Not everyone’s welcome to buy JAV porn star’s controversial memecoin

Japanese porn star and pop singer Yua Mikami has launched a new memecoin project on Solana, raising more than $2.9 million (over 19,000 SOL) in its presale at the time of writing, despite mounting concerns over its management.

The presale was announced on Mikami’s X account, which boasts 8.2 million followers. She did not promote the project on her other major social platforms, TikTok and Instagram, which are followed by 4.5 million and 3.7 million accounts, respectively.

Blockchain analyst EmberCN raised several red flags. The presale doesn’t have a fixed exchange rate or fundraising cap, meaning investors receive a share of the 20% token allocation based on how much is raised. EmberCN also observed that some participants sent SOL directly from centralized exchanges, despite explicit warnings not to do so. Since the project also lacks a refund mechanism, those users may lose their funds.

While the project’s disclaimer states that Japanese investors are not allowed to participate, no technical restrictions have been implemented to prevent them from doing so. Researcher AB Kuai.Dong claimed that the rights to Mikami’s memecoin project have been acquired by Chinese entities, and that the project is being marketed specifically to Chinese investors.

This comes amid growing skepticism around celebrity-endorsed memecoins, particularly on Solana, which has been plagued by scams in recent months. In March, a now-banned X account accused an unnamed Shenzhen celebrity memecoin factory in China of running coordinated pump-and-dump schemes. Some users have speculated (without confirmation) that Mikami’s token may be linked to the same network.

However, some crypto traders welcomed the project, with one calling it a sign that “otaku culture” has officially come to crypto. Despite the enthusiasm, this isn’t Mikami’s first blockchain rodeo. She and other Japanese adult film stars previously launched non-fungible token projects during the 2021 NFT boom.

