In 2020, as a result of the economic crisis caused by the spread of COVID-19, the world financial system is facing an increasing number of problems. The authorities of large countries have applied monetary policies of quantitative easing, which has led to a decrease in the value of fiat currencies and a loss of public confidence in them. At the same time, the profitability of bank deposits has dropped to their lowest levels.

Meanwhile, alternatives to traditional banks are now gaining popularity. Among them are decentralized finance products: cryptocurrency exchanges, wallets, and lending, trading and deposit services. Their indisputable advantages are high-interest deposit rates, which can bring holders massive profits in just a few months, and instant loans that can be borrowed with no documents or Know Your Customer verification.

Although the demand for DeFi products is growing tremendously, inexperienced users may find it difficult to grasp emerging decentralized solutions on the fly. An analysis of the leading DeFi services on the market reveals the difficulties novice users may face and decentralized finance’s true accessibility.

MakerDAO: Trade, borrow and save

MakerDAO is the oldest decentralized service on the market. It allows users to borrow, trade and earn savings using its native Dai stablecoin, which is pegged to the U.S. dollar at a one-to-one ratio. MakerDAO is reminiscent of a bank, as it issues loans secured by cryptocurrencies, but does not require documents, checks or good credit history. Users can pledge their savings in Ether (ETH), or in any of the 10 cryptocurrencies accepted by the platform, and receive a certain amount of Dai in return.

Once the loan has been taken out, the tokens can be spent on anything, although they are mostly used for investment. In order to return the loan, one needs to return the same amount of Dai that was earlier received, plus a little interest on top. If during this period, ETH price has increased, the user makes a profit, as the amount of the collateral in ETH increases in terms of its price in U.S. dollars.

How easy is it to take out collateralized loans with MakerDAO? To borrow assets, a user just needs to have an active crypto wallet from MetaMask, Ledger, Coinbase, Trezor, WalletConnect or D’cent and a balance of at least $40. But the total amount of the loan is always limited by the collateralization ratio of 150%. That means it’s not possible to borrow more than 66% of the collateral. Simply put, the borrower gets 66 cents when depositing $1.

Overall, the platform is convenient to use, although searching for the right instrument can be a bit challenging, as the user interface is cluttered and constantly redirects to mirror pages. For instance, platform services are located on the Oasis decentralized application, while the interest rates on deposits are displayed only after a wallet is connected and a registration transaction is concluded.

Usability is made more difficult by only having two coins available for deposits: Dai and ETH. Apart from that, MakerDAO is clear-cut for any user who has interacted with crypto exchanges before.

