How’s the first registered offering of security tokens in the U.S. going? See for yourself.

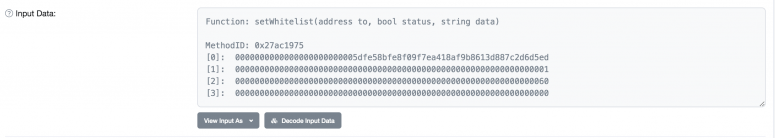

In the two weeks since INX Ltd. commenced its long-awaited initial public offering (IPO), more than 350 investors’ Ethereum addresses have been added to the “white list” of approved buyers. You don’t need to take the company’s word for it, it’s all on the blockchain, viewable through block explorer sites like Etherscan.

The public data doesn’t show who these registered investors are or how many of the tokens, priced at $0.90 each, any of them has agreed to buy. (INX is seeking to raise $117 million through the sale, which is expected to take several weeks to complete.)

But doing an IPO on-chain gives the public, and INX itself, a novel vista on the process, which traditionally has been a back-room affair.

Traditionally, to get information on who beneficially owns an interest in securities held at central securities depositories like The Depository Trust Company, investors or issuers would have to go to the investment banks or broker-dealers who coordinated the sale, said Lewis Cohen, a principal at DLx Law.

INX claims the additional transparency will change how issuers relate to investors.

“Never before has an issuer had such a transparent view of who its ultimate beneficial owners are,” said Jonathan Azeroual, co-founder and vice president of INX, in one of the first interviews given by company executives since it came out of its pre-IPO quiet period. “The value relies on the ability to connect with your token holders in a way never experienced before.”

The shared ledger could also open a window onto trading patterns after the INX tokens have been distributed.

“A potential benefit of using a blockchain is that data service companies could conceivably build models to try and analyze movements in the security tokens on-chain and start to create data that is interesting to investors, correlating the timing and amounts of transfers to sales and other events,” said Cohen, who is not involved in the INX transaction.

However, the ability to accurately track share transfers will be diminished if investors are allowed to have two or more whitelisted addresses, added Cohen, who made his bones as a securities lawyer and now specializes in blockchain work. Azeroual said INX hasn’t opened the ability to whitelist multiple addresses, but expects to after the offering ends.

Rarefied as it may sound, the whitelist is not some exclusive country club. On the contrary, unlike previous unregistered security token sales, which were open only to well-heeled investors in the U.S., INX is soliciting the general public.

Whitelisting simply means Tokensoft, INX’s transfer agent, has verified investors’ identities and made sure they are not on a government sanction list. If an address isn’t on the list, the smart contract will not allow it to receive tokens.

“In this token contract, we want to do what we call preventative compliance,” said James Poole, chief technology officer at Tokensoft. “We want to set it up so the rules are enforced on the blockchain and there doesn’t need to be anybody sitting between these transactions in a peer-to-peer fashion.”

Paper trail

INX stressed the time it has been working with regulators on the sale – two and a half years – which is also reflected on the blockchain. The 200 million INX tokens were minted 218 days ago, according to the INX token tracker on Etherscan.

Looking at the main token contract on Etherscan, anyone can see the full supply of INX tokens that Poole said were minted before the sale but have yet to be distributed as outlined in the prospectus, At some point in the future, the INX tokens will be distributed to the buyers.

So far, transactions on the blockchain are only additions of whitelisted investors. Soon they’ll be interspersed with transactions, transfers and distributions, Poole said.

Counting the whitelisted investor transactions on Etherscan gives observers a rough estimate of how many investors have registered for the sale. Given the lengthy process investors have to go through to register, there could be more investors in the pipeline, said Poole.

“The number of people who are interested in this is higher than the number of people [visible] on the blockchain,” he said.

On-chain smart contracts give regulators assurance that know-your-customer (KYC) and anti-money laundering (AML) rules are being followed with an easily accessible audit log to prove it, said Douglas Borthwick, chief marketing officer and head of business development at INX.

