A crowd loan is a Polkadot (DOT) crowdsourcing event in Polkadot that allows the community to support project bids in upcoming parachain slot auctions. Users contribute DOT, receive rewards in project tokens and get their DOT back in two years (a standard slot lease duration). This mechanic helps projects raise substantial capital in DOT tokens that may even exceed a few hundred million in dollar notion value.

The obvious downside for users is the need to lock their DOT for two years where they don’t have access to their liquidity during this lockup period.

In mainstream finance, there are private companies and initial public offering (IPO) lockup agreements. The lockup agreements prohibit company insiders — including employees, their friends, family and venture capitalists — from selling their shares for a set period of time. These shares are “locked up” to ensure that their owners don’t enter the public market too soon after the public offering.

To work around restrictions on lockup stocks, people could enter arrangements where they lock in their gains or even get some money in advance toward the day they can sell their holdings. Corporate lawyers started prohibiting these arrangements because they would create unnecessary market pressure and, in some cases, introduce the legal risks that lockups intend to avoid.

The concept of liquid staking

Fortunately, this scrutiny has nothing to do with the blockchain realm that is not restricted by the concerns of private lawyers. We may very well create claim rights on the locked assets by issuing a special type of derivative tokens that represent these rights on the underlying principal assets.

Derivative tokens are usually minted at a 1-to-1 ratio for the locked tokens. They can be issued by a liquid staking provider if users send initial assets to their custodian address or the target staking protocol may send derivative tokens directly to every depositor to simplify accounting. The latter mechanism is widely used in Ethereum-based automated market makers (AMMs) and pooled lending protocols that issue liquidity pool tokens — e.g., AAVE, Compound, or Curve.

In any case, there is always a clear arbitrage between the market and the eventual custodian. Every user can claim underlying at some point by submitting derivative tokens back to the staking protocol. If the arbitrage is immediate, the ratio between derivative tokens and locked assets nears 1-to-1. Otherwise, it may deviate depending on how fast the underlying can be unlocked.

This concept opens up an emergent market for many decentralized finance (DeFi) projects. You may already see quite a few of them bringing liquidity for various types of collateral, active stakes in proof-of-stake (PoS) protocols and other non-fluid assets. For instance, Lido has absorbed over $6.7 billion worth Ether (ETH) staked in Ethereum 2.0 (which is almost 19% of all ETH staked in Ethereum 2.0 deposit contract). Marinade Finance managed to get over $1.6 billion worth of Solana’s SOL locked via its protocol on Solana.

The success of liquid staking providers is highly dependent on the potential size of locked assets and the activeness of investors they target.

Liquid staking and crowdloans on Polkadot

The design of Polkadot crowdloans quite naturally marries with liquid staking too. The anticipated volume of liquidity to be locked in crowdloans may reach 20% of the DOT supply (which comes to an impressive eight billion U.S. dollars). Secondly, crowdloan participants are usually the most active investors who always look for maximizing their gains. Liquid staking seems to be an attractive opportunity for them.

