India, Nigeria and Thailand are ranked as the three top countries in Chainalysis’ 2023 Global Crypto Adoption Index, with lower middle income nations leading the way in grassroots adoption of cryptocurrencies.

The blockchain analytics firm released an excerpt to its annual Index report which shows that central and south Asia and the wider Oceania regions dominate the top of its index, with six of the top ten countries located in this area of the world.

The index highlights that worldwide grassroots cryptocurrency is down as a whole in the wake of the FTX implosion of 2022. However, lower middle income countries identified under the World Bank’s classification of nations by wealth have shown the strongest recovery in grassroots crypto adoption over the past 12 months.

“In fact, LMI is the only category of countries whose total grassroots adoption remains above where it was in Q3 2020, just prior to the most recent bull market.”

Chainalysis goes on to highlight a number of promising aspects that could be derived from this data, highlighting that nations in the the LMI category typically have growing industries and populations and account for more than 40% of the world’s population.

“If LMI countries are the future, then the data indicates that crypto is going to be a big part of that future.”

The excerpt also suggests that institutional adoption driven by organizations in high-income countries is gaining pace despite a prolonged bear market. The report also predicts a potential “bottom up and top down” adoption of cryptocurrencies where these assets serve the needs of users from both high wealth and developing nations.

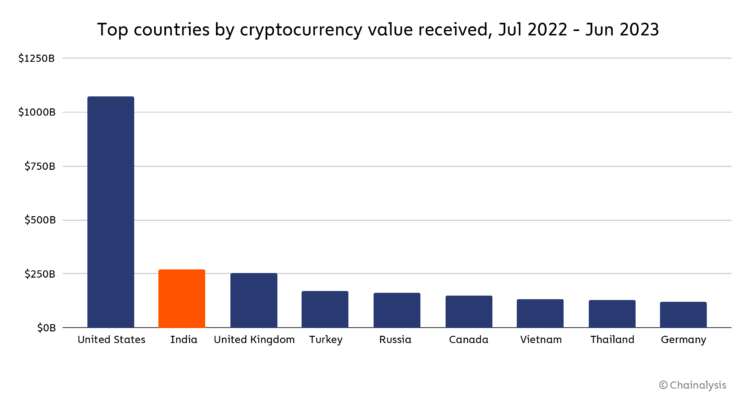

India remains the largest cryptocurrency market of the region and leads grassroots adoption according to Chainalysis’ index. It has also become the second-largest crypto market by raw estimated transaction volume globally ahead of other major economies.

Chainalysis also notes India’s unique tax deducted at source (TDS) scheme applied to cryptocurrency transactions that requires a 1% tax to be levied for all transactions that must be deducted from the user’s balance at the time of the trade in order for the trade to be completed.

Magazine: How to protect your crypto in a volatile market: Bitcoin OGs and experts weigh in