Aave: Unsecured flash loans

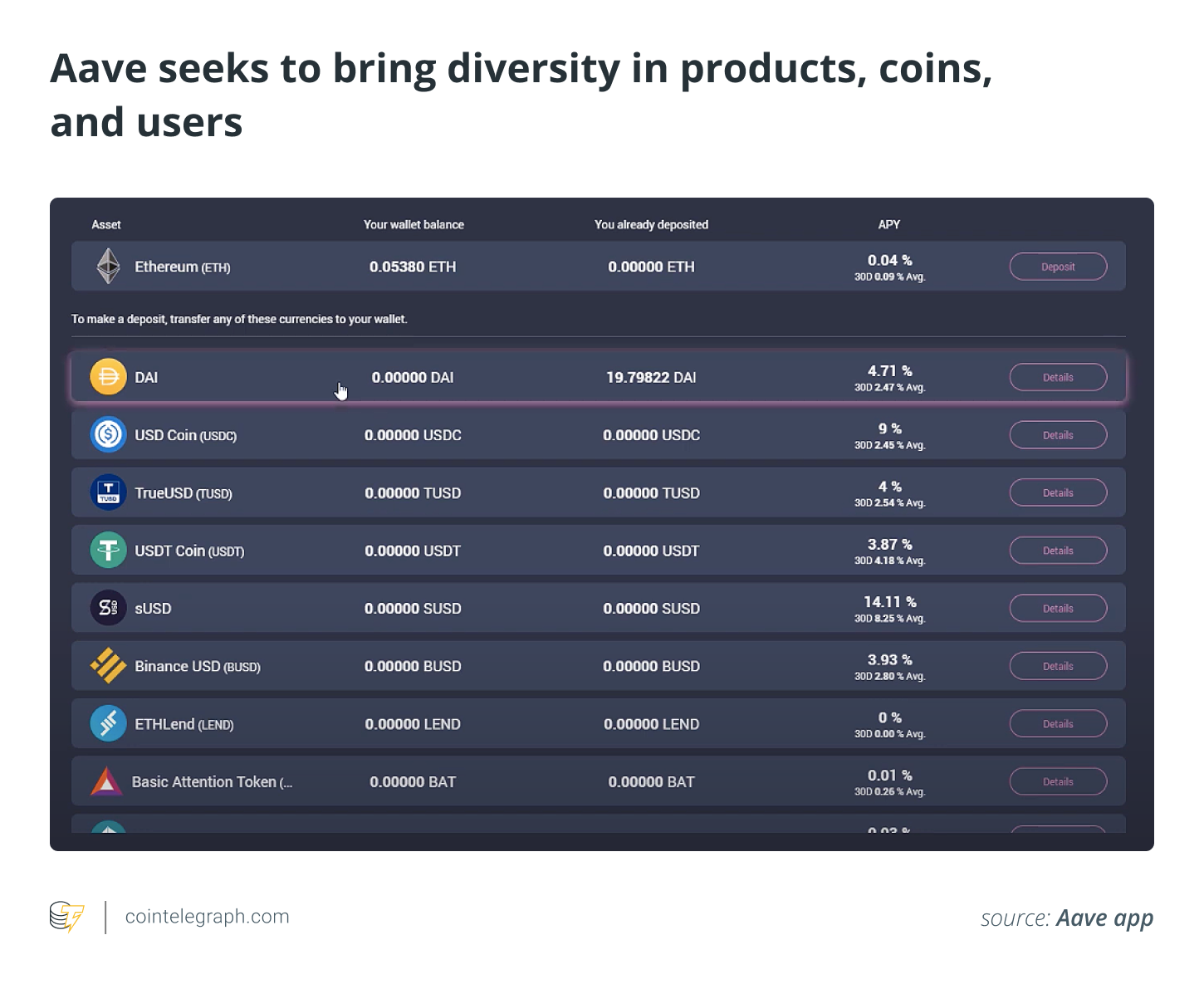

Aave allows users to take out loans for cryptocurrency collateral and offer up crypto for interest. The interface is more user-friendly, the website is unified and streamlined, and it supports over 10 wallets.

Aave has a choice of 19 coins and offers flash loans without any collateral, but it’s necessary to return the loan and pay interest in the same block. Such operations are accessible only to experienced arbitrage trading professionals who know how to make money on the difference in cryptocurrency exchange rates in the short term.

Collateralized loans don’t seem to be as attractive as flash ones, given the comparatively low collateralization ratio of 50%–75%, which is two to four times lower than the ratios offered by other DeFi lending apps.

However, Aave borrowers are free to choose between a stable or variable interest rate. Stable rates do not change in the short term, but they can be adjusted in the long term, depending on market dynamics. The variable rate is based on supply and demand within the Aave platform. The first option is optimal for planning interest payments, while the second is best suited for flexible yield management, as changes in the variable rate can significantly affect the condition of the loan over time. Switching between rates is an effective approach to financial planning.

There is no fixed repayment period for the loan, but delays in payments will lead to an increase in interest and the eventual liquidation of the position and sale of the collateral. Therefore, it’s important to monitor the liquidation threshold. The deposited funds can also be withdrawn on demand or transferred to loan collateral.

Aave offers the conditions to make money on deposits. Support for 20 coins and high interest rates make the platform attractive for a wide range of users. For example, Basic Attention Token (BAT) yields as much as 40% per year, compared with 1% for U.S. bank deposits.