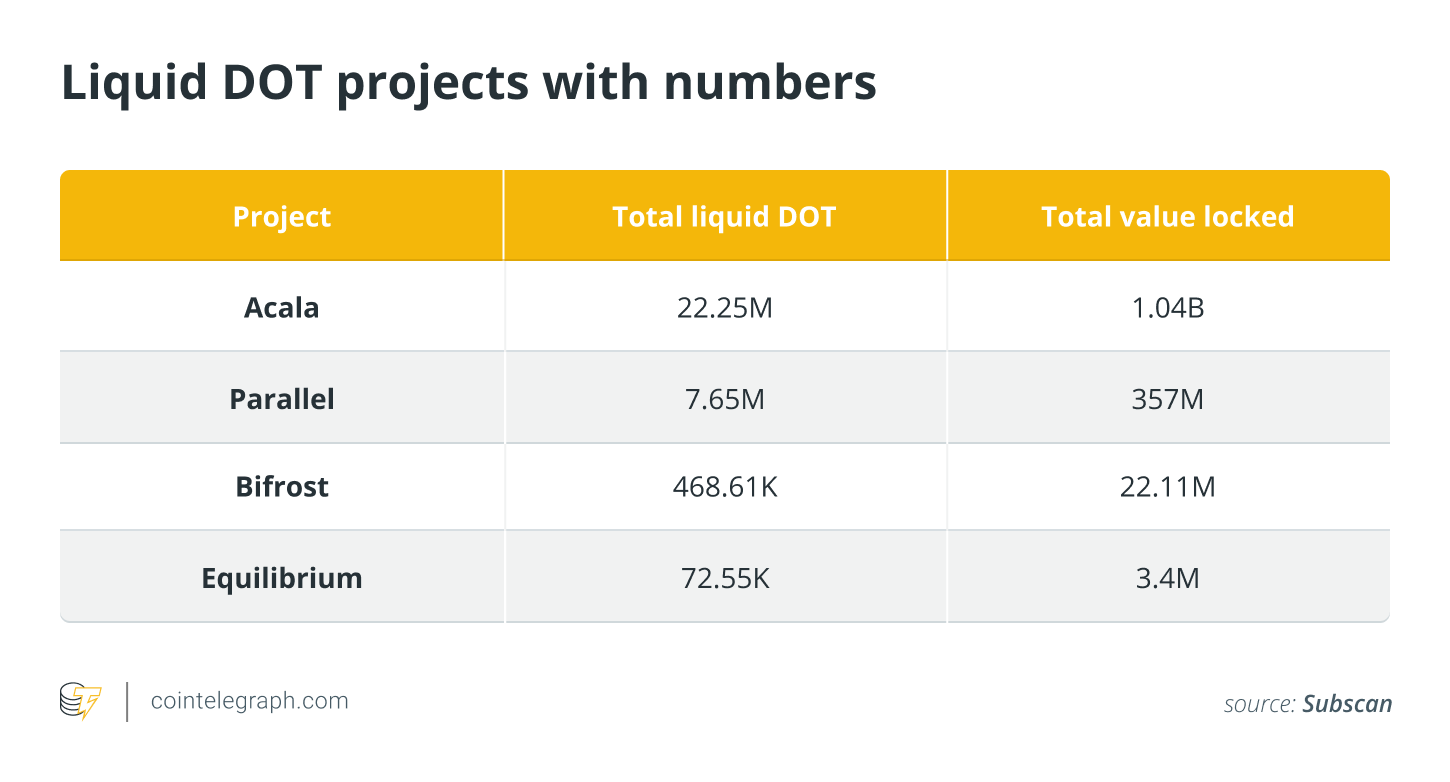

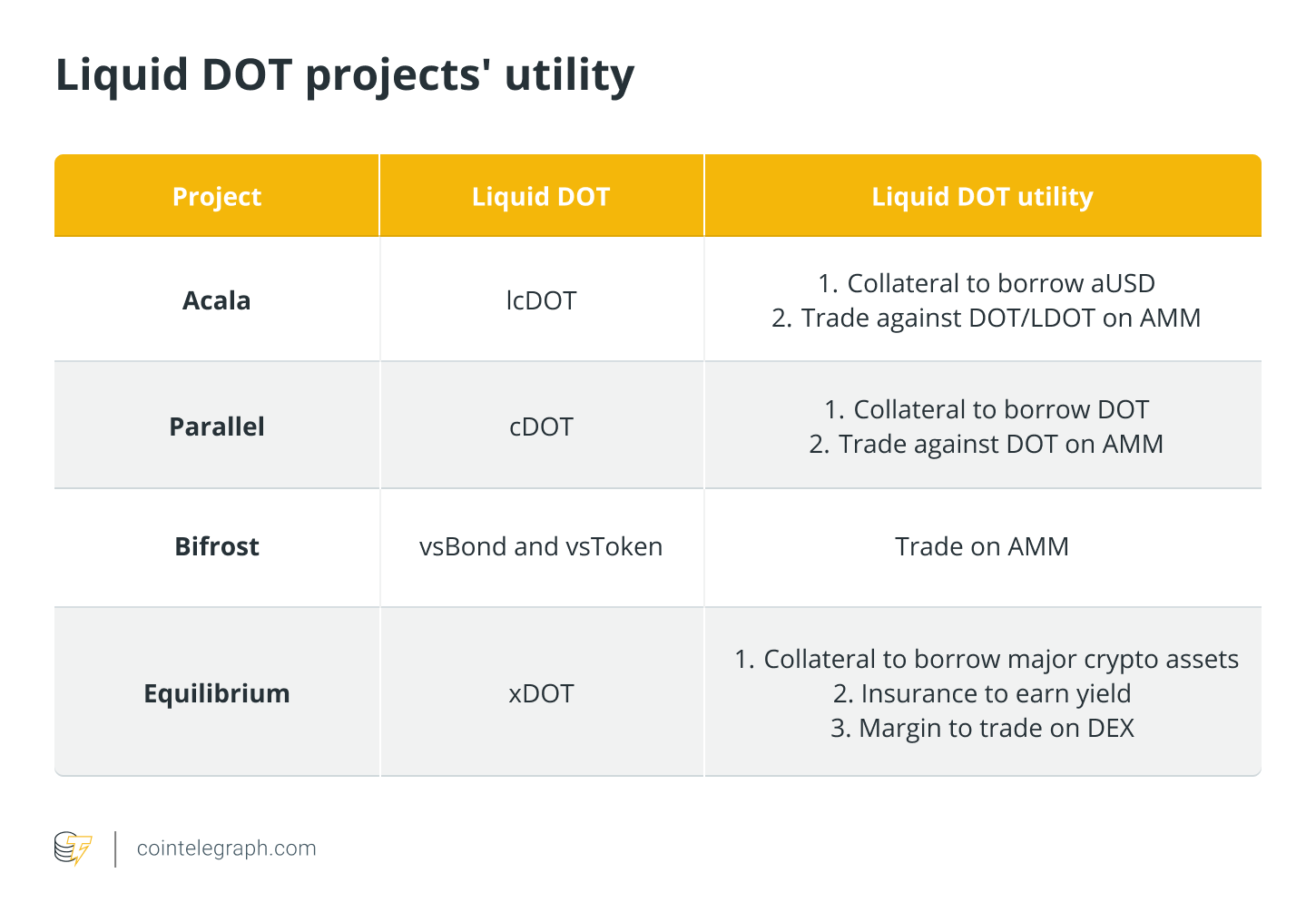

Certainly, the most advanced DeFi teams of Polkadot are already leveraging this use case. Each of them has introduced its version of liquid DOT that is minted on their chains at a 1-to-1 ratio for initial DOT locked via their platforms. This is what these projects are currently offering for their users:

Liquid staking is pretty much an excellent opportunity for Polkadot-based DeFi projects to boost their total value locked (TVL) significantly from the get-go. Liquid DOT will be the liquidity that sticks with them for the whole parachain lease period of two years.

Major market players could not miss this opportunity as well. For instance, there is a liquid DOT introduced by Binance, called BDOT, and the exchange plans to make use of that liquidity both in trading and speculation. But, we will be considering only liquid staking by ecosystem projects, so Binance USD (BUSD) and wrappers on other exchanges will be out of our today’s scope.

Liquid DOT’s traction so far

Before we delve into the actual mechanics behind each setup, let’s consider some numbers we’ve gathered as of November 15 at 9:00 pm UTC:

As we can see, definite leaders here are Parallel and Acala. Acala handles this huge amount thanks to its primary positioning as a top project in the ecosystem. Parallel managed to get a good head start by offering to DOT contributors bonuses in Parallel’s native token PARA, as well as special bonuses from supported projects.

