Institutional traders have long known the benefits of derivatives trading, including leverage and hedging. By trading options markets, one can predetermine maximum gains and losses, even with volatile assets like Bitcoin (BTC).

Despite being far more complex, such instruments allow traders to generate gains independent of what happens over the next weeks or even months, which is essential for traders’ peace of mind to achieve optimal performance.

Retail traders have only recently begun using derivatives, although they have focused almost exclusively on futures contracts offered by BitMEX, OKEx, Binance and so many others. The main problem here is liquidation risk, as cryptocurrencies are incredibly volatile.

Buying a call option? Here are the costs and benefits

The buyer of a call option can acquire Bitcoin for a fixed price on a predetermined date. For that privilege, the buyer pays an upfront premium for the call option seller. Contracts have a set maturity date and strike price so that everyone knows potential gains and losses beforehand.

If Bitcoin appreciates over the following hours or days, the price paid for this call option should increase. The buyer could either sell this option contract and close his position with a profit or wait until contract expiry.

At the specified contract date and time of maturity, the call option buyer will be able to acquire Bitcoin for the previously agreed price. Remember, the buyer paid a premium in advance for this right. If Bitcoin’s price is currently below the contract price, the buyer can walk away. That’s why it’s called an “option” in the first place.

Each exchange sets its minimum trade size, although a 0.1 Bitcoin contract tends to be the lowest figure.

Benefits of Bitcoin options compared to futures contracts

The main benefit to the buyer of an option is that they know in advance the maximum loss and also do not have to worry about having their position closed in advance.

Let’s imagine a scenario in which an investor has $500 and expects the price of Bitcoin to increase substantially over the next month. By using futures contracts, it is possible to leverage their position, boosting gains by 20 times or even 50 times.

It should also be said that there is one risk with this strategy. What happens if over the following days the market suddenly drops 2% or 5%, an occurrence quite frequent with Bitcoin. If this happens the position will get liquidated or forcibly terminated. Meaning, even if markets recover shortly thereafter, there is no second chance for the option holder.

BTC call option buyer returns

Theoretical return for a call option buyer

The example above shows that the call option buyer paid a $450 premium upfront for the option to acquire a Bitcoin at a fixed price of $7,500 on April 24. The buyer has a limited downside of $450, while their upside is unlimited.

The premium paid upfront for a call option depends on:

Current Bitcoin price: If Bitcoin is trading at $5,000 and the expiry takes place in 10 days, a call option with a $9,000 strike price will most likely cost less than $40. On the other hand, a $4,000 strike should set the buyer back $1,100 or more.

Days until maturity: The higher the number of days until maturity, the higher the price of a call option will be. Assuming both have the same strike price, the one with the farthest expiry will tend to cost much more.

Recent volatility: If the price hasn’t oscillated very much over the past 30 or 60 days, odds for a substantial price increase are low. Low volatility causes call option prices to be lower when compared to a high volatility scenario.

Interest rate: A high-interest rate would result in excessive premiums of options. Fortunately, that hasn’t been the case, as the cost of borrowing money is currently close to zero.

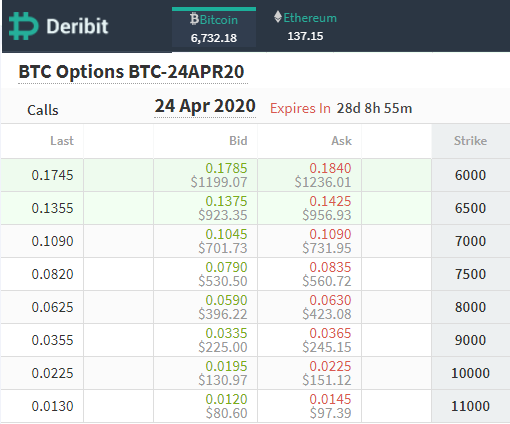

Call option prices screenshot on March 26. Source: Deribit

Because Bitcoin traded at $6,730 on March 26, one should expect a $6,000 strike for a call option to cost $800 or higher. On the other hand, an $11,000 strike price in just 28 days seems quite unlikely to happen, hence its $90 price.

It might seem unreasonable to sell a call option with unlimited downside in exchange for a fixed upfront. Except, that is not the case if the investor already owns Bitcoin. Under this new perspective, the call option seller is potentially getting paid more than making a regular sale.

Buying a protective put option

A put option grants its buyer the opportunity to sell Bitcoin at a previously agreed-upon price on a future date. Once again, the buyer pays an upfront premium for this privilege. Instead of using a stop-loss order on a regular exchange, a holder can reduce their losses from a price drop using options contracts.

With Bitcoin currently trading near $6,730 levels, a $6,000 put option contract expiring in 27 days costs $440. If Bitcoin drops to $5,000, this investor would then be able to make a sale for the predetermined price of $6,000, resulting in a net loss of only $170.

Investors tend to consider this strategy as insurance. If the price of Bitcoin does not drop below the $6,000 strike price, the investor paid a 6.5% premium for nothing. Their upside, on the other hand, has been reduced by $440, although it remains unlimited.

Options provide a nearly endless limit of investment strategies

The fact that a call option buyer has an unlimited upside — and unlike futures contracts, can’t be forcibly liquidated during the trade — should be an excellent incentive that encourages retail traders to use it more often.

In addition to the basic methods described above, there’s much more to options trading, including strategies that combine different strikes and maturities. Institutional traders have long been taking advantage of those instruments and this allows them to take time off-screen and prepare for different investment scenarios by hedging their positions.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.