Aave adheres to the philosophy of offering choice, not only in terms of products but also in working with a diverse audience, as Aave’s Discord channels are available in 11 languages, with technical support options.

Compound: When the name speaks for itself

Compound rewards its users for both providing loans and receiving loans. To get the most out of the platform, users often make deposits, take out loans and put them back as deposits. This makes Compound the largest DeFi project in terms of assets under management.

Compound got a second lease on life after starting to reward lenders and borrowers with its native COMP token, thus popularizing yield farming on the platform and making it profitable to borrow, as COMP tokens fully covered the interest under some market situations, and the interest itself is provided by the growth of the token accrued to all platform users. In short, the borrowers were paid for borrowing some assets.

Despite the fact that there are only seven supported coins, the interface is quite intuitive, with the lending and deposit panels located on the same page. Users can take out loans for all of the supported collateralized coins, except for Tether (USDT), when choosing deposit rates.

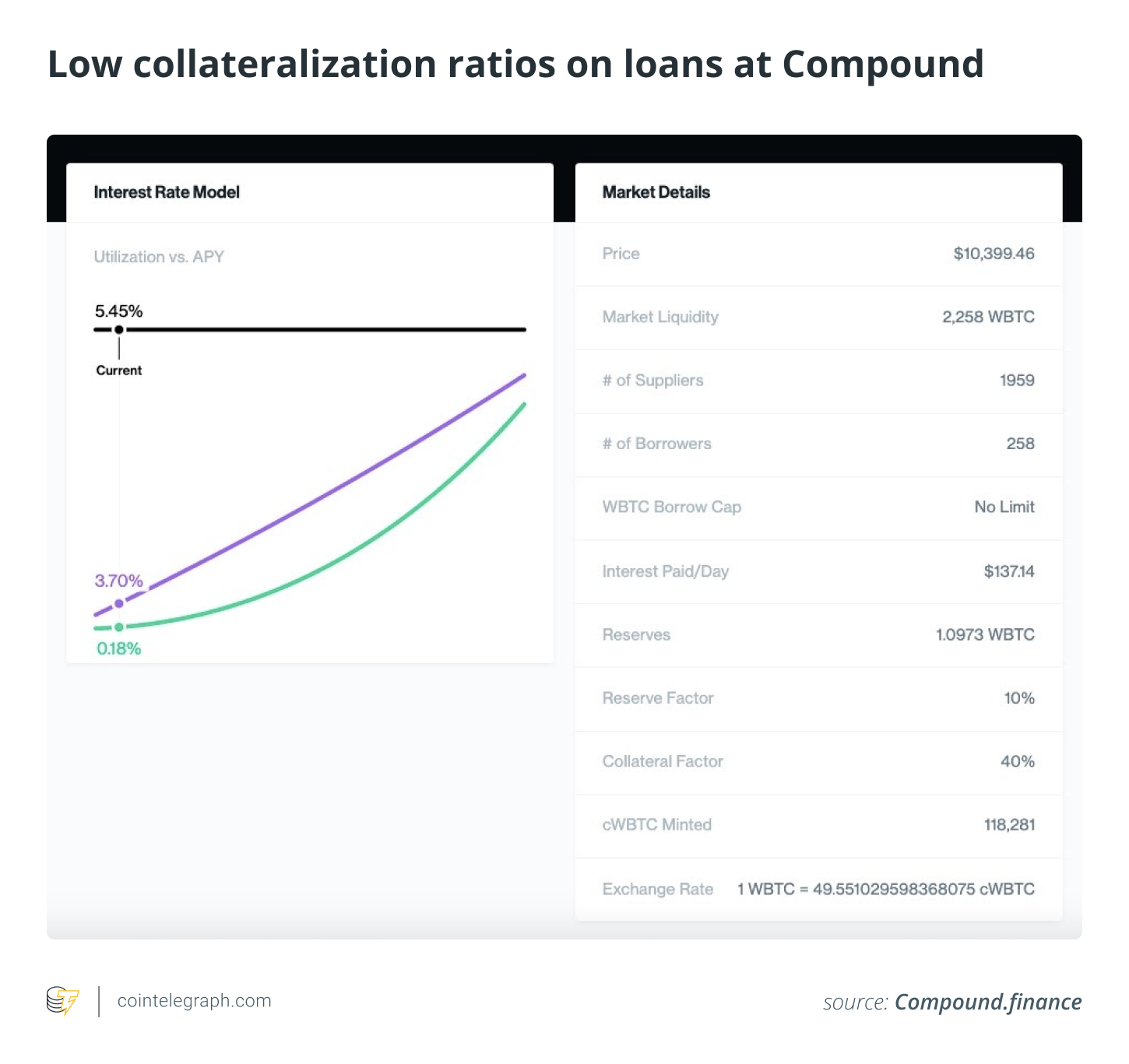

Compound differs from its competitors by housing a large number of partner projects from third-party developers, such as Instadapp and TokenSets, which pour in liquidity. But lower deposit rates that reach 12.42% per year make the platform less valuable. Some restrictions may also apply to loans with limits on amounts of credited funds — for instance, no more than 40% of funds in cryptocurrencies for Bitcoin (BTC) loans.

Unlike Aave, users of Compound are more likely to get answers from community members or open sources, as the platform has no support services.

