

Featured image from Shutterstock. Charts and pricing data via TradingView.