Retail traders commonly engage in options trading. In this practice, distinguishing between intrinsic and extrinsic value is a crucial aspect to comprehend. Understanding these two components can help traders better evaluate options contracts and develop effective trading strategies.

This article will provide an overview of intrinsic vs. extrinsic value, explain how to calculate them, discuss strategies using intrinsic and extrinsic value, and provide tips for profiting from options trades using these concepts.

What is intrinsic and extrinsic value?

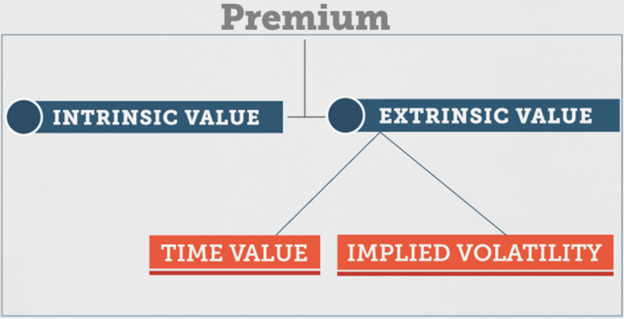

Every options contract has two components of value – intrinsic value and extrinsic value.

Intrinsic value is the amount an option is in-the-money. For call options, it is the amount by which the strike price is below the current market price of the underlying asset. For put options, it is the amount by which the strike price is above the current market price. Intrinsic value represents the minimum value of an option. The amount could be realized by exercising the option and trading the underlying asset at the current market price. An option only has intrinsic value if it is in-the-money – if the strike price is favorable compared to the market price. At-the-money and out-of-the-money options have no intrinsic value.

Extrinsic value is the additional value of an option above the intrinsic value. It represents the premium paid for the option based on how likely it is to become profitable by expiration. Extrinsic value comes from the uncertainty of where the underlying market price will move in the future. Factors impacting extrinsic value include time to expiration, volatility, and interest rates. Unlike intrinsic value, both in-the-money and out-of-the-money options can have extrinsic value. Extrinsic value decays over time as expiration approaches until only intrinsic value remains.

How to calculate intrinsic and extrinsic value

How to calculate intrinsic value:

- For call options, intrinsic value = current share price – strike price

- For put options, intrinsic value = strike price – current share price

The intrinsic value is zero if the calculation results in a negative number.

How to calculate extrinsic value:

Extrinsic value = option premium – intrinsic value

The option premium is the current market price of the options contract. Extrinsic value is whatever premium exists above the intrinsic value.

Strategies using intrinsic and extrinsic value

Understanding intrinsic and extrinsic value unlocks several strategic approaches to trading options.

Here are some examples:

- Buy undervalued options: when an option’s premium is less than its intrinsic value due to mispricing, it represents an opportunity to buy an undervalued contract. This is rarely seen in liquid options.

- Sell overvalued options: when an option’s premium is mainly extrinsic value with little or no intrinsic value, it may be overvalued. Consider selling the option and collecting the high premium.

- Protect profits with intrinsic value: as an option becomes deep in-the-money, maintain the position to benefit from ongoing intrinsic value. The intrinsic value acts as a buffer against losses.

- Time extrinsic value decay: when selling options, target those with high extrinsic value close to expiration to maximize decay. The passage of time will erode the premium collected.

- Exercise early to capture intrinsic value: if deep in-the-money, exercise the option before expiration to immediately gain the intrinsic value instead of waiting.

- Roll out and up to collect more extrinsic value: as expiration approaches, roll the option out to a later date and up to a higher strike to collect more extrinsic value–delay expiration.

How to profit using intrinsic and extrinsic value

There are several ways traders can profit from options trading using their understanding of intrinsic and extrinsic value:

- Sell overvalued options: look for options with high extrinsic value relative to intrinsic value. The inflated premium provides a profit opportunity.

- Buy undervalued options: search for mispriced options with significant intrinsic value but little premium. The low price is attractive for purchase.

- Sell covered calls: when holding the underlying, sell calls with minimal intrinsic value to mainly collect extrinsic value as a premium.

- Sell cash-secured puts: sell puts out-of-the-money or at-the-money to maximize the extrinsic value premium collected.

- Calendar spreads: sell short-term options with little intrinsic value and buy longer-term options with higher extrinsic value—profit as short-term decays.

- Roll options outward: close position nearing expiration and open new option further out in time with more extrinsic value–continue collecting premiums.

Tips and tricks for trading intrinsic and extrinsic value

Here are some useful tips for trading intrinsic and extrinsic value:

- Pay close attention to time value decay accelerating in the last 30-60 days till expiration

- Be aware of upcoming events like earnings that could drastically alter intrinsic value

- Use volatility to your advantage – target options with high volatility for selling

- For long options, choose those deep in-the-money to have high intrinsic value

- Adjust strike prices to balance intrinsic/extrinsic value based on outlook

- Use spreads to lower cost basis if buying options with mainly intrinsic value

- Close positions early to lock in profits from remaining intrinsic and extrinsic value

Conclusion

Recognizing the disparities between intrinsic and extrinsic value can open doors to strategic trading chances in options. Traders can gain from purchasing undervalued options, vending overvalued ones, and adeptly handling positions based on these value dynamics. These ideas are precious for forming options spreads, picking expirations, and timing trades. With a suitable approach, intrinsic and extrinsic values can yield steady profits and safeguard against risks in options trading.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.