Banking has become an imperative part of our life. Whether a working professional, a business or a a student, using banking channels is a prerequisite nowadays.

A majority chunk of the population uses traditional finance alternatives in some or the other way on a daily basis. According to one of the recent World Bank’s Global Findex reports, a substantial 1.7 Billion adults across the world still don’t have an account in a bank or any other financial institution and can be termed unbanked.

China, India, Bangladesh, Pakistan, Indonesia, Mexico, Nigeria, take up 46% of this 1.7Billion.

The key factors responsible for this unbanked population are

- Lack of adequate financial liquidity

- Feeling of not needing a bank account

- Scarcity of appropriate documentation to open an account

- Distance from the nearest financial institution and withdrawal locations

- Infrastructure limitations

Since a major chunk of the global population is not a part of the legacy financial system, there is a huge market for cross-border P2P remittances. According to a report by the World Bank, the international volume for cross-border remittances is estimated to have touched the $689 billion figure in 2018, up 10% from 2017. Projections for growth in the overall remittances market point to $747 billion in 2020

In spite of all these mind-boggling but inspiring numbers, shortfalls remain and plague the abounding and progressing P2P remittance market.

- Traditional money transmitter organizations (MTOs) such as Western Union and MoneyGram rely on cash-based transactions.

- Intermediaries provide an additional layer of “so-called” protection, safeguarding parties from fraudulent activities and malicious intentions. This security comes with high fees, regulation, and other counterproductive complications.

- Consumers deal with the P2P platform but don’t associate the loan with a bank’s brand, and consequently neither the borrower nor the lender is able to build a relationship. This leads to dissemination of less market information which can negatively impact interest rates.

The P2P model materialised as a banking channel that gets rid of intermediaries. But with increased fraud rates and scams, a user verification process is greatly required, thereby contradicting the whole idea of eliminating middlemen

Luckily, blockchain has emerged as a table flip solution to this contradiction. Blockchain’s underlying operational principle and autonomous working model can help navigate through the situation.

Crypto and Blockchain as a Solution

With careful pondering and rumination, it becomes evident that centralized institutions have built their businesses out of selling “trust”, something which blockchain technology aims to eliminate.

At its core, distributed ledger technology is a trustless and decentralized environment where intermediaries are not only redundant but entirely unnecessary.

Only with blockchain, can the real potential of P2P banking be truly realized.

There are significant benefits to using this technology

- Cost reduction: Borrowers deal directly with the lenders which reduces excess “in-between” costs. Also, blockchains employ the use of cryptocurrencies which have minimal or no transaction fees at all

- Swift transfers: All transactions happen in a matter of seconds to minutes

- Financial inclusion: About 1.7 billion across the world who don’t have access to banking facilities can find their place in the global economy. Just with the internet and this seminal piece of technology

- Financial freedom: The freedom to transact in cryptocurrencies and stable coins opens numerous possibilities

- New Global Currency: With blockchain, there comes another fruit of virtual crypto tokens, completely decentralised and ready to serve as global currency.

With the advent of this new solution, there arises a need for a platform that can bring this to reality and this is where companies, like Aximetria GmbH step in.

It is largely perceived that banks are the only tools that people can reliably use for cryptocurrency purchase and cross border transactions. Banks not only take huge commissions, but also cut off entire countries from the cryptocurrency world.

One major example of this injustice is when Argentinian citizens were denied to utilise their savings and tackle the nearing hyperinflation in the country. The Argentinian banks began to block cryptocurrency purchases using bank cards on Government orders. This forced the ordinary people to turn to not always legal, and often dangerous alternatives. For example, to intermediaries willing to sell crypto for cash. However, in this case there is no guarantee that the mediator will not be a criminal. Therefore, each buyer risks not only money, but also health, and even life.

Aximetria, is here to develop a legal and safe option to get rid of the necessity of banks.