Instadapp: Bringing refinancing to the DeFi space

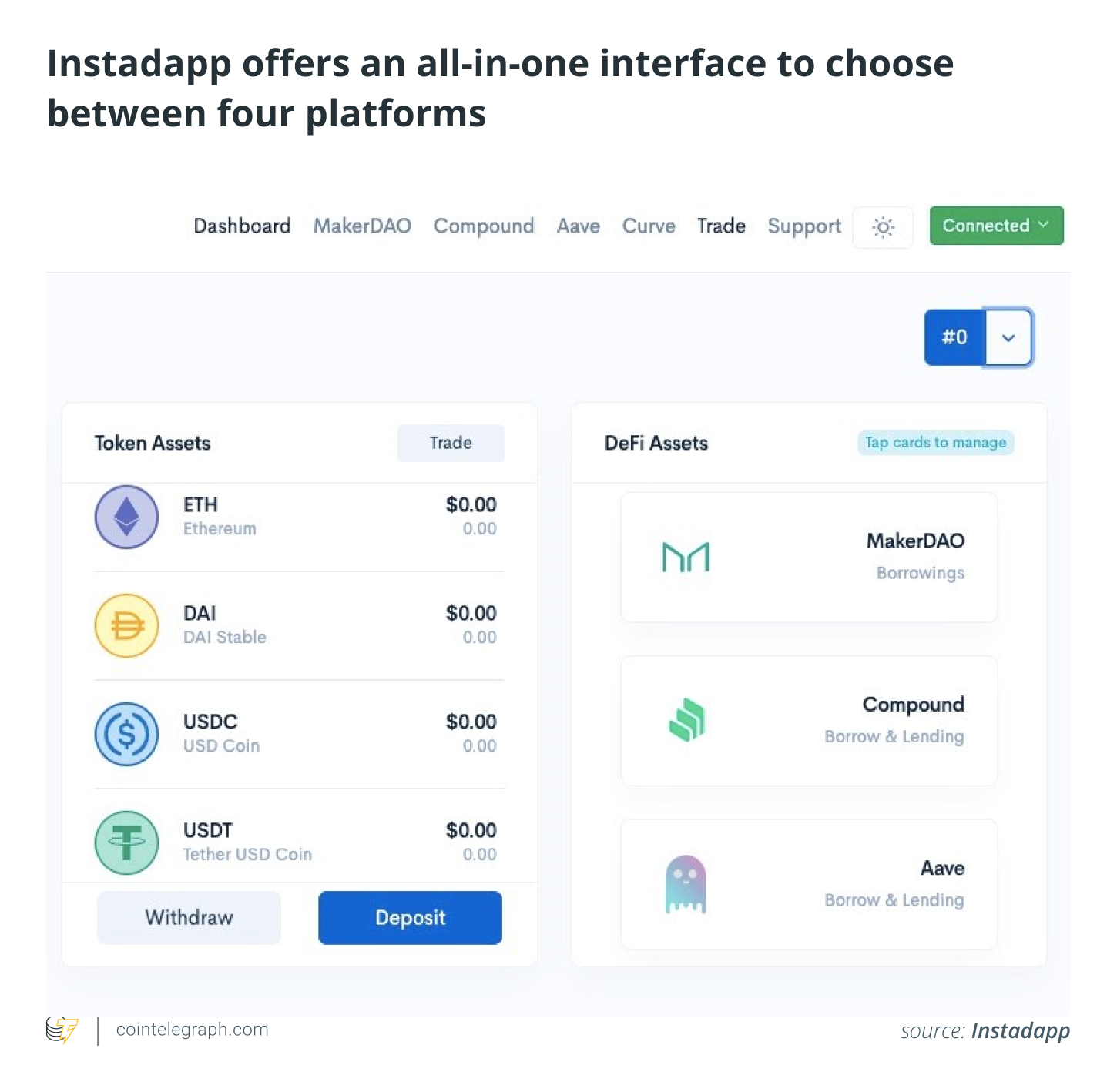

Instadapp is a wallet that allows users to carry out lending, margin trading, exchange and interest earnings transactions based on smart contracts. However, the platform itself provides only cryptocurrency trading services, and users will have to resort to the connected MakerDAO, Aave, Compound and Curve services to take loans or make deposits.

Despite this, Instadapp offers a convenient all-in-one interface that highlights the many features of the service. Among the unique offerings is the ability to refinance debt from Compound to MakerDAO, which is presented in a very intuitive fashion. One can get a loan or make a deposit in three steps, just like in the applications described above: registering a wallet, sending a confirmation transaction and making a deal.

There is nothing specific about Instadapp’s customer service. The support service in Discord responds within hours on a daily basis, and the FAQ section is quite exhaustive.

Yearn.finance: A solid lineup of products, some of which are in beta

Yearn.finance is an aggregator of credit and yield farming platforms such as Aave, Compound, DyDx and Fulcrum, automatically creating an optimal balance for attaining maximum profitability. However, unlike Instadapp, the platform has its own tokens used for periodically rebalancing user’s funds to select the most profitable lending services.

An added bonus for Yearn.finance users is guaranteed rewards in YFI tokens for using the platform’s services. YFI is the platform’s governance token and is only distributed to users who provide liquidity using yToken. With YFI, the project strives to issue the most highly decentralized digital asset, which has no premining, presale or distributions to the team, with all changes made through online suggestions and YFI-tokenholder voting.

