The Bitcoin MVRV ratio, an on-chain indicator, could suggest the asset may not have hit its top for the current rally just yet.

Bitcoin MVRV Ratio Says Market Isn’t Overheated Right Now

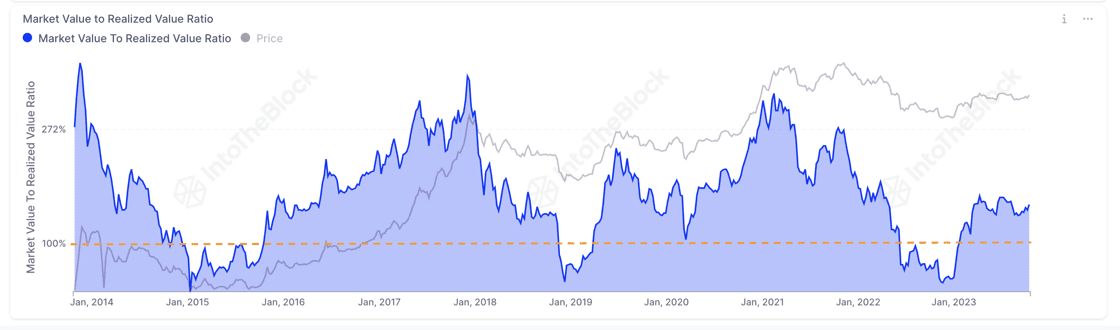

According to data from the market intelligence platform IntoTheBlock, past bull markets hit their peaks when the MVRV ratio crossed the 300% mark. The “Market Value to Realized Value (MVRV) ratio” refers to an indicator that keeps track of the ratio between the Bitcoin market cap and realized cap.

The “realized cap” here is a capitalization model for BTC that calculates the total value of the cryptocurrency by assuming that each coin in circulation is worth the same as the price at which it was last moved, rather than the current spot price.

As the price at which a coin was last moved on the blockchain was likely the price at which it changed hands, the realized cap can be interpreted as the total amount of capital that the investors as a whole have put into the asset.

The MVRV ratio compares the price of the coin (the market cap) with the realized cap, so it can tell us whether the investors are holding more or less than they put in.

Now, here is a chart that shows the trend in the Bitcoin MVRV ratio over the last few years:

Looks like the value of the metric has been going up in recent days | Source: IntoTheBlock on X

In the above graph, the Bitcoin MVRV ratio is shown as a percentage. At the 100% mark, the two capitalization models approach a equal value, suggesting that the market as a whole is just breaking-even.

Above this threshold, the investors are holding a net amount of profit, while below they are carrying loss. From the chart, it’s visible that the BTC MVRV ratio has remained above the break-even in recent months as the asset’s price has observed a rally.

At present, the metric is floating about the 150% level, suggesting that the market cap is 50% more than the realized cap. Historically, the larger the investors’ profits have gotten, the more likely they have become to take part in a selloff.

Because of this reason, tops have generally formed when the MVRV ratio has hit high levels. IntoTheBlock notes, however, that the bull markets in the past have usually only hit their peaks when the indicator has crossed the 300% mark.

Clearly, the indicator is still a significant distance away from this mark at the moment. This could be a potential sign that the Bitcoin rally hasn’t reached a state of overheat yet and thus, there might be more to come for the cryptocurrency’s price in terms of bullish momentum.

BTC Price

The Bitcoin rally has hit the pause button in the past week as the asset’s price has taken to sideways movement. Currently, the coin is trading around the $34,500 mark.

The value of BTC appears to have gone stale in the last few days | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com