Equilibrium has also announced additional bonuses in its native token EQ on every DOT locked via its xDOT platform. Besides bonuses, the project has launched a referral program that allows earning EQ on every stake to xDOT via referral links.

As such, crowd loan investors can enjoy an exclusive opportunity to earn regular crowd loan rewards while keeping their DOT liquid and get extra rewards from liquid staking on top. Seems like these pleasant additional benefits may even increase over time as competition between liquid staking providers is heating up.

Now that we looked at the landscape, let’s have a look at each project in greater detail.

Acala

Users will contribute DOT using Acala’s Liquid Crowdloan DOT (lcDOT) option in Acala’s crowd loan. Contributions go to the Acala proxy account managed by the Acala Foundation. Users receive 1 lcDOT for every 1 DOT locked. Users will also receive Cardano (ACA), though it’s not clear if those will be attributed to initial DOT contributors or lcDOT holders. For now, lcDOT supports contributions only for one project, Acala.

lcDOT can be used as collateral for minting the Acala dollar decentralized stablecoin (aUSD). Also, it will likely be listed on their Uniswap-like AMM for pairs with DOT and Liquid DOT (LDOT).

At first, Acala will be collecting DOT on a proxy account controlled by a multisignature wallet from the Acala Foundation. When the Acala parachain is live, the ownership of the proxy account will be transferred from the multisig to the Acala parachain account that is fully trustless and controlled by Acala’s on-chain governance.

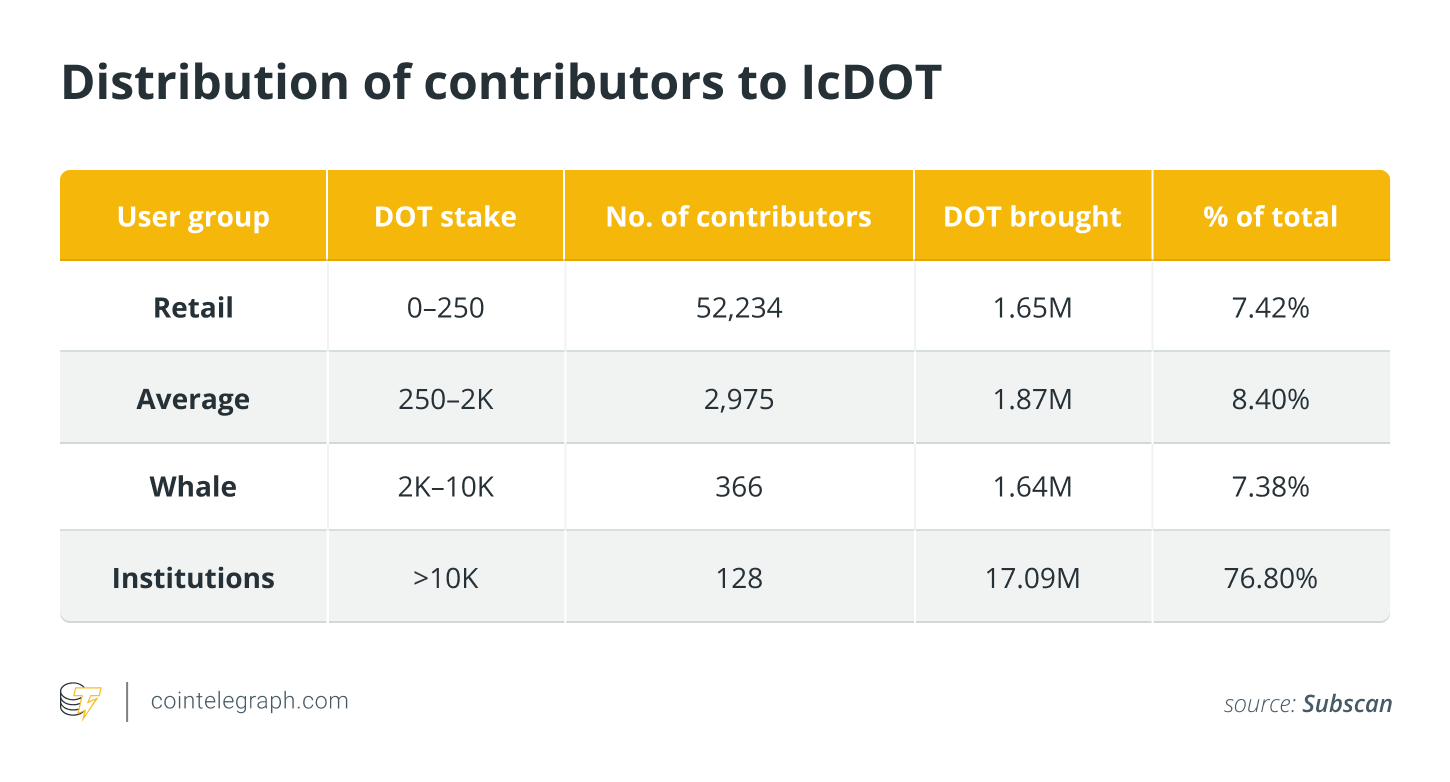

Despite a substantial 80%+ share of whales and institutions, that confirms the Pareto rule once again, we see an impressive number of contributions from retail users. Furthermore, there is no other option to contribute to Alcala’s crowd loan on its website, rather than lcDOT. Given the outrageous 27 million DOT collected during its crowd loan, this retail activity is quite expectable.

Parallel

Users will contribute DOT using Parallel’s cDOT mechanics. Parallel supports multiple projects and offers extra bonuses both in PARA tokens and from their “partner” projects to users participating in crowdloans via cDOT.

