O’Leary emphasized that the share purchases and FTT token sales both affected FTX’s balance sheet.

Shark Tank investor Kevin O’Leary blamed popular crypto exchange Binance for the FTX crash while speaking at the Senate Committee hearing on the 14th of December. According to the Canadian entrepreneur. Binance caused FTX to collapse on purpose. In October, FTX was one of the reigning crypto exchanges, with millions of users globally. From being one of the biggest exchanges on earth, the crypto company collapsed in the twinkle of an eye. The sudden misfortune of the company sparked fears among investors and triggered lawmakers to consider stricter regulations on digital assets.

O’Leary Points Finger at Binance for FTX Misfortune

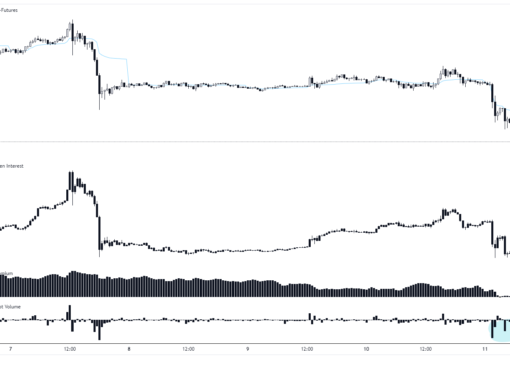

During the hearing titled: “Crypto Crash: “Why the FTX Bubble Burst and the Harm to Consumers,” the investor said Binance is a “massive unregulated global monopoly.” He mentioned that FTX and Binance were at war, and the latter put the former out of business intentionally. Notably, Binance and its CEO Changpeng Zhao, popularly called CZ, played a role in the FTX debacle. Last month, CZ announced plans to sell its holdings of FTX’s native token, FTT. The news triggered a liquidity crisis for FTX. Zhao also backed out of an agreement to acquire FTX. The two major events – unloading the FTT tokens and backing out of the acquisition deal- may have contributed heavily to the crash. Days after the token sales, FTX filed for bankruptcy in the US. However, there is almost no fact to prove what O’Leary and FTX CEO Sam Bankman-Fried said that the exchange could have emerged unharmed. The company was already facing allegations of involvement in different illegal activities before Binance’s input.

Speaking further during the hearing, O’Leary said SBF confirmed that FTX used almost $3 billion to repurchase its shares owned by Binance. He mentioned that CZ was not complying with regulators’ requests and compliance standards in different jurisdictions.

“Apparently, according to Sam Bankman-Fried, CZ would not comply with regulators’ requests in different jurisdictions to provide the data that would clear them [FTC] for a license […] The only option the management and Sam Bankman-Fried had was to buy him out at an extraordinary valuation close to $32 billion.”

Call for Stricter Crypto Regulation

O’Leary emphasized that the share purchases and FTT token sales both affected FTX’s balance sheet. He also argued for stronger regulation, referring to LedgerX. The investor added that the FTX-owned derivatives trading platform is the only entity that did not crumble after the FTX misfortune. According to him, LedgerX was able to stand the test of time because it was regulated by the Commodity Futures Trading Commission.

Bahamian authorities arrested FTX CEO on Monday, and he is facing criminal charges like money laundering and wire fraud. Before his arrest, he told Forbes that the Binance chief “played” him and acted in bad faith.

Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience.

Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.