Seismic shifts in the way banks do business are starting to be announced by global banking giants and it seems RippleNet/ODL is right at the epicenter.

Ripple Partner Banks such as Santander, HSBC and SBI Group are starting to come out of the woodwork regarding RippleNet usage and expansion.

This is the year the wheat will be separated from the chaff. Not many months ago, the media was saying no one will use XRP, which made for good skeptical headlines. Today, you can’t say that, as people are starting to use xRapid because it’s better, faster and cheaper… I expect dozens of banks to be using XRP by the end of 2019 – Ripple CEO predicted dozens of banks woud be using XRP by the end of this year, that figure is today 24, or two dozen…

Our biggest takeaway from Swell this year was the sheer number of banking elites discussing DLT and ODL as if it is now generally accepted as the future of banking.

For decades banks and financial institutions have lived with slower growth, slow payments, unable to use the trillions sat in pre-funded Nostro Vostro accounts.

Ripple has found a revolutionary new way and its working partners have now realized the potential of XRP, ODL, DLT and the vast amount of savings it represents.

This year has been our strongest for Ripple yet. In 2019 we’ve seen continued momentum with customers, growth of RippleNet and adoption of On-Demand Liquidity. In just a year since we launched ODL, we are already making an impact on the bottom line for our customers. We’re excited to continue this momentum into next year and for the expansion of ODL into new markets

First off Santander SA Chairman Ana Botin announced on Bloomberg yesterday that they are about to launch RippleNet powered OnePay FX in the United States.

Botin revealed Santander intends to expand its remittance payments over their MXN/US corridor over which millions send up to $36 Billion every year.

This implementation demonstrates Santander’s commitment to Ripple’s financial technology, which Santander estimated could save the banking industry $20 billion per year in costs related to cross-border payments, improve regulatory compliance and create powerful new value propositions for customers. Using Ripple, financial institutions like Santander can lower operational costs, reduce risk associated with payment errors and provide better customer service by increasing payment visibility for both banks and customers

Santander has been testing RippleNet on xCurrent since they partnered in 2016, the bank has now realized the time and money saved by switching to ODL.

Ana Botin also said her bank expects to see up to 12% tangible return over the next couple of years which far exceeds their cost of equity.

We have not been able to launch a new product for fives years, that tells you how much potential there is. We are launching OnePay FX in the US which is a blockchain retail cross border payment service with Ripple. We created the North America corridor, Mexico/US so we are now running a lot of these businesses together so you will see some very good results in the coming years

Also in the spotlight, Ripple Partner HSBC says XRP is a ‘game-changer’ and appears to be preparing for huge changes in the way it does business.

HSBC is one of the largest financial institutions in the world and largest in Europe with over $2.5 trillion in assets and revenues of around 140 billion.

DLT can streamline end-to-end value transfers, reducing costs, operational risks and settlement periods. For example, Ripple’s XRP ledger provides real-time cross-border settlements, using tokens that represent central bank currencies. As well as transforming operational efficiency, such a ledger would release huge amounts of capital by reducing settlement periods and giving users a single view of the location and eligibility of collateral assets

In a 2018 HSBC report explaining DLT, XRP and Ripple tech, they outline that it will be the future of payments with mass-market adoption during 2020/21.

The bank also launched RTP for instant money transfers in the U.S. no official links to XRP but the report was announced on Warren Buffets BusinessWire Website!

Payments – DLT can streamline end-to-end value transfers, reducing costs, operational risks and settlement periods. For example, Ripple’s XRP ledger provides real-time cross-border settlements, using tokens that represent central bank currencies. In foreign exchange, HSBC’s FX Everywhere tool processed more than 3m inter-company FX transactions worth $250bn in its first year… Following successful implementation inside the bank, we are now exploring how this technology could help multinational clients – who also have multiple treasury centres and cross-border supply chains – better manage foreign exchange flows within their organisations

Finally, check out below, could be something, it may be nothing but worth a mention, HSBC international money transfer service down for maintenance on Monday.

Thanks to Lord Lionel for bringing us this little speculatory snippet…

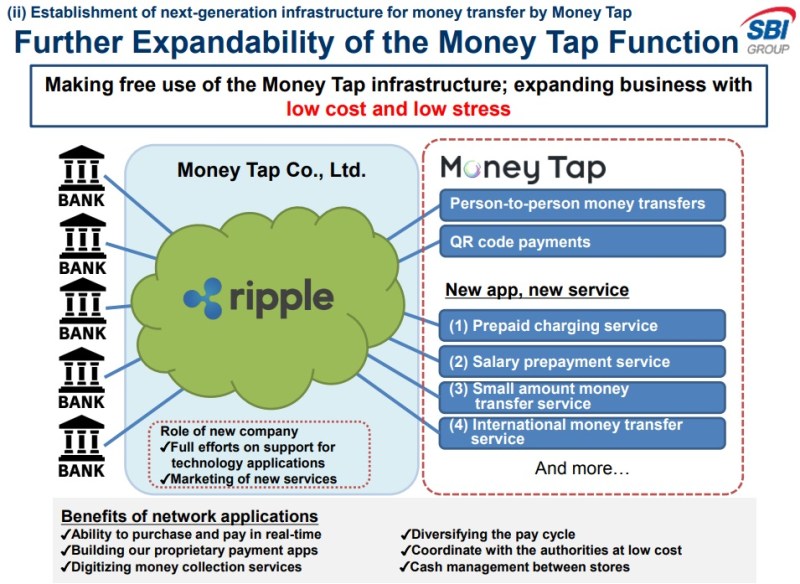

Last but not least we return to major Ripple partner SBI Group who have announced new initiatives to dramatically increase XRP mass adoption.

As we reported a few months ago, Ripple powered MoneyTap opens up access to 80 million Japanese App users who will be able to use XRP for all payments.

Added to this SBI also intent to push adoption by giving away XRP to 30,000 app users, plus SBI intends to use XRP for remittance between Japan and Asia in 2020.

In a report, which contains SBI’s performance and strategy, the group says it is going to be making use of XRP for remittance between Japan and South-East Asia, pointing that SBI Remit, a subsidiary of the SBI Holdings will increasingly make use of Ripple’s On-Demand Liquidity service

NewsLogical

Many in the community worry about XRP price, if you do your own research and have good enough grey matter to connect the dots and see what Ripple is building.

Anything that will one day become revolutionary starts life being financially manipulated, it happened to Apple over 20 years ago, it’s happening to XRP today.

Check out below from 1997 where Steve Jobs describes blatant price manipulations, watch from 08.38, at time of video Apple share price was $3.96, today $262…

We must keep our eye on the prize & that is turning out some great products, communicating with our customers as best we can, keeping the community of people that are going to make this stuff successful, like yourselves in the loop so you know everything. And just marching forward one foot in front of the other and the stock price will take care of itself. I’ve seen the ups & downs when you’ve seen enough of them and you know whats going to happen. So when you get up in the morning and the share price is down because of some story, go out & buy more shares, that’s what I do…

Steve Jobs – Apple CEO 1997