Parallel’s cDOT tokens will be launched when Parallel secures a parachain slot. These tokens will be used inside Parallel’s DeFi system as collateral to borrow stuff or as a lending asset on their compound-like money market protocol.

The technical setup is similar to all of the above where initially, there will be a multisig custody of user contributions that will vote for other projects collectively. There is no open information on the multisig participants at the time of writing.

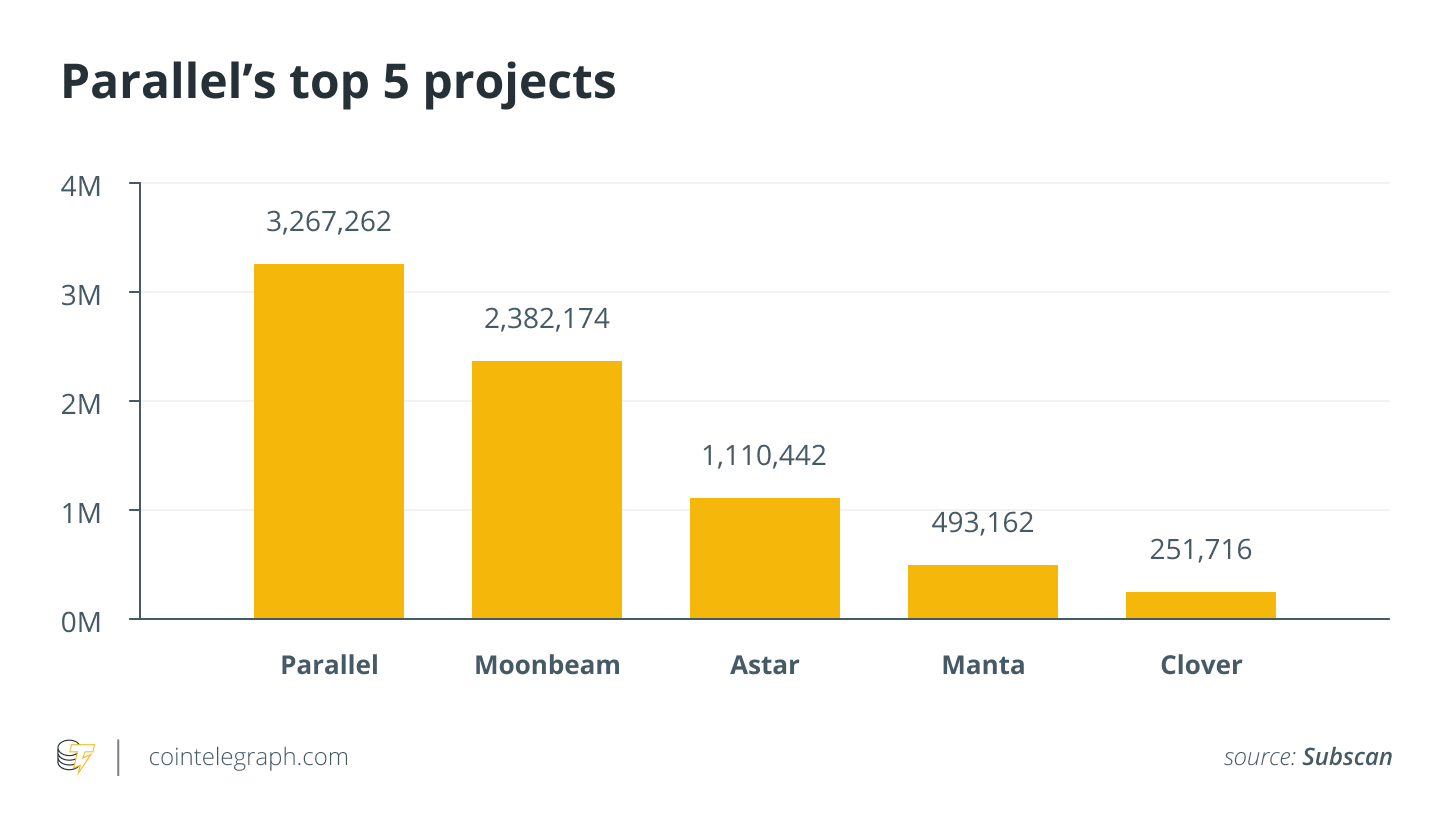

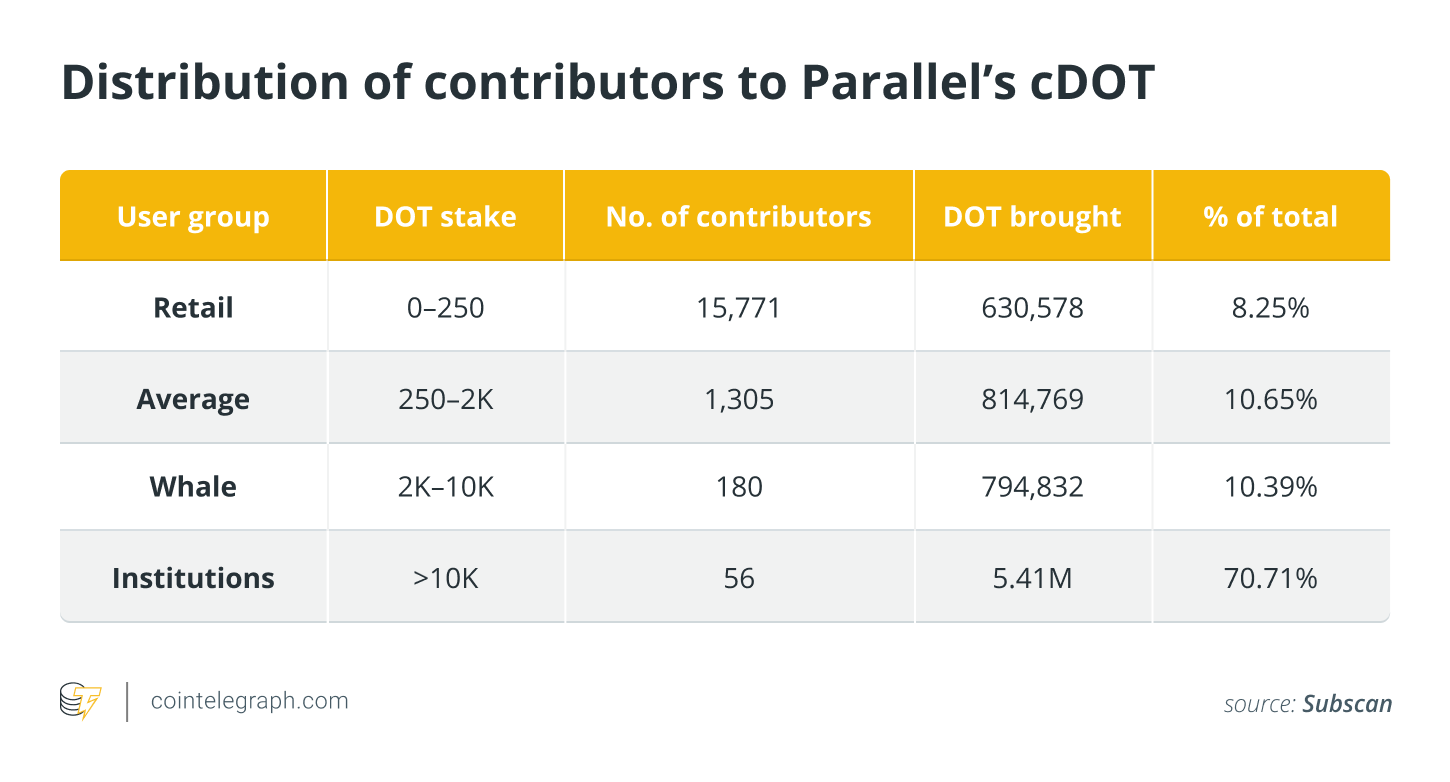

It is quite predictable that most of DOT are staked for Parallel. Their website doesn’t offer any other options to participate in their crowdloan but cDOT.

It remains unclear how Parallel is going to support Moonbeam crowdloan purely from a technical perspective, as Moonbeam’s parachain doesn’t include a multisignature pallet for now. It may be even impossible to distribute Moonbeam’s crowdloan rewards in GIMR, Moonbeam native token, that will arrive at Parallel’s address managed under multisignature permissions. Despite that, the amount of DOT they collected for Moonbeam is impressive.

Interestingly enough, the picture is very similar to Acala’s. Parallel even has one single mega-contribution of 1.5 million DOT from a single address that pledged DOT for Astar, Clover, Moonbeam and Parallel.

Bifrost

Users will contribute DOT using Bifrost’s SALP protocol. SALP supports several projects which are technically suitable for handling multisig transactions. Bifrost offers its users two types of tokens: vsBond and vsToken. vsBonds are tied to particular projects and allow to collect crowd loan rewards.

They are tradeable on the “buy-in-price” pending orders exchange. vsTokens, on the other hand, are not tied to any particular project and allow users to redeem DOT at the end of the lease period when combined with corresponding vsBonds. vsTokens trade in a Bancor and 1-to-1 peg pool at maturity. vsBond and vsTokens may also be used inside Bifrost’s DeFi ecosystem.

Technically, the solution is similar to Acala’s. Initially, until Bifrost is not a parachain, they will use a multisig address controlled by Bifrost. After the project wins a parachain slot, the multisig control will be passed over to the parachain account. A prerequisite for that is the flawless functioning of Polkadot’s XCM protocol.