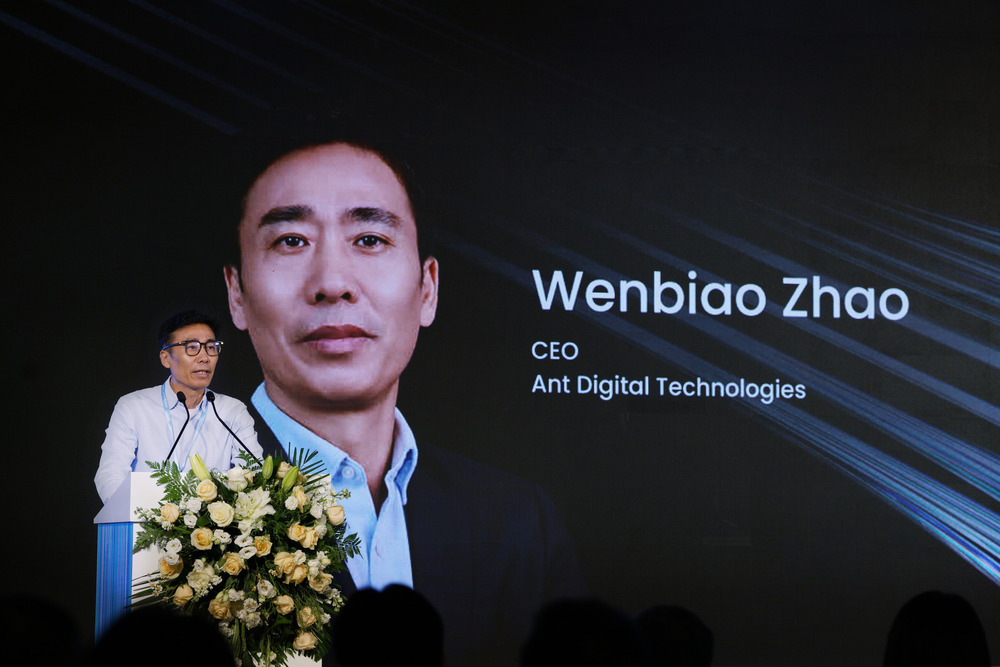

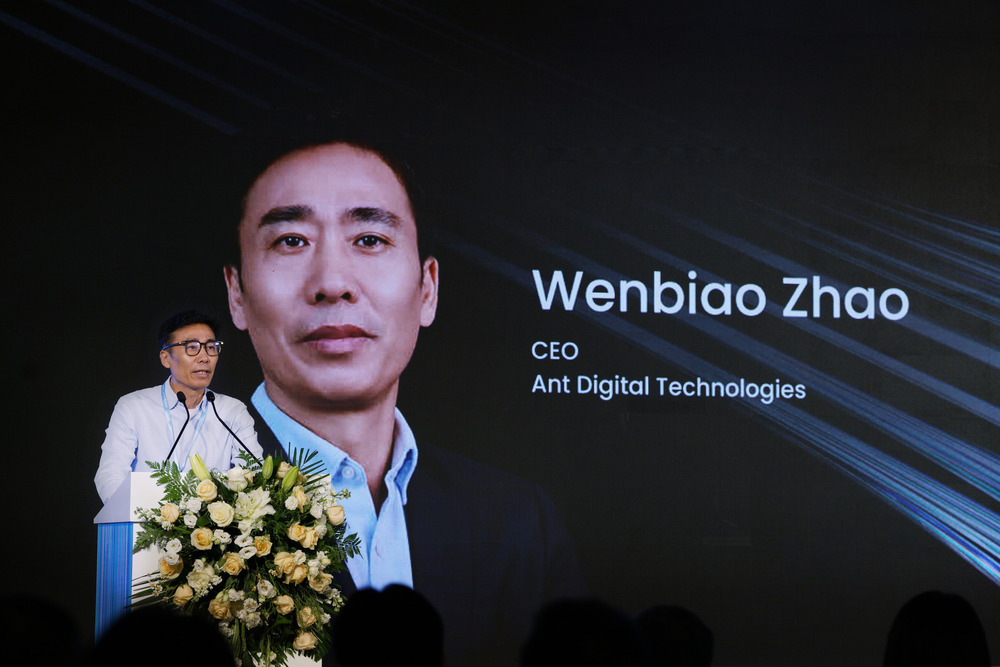

Ant Digital launches Jovay layer-2 to join Ethereum’s real-world assets party

Ant Digital Technologies, a subsidiary of Alibaba’s fintech arm Ant Group, unveiled a new Ethereum layer-2 network called Jovay on April 30 to compete in the growing race to tokenize real-world assets (RWAs).

Ant Digital said its new layer-2 network is capable of handling 100,000 transactions per second with a 100-millisecond response time. It forms part of Ant’s broader “Dual Chains and One Bridge” strategy, alongside its AntChain asset layer and cross-chain bridge infrastructure.

“Jovay is currently operating as a layer-2 solution on Ethereum, emphasizing performance and security as core pillars of our platform,” Cobe Zhang, head of Jovay, told Magazine.

“Looking towards the future, we are excited about broadening our horizons through integrations with different layer-1 networks to elevate our scalability even further.”

Zhang says the Jovay team is aiming to release the mainnet in the third quarter of 2025.

Ant Digital’s layer-2 announcement comes amidst a strategic expansion. It recently set up a global headquarters in Hong Kong and is using Dubai as its Middle East base. Both regions are fast becoming hubs for digital asset regulation.

Just a week before the unveiling of its layer-2 project, the company also introduced its new smart contract infrastructure, the AI-powered DeTerministic Virtual Machine (DTVM) Stack, which uses large language models to automate and accelerate development.

Currently, Ethereum leads adoption in the RWA space, accounting for the vast majority of tokenized US Treasuries and institutional asset flows.

Read also

Expect more selling pressure from South Korea in June

South Korea’s Financial Services Commission (FSC) has reportedly finalized a new set of guidelines that will allow nonprofit corporations and registered cryptocurrency exchanges to legally sell digital assets starting in June.

The move is part of a broader effort to gradually open the country’s digital asset market to institutional investors, formerly constrained by local regulations.

Under the new guidelines, nonprofit corporations with over five years of operating history and subject to external audits will be permitted to accept and sell cryptocurrency donations. These organizations must establish internal donation review committees to assess the legitimacy of incoming funds and evaluate liquidation plans in advance. Only crypto assets listed on at least three of the five licensed fiat-to-crypto exchanges will be eligible for donation.

Crypto exchanges will also be allowed to sell digital assets, but under strict conditions aimed at preventing market disruption and conflicts of interest. Only exchanges registered as Virtual Asset Service Providers (VASPs) under local regulations will be eligible. Sales can only be made to cover operational expenses and must be limited to the top 20 cryptocurrencies by market capitalization. Additional restrictions include a daily sales cap and a prohibition on selling tokens directly through the exchange’s own platform.

The FSC also introduced new listing standards to address the extreme price volatility often seen when tokens debut on domestic exchanges. So-called “listing pumps” have drawn regulatory scrutiny due to rapid price surges caused by limited initial circulating supply. As a response, token issuers will now be required to secure a minimum circulating supply before trading begins, and market orders may be restricted during early trading phases.

Read also

Sky Mavis’ messy divorce with Ragnarok Monster World

A public rift has emerged between Singapore-based Vietnamese startup Sky Mavis, the developer behind the Ronin blockchain, and Ragnarok Monster World, after the company accused the Web3 game’s creators of secretly cutting a deal with a rival blockchain.

In an April 27 X post, Sky Mavis co-founder Aleksander Larsen said the team behind RMW, known as 0x&, ignored advice and “lost favor with the community.” As a result, the company announced it would end its professional ties, remove the game’s assets from Sky Mavis products within 48 hours and delist RMW NFTs from the Ronin Market. The company also distanced itself from the game’s upcoming $ZENY token launch, stating that its presence on Ronin should not be interpreted as endorsement or affiliation.

In a follow-up post, Larsen said that instead of removing NFTs entirely, Sky Mavis would revoke the game’s verification badge on the Ronin Market, marking its unaffiliated status going forward.

The move prompted an immediate rebuttal from Ragnarok Monster World. It denied engaging in secret agreements and said that all discussions with other blockchain networks had been shared with Sky Mavis. The developers further stated they had honored all contractual obligations and committed to continue operating the game on Ronin.

The public spat highlights a core irony in Web3 games. One of the space’s founding promises is that blockchain games are meant to be immune to bans and shutdowns. Ronin is moving toward that vision with a permissionless architecture that lets anyone deploy smart contracts or launch games without Sky Mavis’ approval. However, the ecosystem still revolves around Sky Mavis’ platform power. Projects may be technically permissionless, but without marketplace verification or ecosystem support, they risk losing exposure to the Ronin community. RMW still exists on-chain, but is stripped of the network’s stamp of approval.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Yohan Yun

Yohan Yun is a multimedia journalist covering blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has covered Asian tech stories as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.