Related: Powering DeFi market: Overview of the top 5 DEXs by total trade volume

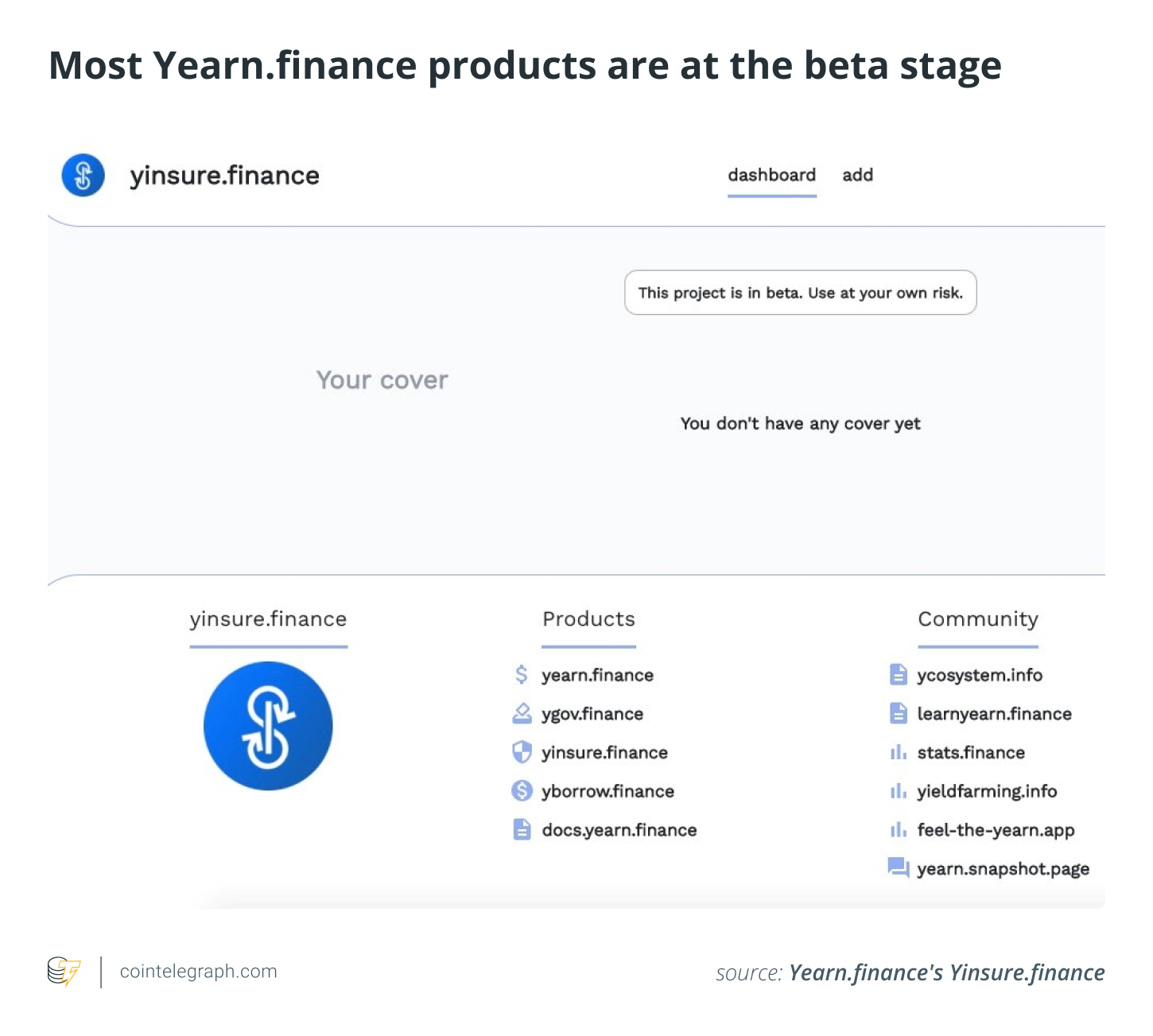

Despite being an aggregator, Yearn has a solid lineup of products, offering all-in-one services for working with crypto in terms of trading, loans and even insurance. Its Yinsure.finance service offers deposit insurance against unforeseen situations like acute fluctuations in exchange rates or platform hacking.

The downside is that Yearn.finance provides poor descriptions of its products, and users are often forced to turn to its Discord channel in search of answers, or to the 7,000-strong Telegram community, with prompt administrator response times. Most Yearn-ecosystem products are in the beta stage and are operating in testnet mode. This results in low service stability, lags in page loading times and wallet authorization resets.

DForce: What doesn’t kill you makes you stronger

Despite being hacked in April, dForce has recovered and returned to being rated as one of the top DeFi projects. DForce markets itself as a network matrix of finance protocols interoperable on the liquidity and asset level, which is bound together by its native DF token.

Using the token, users of the dForce ecosystem can seamlessly traverse several financial protocols to earn without switching platforms or tokens. As promising as the description may be, the application’s interface is cumbersome and poorly informative for novice users, brimming with complicated terms.

Related: DeFi oracles, explained

Among the advantages that distinguish dForce is the support for staking pools, though there are only seven coins available on 11 cryptocurrency wallets. Although the lack of lending products may be a disadvantage, it does not generally overshadow the user experience, judging by the total $33 million locked on the platform. However, understanding how the system works can be difficult for a beginner, as dForce differs greatly from its competitors in almost everything, including interface, terminology and site architecture.