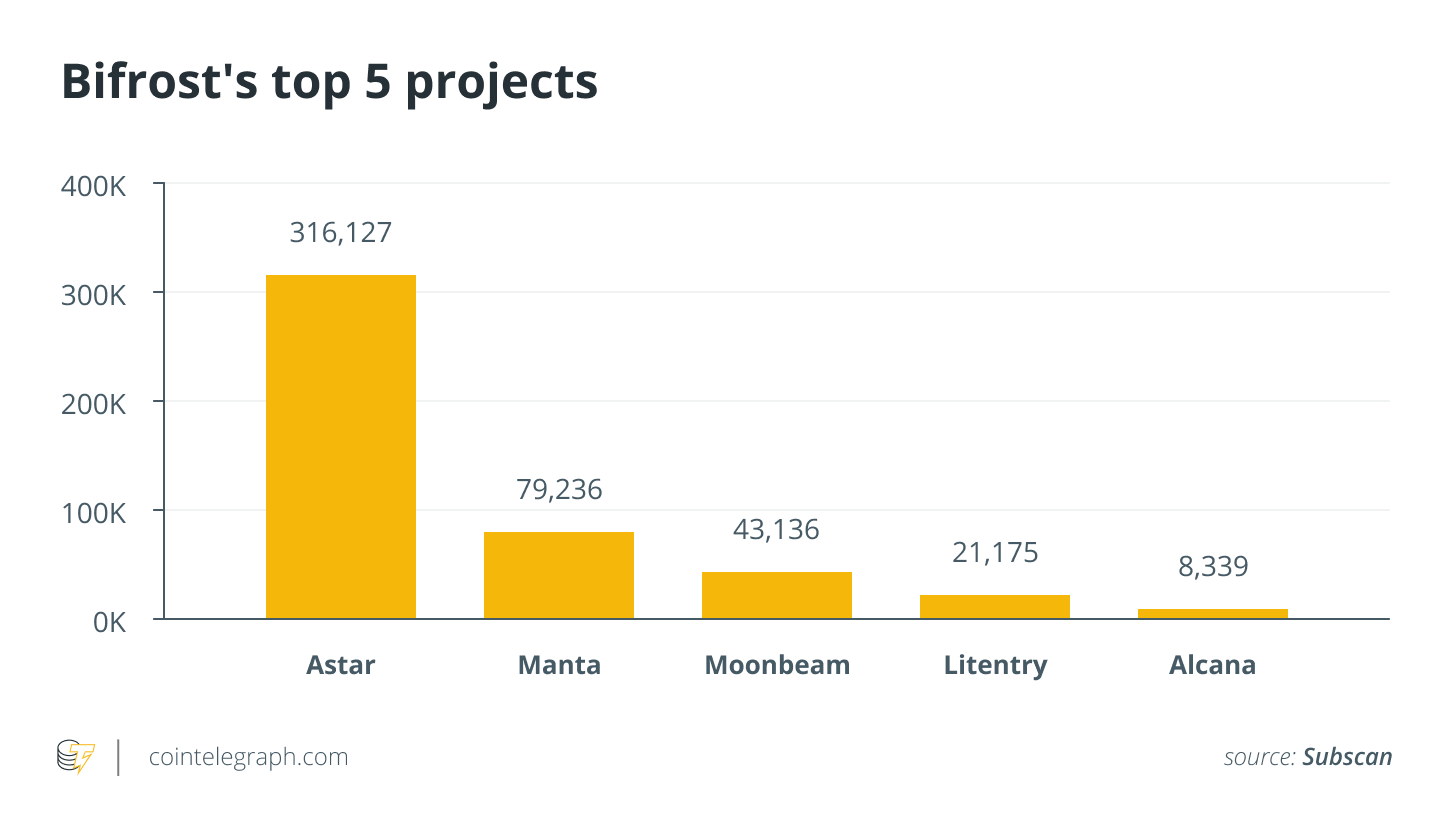

Astar is the clear beneficiary here specifically thanks to the single fat stake of 300,000 DOT. This money comes from DFG, a venture capitalist (VC) firm that contributed to Astar’s crowd loan via Bifrost’s liquid DOT solution.

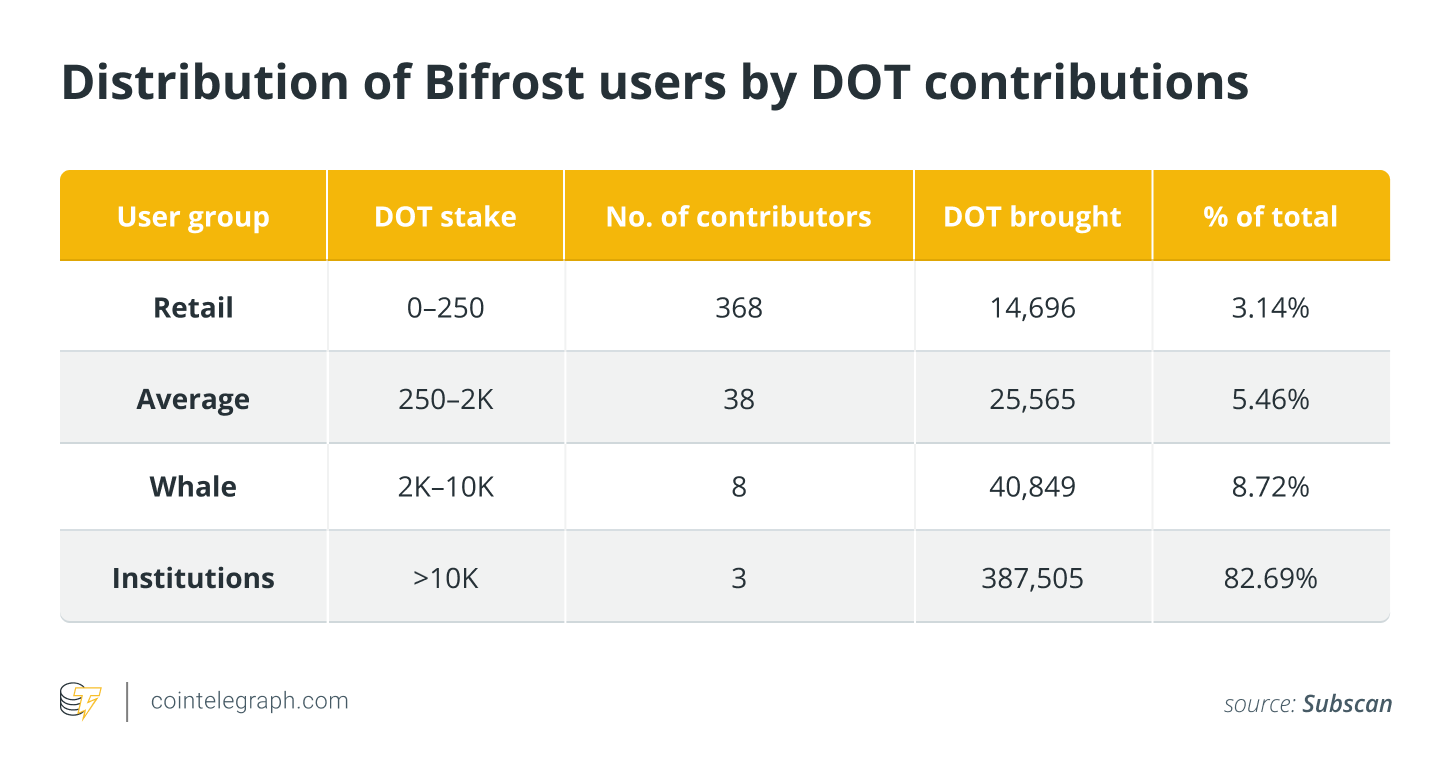

Similar to Acala and Parallel, the Pareto rule perfectly works here as well, as the share of institutions hovers around 80% of the total DOT stake. Though in the Bifrost case, whales largely dominate over retail and average investors compared to the first two projects.