“One thing that folks have always been anxious about when it comes to crypto has been anonymity,” said Borthwick. “Obviously that’s a problem in the securities market as well. Now, we’re adding KYC/AML on a smart contract and whitelisting on the smart contract so that it allows you to trade things without having to worry about moving it into the wrong hands.”

A blockchain doesn’t remove every compliance hurdle, however. INX’s prospectus notes that the Securities and Exchange Commission (SEC) views the Ethereum blockchain as only a courtesy record and that either Tokensoft’s or INX’s records will be the primary ones.

The cryptosphere has no comprehension of this. There are certainly lots of shortcuts and ways that we could make things more efficient, but that doesn’t cross the t’s and dot the i’s.

“What counts when it comes to determining share ownership, what counts is what [INX calls] the ‘INX Registry,’” Cohen said. “The INX Registry does not appear to utilize the Ethereum blockchain … To [its] credit, INX is paving the way for when on-chain transfers become the definitive record of ownership.”

Azeroual said that while the transfer agent is the final system of record for U.S. regulators, “the Ethereum blockchain is what is used by the transfer agent to get those records as a reliable source of truth.”

At the same time, unlike stocks, which traditionally list on a single exchange, INX tokens will be tradeable on any digital platform that can handle blockchain securities 24/7, Borthwick said.

“Stocks do have multiple listings sometimes – say NYSE and LSE – but it is a time-consuming process, and expensive,” Borthwick said. “Whereas a security token like INX can trade and will trade on multiple exchanges at once, and all that is required is some lines of code.”

With a direct relationship between issuers and holders, the need for third parties to handle dividend payments and ownership discovery could disappear, Borthwick added.

Dotting the i’s

Since INX is not going public on a national exchange, its IPO will last for weeks and possibly months because the company has to comply with Blue Sky Laws, which are state-level, anti-fraud regulations for security issuers.

“The Blue Sky Laws means we have to apply to each state,” Borthwick said. “We have to show them our F-1,” the prospectus for issuers outside the U.S. (INX is based in Gibraltar.) “The state then looks at the F-1 and asks us to add in different sections to protect the citizens of their specific states.” (Eventually, there will be secondary trading of the INX token on crypto exchanges, he said, declining to name any.)

So while INX has been given approval by the SEC, the exchange has to apply for a permit from each state to sell the securities. Some states may restrict the sale to accredited investors or institutions, and some will allow INX to sell to anyone, he added.

To get the SEC on board, INX and Tokensoft had to get the regulator comfortable with the latter company being the transfer agent, said Mason Borda, CEO of Tokensoft. If someone loses their wallet, Tokensoft can freeze the token, investigate it, revoke the token and assign it to a newly generated wallet.

Since there are transfer restrictions on securities, the token had to use the ERC-1404 standard, which allows an issuer to impose said restrictions, Borda added. (ERC-1404 is a layer on top of ERC-20, the standard that spawned the initial coin offerings of the 2017 bull market.) The INX token also allows for adding administrator accounts in case INX wants to use a different transfer agent.

INX plans to use the sale proceeds to build an exchange for trading cryptocurrencies, security tokens and derivatives; the tokens will be redeemable for trading fees and entitle holders to a cut of the future exchange’s profits.

While some of the rowdier voices on crypto Twitter have criticized INX for not using the Bitcoin blockchain (even though INX’s early investors and advisers include stalwart Bitcoiners like Samson Mow and Jameson Lopp, respectively) Borthwick said Ethereum was the only blockchain regulators were comfortable with in 2017 when INX embarked on its journey.

“The cryptosphere has no comprehension of this,” he said. “There are certainly lots of shortcuts and ways that we could make things more efficient, but that doesn’t cross the t’s and dot the i’s.”

Cohen, the lawyer, compared the innovations of tokenization and subsequently INX’s blockchain IPO to the centuries-old invention of the joint-stock company, which made it possible to own an indirect interest in a business that continued after its founder died.

“If one of the things that INX does is provide investors with an enhanced relationship with itself through the use of the token, I think that would be a real game-changer,” Cohen said.