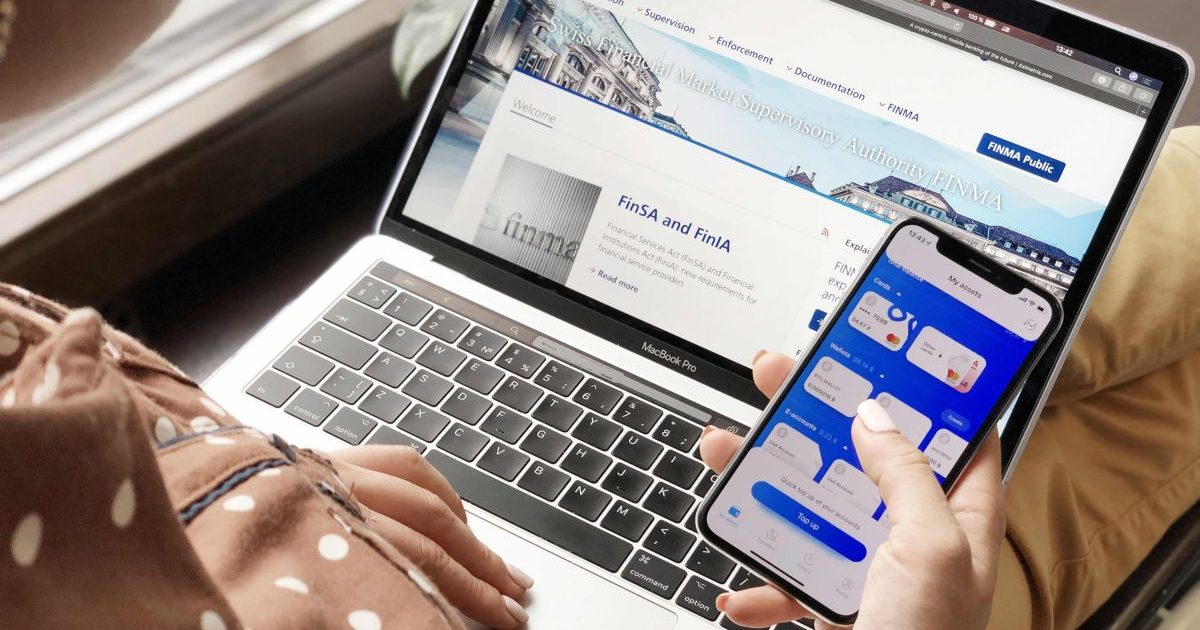

The Swiss VQF-regulated fintech company is on a mission to promote mass crypto adoption by blending swiss-level financial instruments with blockchain technology.

Aximetria aims to make crypto available to anyone, anywhere, at 0% commission, with a special focus on the unbanked and underbanked population.

It provides all the advantages of a local bank, including cashback, bonuses and other expected features and benefits, plus the ability to easily convert fiat to crypto (and vice versa) and much more.

The company creates the best experience of using cryptocurrency as a technology and strives to make the financial system more open, transparent and effective for everyone.

AxiCash

AxiCash is Aximetria’s proposed solution to put a stop on illegal and life-threatening ways to dealing with cryptocurrencies. AxiCash is developed with a mission to provide the people of the world, the freedom to choose what they wish to do with their money.

People with government restrictions or unstable economies suffer more than anyone else because they can’t use their fiat money to buy into crypto easily.

There are multiple hindrances in cross-border remittances and to buy/sell crypto in Argentina, Brazil, India, and other countries where you pay huge commissions. There are also limits in South Africa on cryptocurrency transactions that can also be blocked by some banks.

P2P services like AxiCash solve these problems. AxiCash enables people to buy and sell cryptocurrencies without the use of bank cards, and most importantly – without the risk of running into scammers!

The Mechanism

AxiCash is unique from other similar peer-to-peer financial services as it ensures the security of cryptocurrency transactions due to KYC procedures and secure blockchain technology.

The main link in transactions through AxiCash are the ‘Agents’ – Aximetria users who are willing to make transactions with other users with restrictions on the use of bank cards.

The user interaction algorithm in AxiCash is extremely simple:

– The buyer registers in the Aximetria application and goes through the authorization process.

– In the AxiCash section of the app, the buyer indicates the type of transaction (exchange, purchase, sale or transfer) and the amount, and then selects on the map the nearest Agent. Each Agent has a rating, which Aximetria makes based on scoring by peers.

– After filling out the application, the buyer receives a confirmation from the Agent about the possibility of a transaction. The size of the commission, available currencies and maximum amounts for exchange with different Agents may vary.

– The buyer transfers the funds to the Agent – for example, in cash at a meeting or transfers the agreed amount to an electronic wallet.

– As soon as the Agent confirms the payment, Aximetria automatically transfers the cryptocurrency to the buyer’s account.

AxiCash beta testing is scheduled to be completed in February 2020, after which the service will work in full mode.

Advantages

- Works with all banking cards – top up and withdraw funds to any bank card worldwide

- Native crypto, with full control over the funds

- 5-7% cheaper than other services

- Zero-fee environment, i.e. no commission on exchange

To survive and evolve in this system, it is important that assets can be spent within the service and Aximetria is continuously working on developing functions in this direction which blends right with AxiCash

- AxiDrop – Integrates with Axicash and provides remittance service to anyone in the world just by knowing a phone number.

- Access to Aximetria Marketplace, where users can spend their crypto on goods and mass consumption services.

Growth Through Numbers

Founded in 2018, Aximetria is one of the world’s fastest growing startups, evolving from product idea to product launch in just 11 months. The company has already earned the trust of more than 100,000 active users worldwide, with a 30% onboarding rate in selected regions, such as Brazil and Argentina.

Based on customer data, Aximetria’s turnover consists of 68.3% of BTC from Brazil, 53.2% from LATAM and 96.2% globally along with 25.9% ETH from Brazil, 39.4% from LATAM and 2.6% globally.

Number of transactions in BTC are:

Brazil – 57.4%

LATAM – 49.3%

World – 71.5%

Number of transactions in ETH are:

Brazil – 35.7%

LATAM – 45.4%

World – 24.9%.

Average ticket size of 487$ from Brazil, 162$ from LATAM and 1838$ globally.

AxiCash Projections in 2020 $40 Million