Equilibrium

Users contribute DOT via Equilibrium using its xDOT. Equilibrium supports projects that are technically capable of handling multisig transactions. Equilibrium also reportedly offers Ledger support for users who will contribute to Equilibrium via the xDOT platform.

There will be one xDOT token for different projects available while Equilibrium will be handling xDOT and project tokens separately. Equilibrium will price xDOT on a special purpose-yield AMM and promises to issue these tokens first in Genshiro (their Kusama-based canary network). Then, xDOT will be launched in Equilibrium once the project obtains a parchain slot on Polkadot. xDOT use cases on Genshiro include borrowing, lending and using them as margin to trade.

Equilibrium’s technical solution uses a multisignature wallet as well. It’s noteworthy that keys of this multisig are held by known VCs including Signum Capital, DFG, Genesis Block Ventures and PNYX.

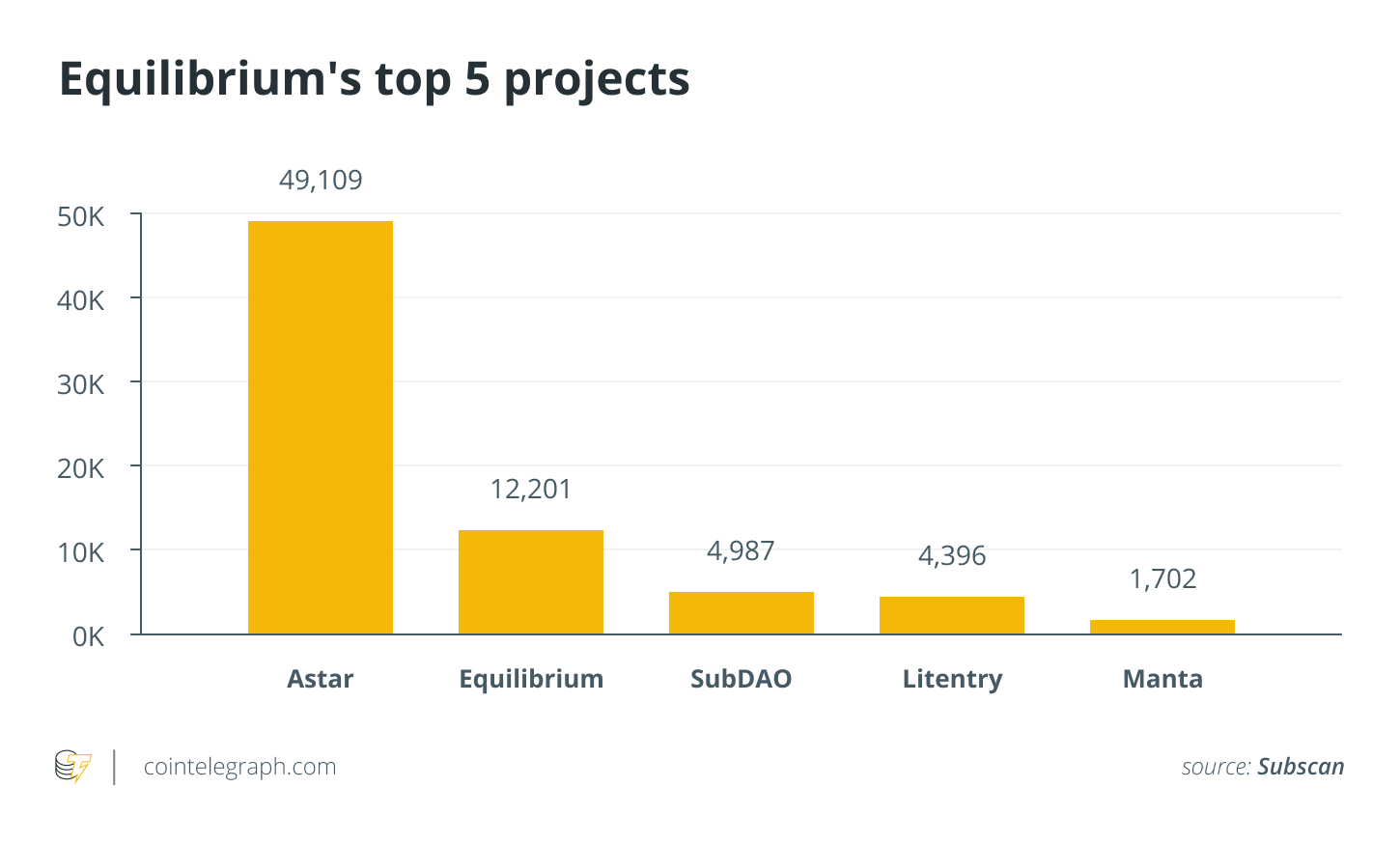

It is quite expectable that the stake for Equilibrium as an xDOT originator overtakes most others. Like in Bifrost, Astar keeps a leading position and this most likely testifies the efficiency of Astar’s business development efforts and its partnership bonuses.

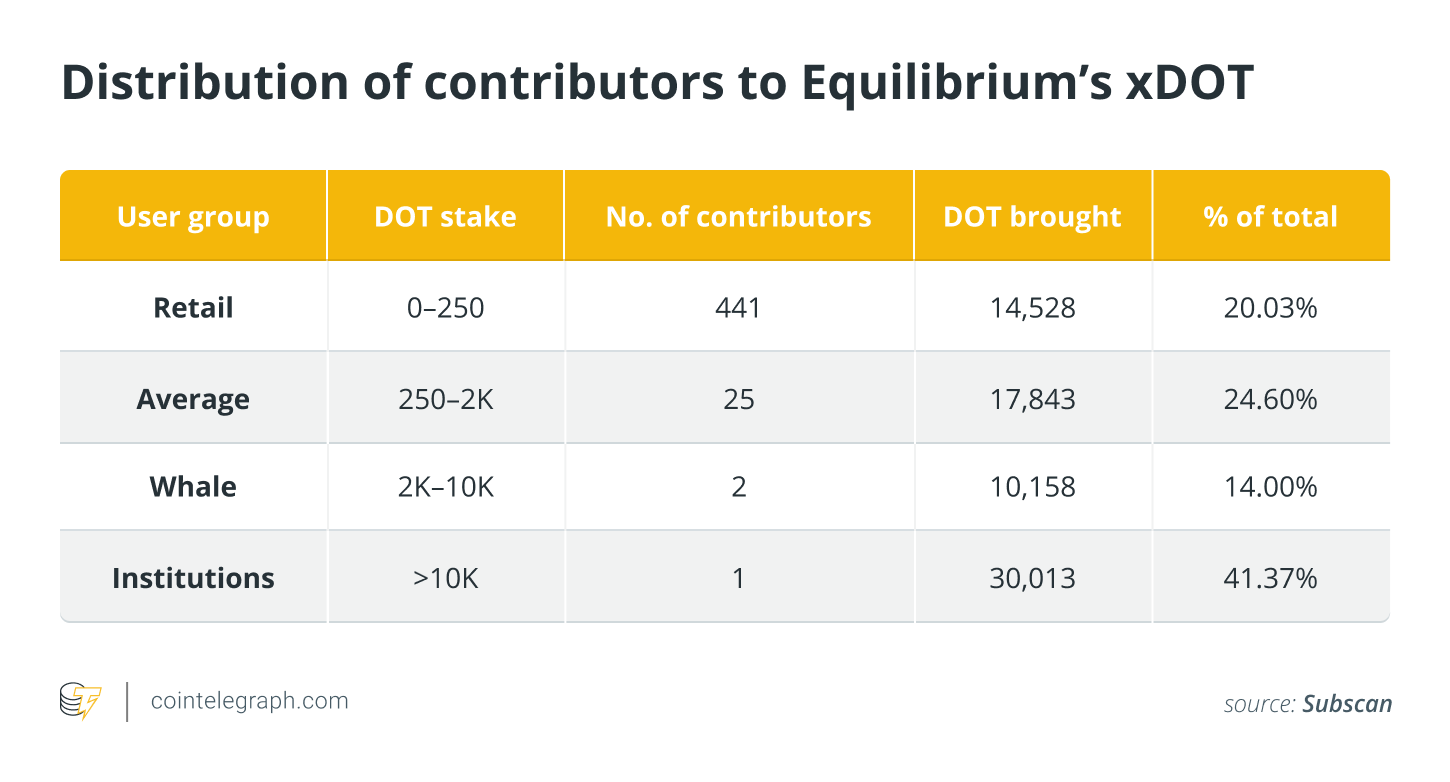

Opposed to Bifrost, the activity of retail users in xDOT prevails over other groups of investors. The project has yet to onboard as many institutions, based on the numbers above. However, Equilibrium’s bonus program that accrues extra EQ tokens on DOT contributed via xDOT may become quite attractive to large stakeholders.

Is liquid DOT staking bulletproof?

Now that we’ve looked into each project in greater detail, we might still want to clarify some other questions. The first natural one is what additional utility projects are offered on their liquid DOT, as users may essentially want to do something with their liquidity. Otherwise, what’s the real use of it?

Related: The evolution of DeFi and its unique token distribution mechanics

This largely depends on the feature set of the underlying projects. Another aspect is how fast they will be able to interconnect with other projects that might be willing to support those tokens. We can judge initial use cases on a project-by-project basis from the information we acquired above.

It looks like there are potential use cases for liquid DOT, and its further acceptance across the ecosystem will largely depend on the success of business development efforts. The one who manages to persuade other ecosystem participants to use their liquid DOT will benefit the most in the long run.

The next question is related to the redistribution of bonuses. If users contribute via liquid DOT mechanics, will they be entitled to the bonuses projects offer for “classical” trustless contributions?

There is not much info circulating about this right now, but from what we know, Acala will offer all of the bonuses it offers to its regular participants. Parallel has talked at least with two projects to offer extra crowd loan bonuses while Equilibrium and Bifrost will most likely be able to support the common bonus structure of crowd loans. However, this can drastically change further as nothing prevents Equilibrium or Bifrost from making similar arrangements with projects running their campaigns.

Last but not least, how secure is the technical setup? Given the number of hacks in DeFi, this question becomes crucially important.

The approach here is similar across the board: a custodian address for DOT managed under multisignature permissions at the start. And, it’s a reasonable solution, as multisigs have become a golden industry standard for secure asset storage. Once the project issuing liquid DOT becomes a parachain, the setup will become fully trustless.

Related: How much intrigue is behind Kusama’s parachain auctions?

The bottom line

Liquid DOT is a beautiful mechanism to unleash the liquidity of locked-up DOT that has attracted the attention of multiple projects in the ecosystem. However, all of them offer somewhat similar technical solutions.

The extent to which these different liquid DOT variations (lcDOT, cDOT, vsBond, or xDOT) will successfully mature largely depends on the business strategies those projects will undergo and how much utility they can provide to their DOT derivatives.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cryptox.

Alex Melikhov is the CEO and founder of Equilibrium, an interoperable DeFi conglomerate on Polkadot comprised of a cross-chain lending platform and order book-based decentralized exchange. With over 14 years of entrepreneurial and fintech experience, Alex has been involved in the cryptocurrency world since 2013. His current project, Equilibrium, aims to solve the problem of liquidity fragmentation in DeFi.